Section

Bond Market

1725 posts

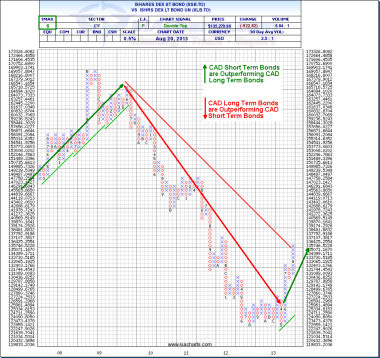

Technical Analysis: Long-Term Interest Rate Direction Has Changed Significantly

by SIACharts.com For this week's SIA Equity Leaders Weekly, we are going to take a look at a…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The Safe Haven Bubble has Popped – What Comes Next?

by MacroBusiness The safe haven slaughter goes on. You might read elsewhere that what is transpiring in emerging…

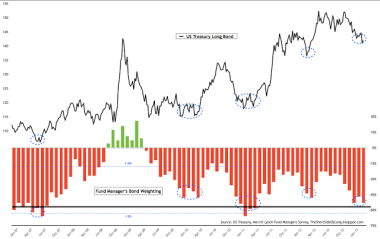

Why the Big Move in Bonds May be Over

by UKarlewitz, The Fat Pitch The main points in this post are: Individual and professional investors have already…

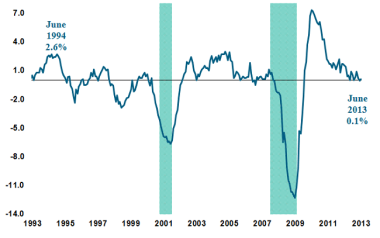

Is the Interest Rate Outlook Closer to 1994 or the Post-World War II Era?

August 21, 2013 by Kathy A. Jones, Vice President, Fixed Income Strategist, Schwab Center for Financial Research Key…

Can the Sector That Helped Undo the US Economy be Key to Its Recovery?

In his inaugural blog post, Rick Rieder explores the fortunes of a sector he believes will help make…

Determined to Taper

The release of the July Federal Open Market Committee meeting minutes today and the Jackson Hole Economic Policy…

Three Worries for the Bulls

by Ryan Detrick, CMT, Schaeffer's Trading Floor A few charts caught my attention today and they all are…

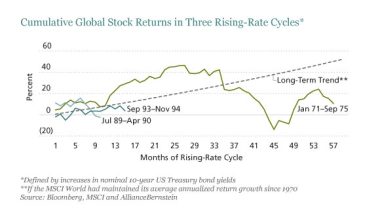

When Rising Rates Hurt Stocks, How Bad Did It Get?

by Chris Marx, AllianceBernstein By Chris Marx and Alison Martier A reader of our recent blog post about…

Preparing Equity Portfolios for Rising Rates

by Russ Koesterich, Chief Global Strategist, Blackrock While Russ doesn’t foresee a bond market meltdown, he does expect…

"Open Your Eyes!"

Submitted by Mark J. Grant, author of Out of the Box, via ZeroHedge.com "Diseased nature oftentimes breaks forth…

3 Equity Ideas to Consider in the Hunt for Income

by Russ Koesterich, Portfolio Manager, Blackrock Russ explains why investors looking for income should still consider equities, and…

The Economy and Bond Market Radar (August 12, 2013)

The Economy and Bond Market Radar (August 12, 2013) Treasury yields moved modestly lower this week as global…

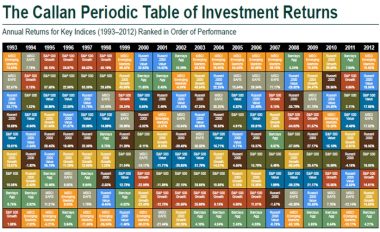

Fear Capital Misallocation—Not Market Cycles

by William Smead, Smead Capital Management A great deal of time and energy is spent trying to determine…

El-Erian Warns "Don't Be Fooled" By Europe's Tranquility

by Mohamed El-Erian, originally posted at Project Syndicate, August is traditionally Europe’s holiday month, with many government officials…

Jeffrey Saut: "The One Chip Rule"

“The One Chip Rule” August 5, 2013 by Jeffrey Saut, Chief Investment Strategist, Raymond James Back in the…