CANADIAN ADVISORS EXPECT STOCK RALLY TO CONTINUE IN Q4

TORONTO, October 19, 2012 - The strong rally in global stock markets has bolstered the confidence of Canadian investment advisors who are substantially more bullish in their outlook for stocks than they were in third quarter (“Q3”), according to the Q4 Advisor Sentiment Survey (the “Q4 Survey”) conducted by Horizons Exchange Traded Funds Inc. (“Horizons ETFs”).

TORONTO, October 19, 2012 - The strong rally in global stock markets has bolstered the confidence of Canadian investment advisors who are substantially more bullish in their outlook for stocks than they were in third quarter (“Q3”), according to the Q4 Advisor Sentiment Survey (the “Q4 Survey”) conducted by Horizons Exchange Traded Funds Inc. (“Horizons ETFs”).

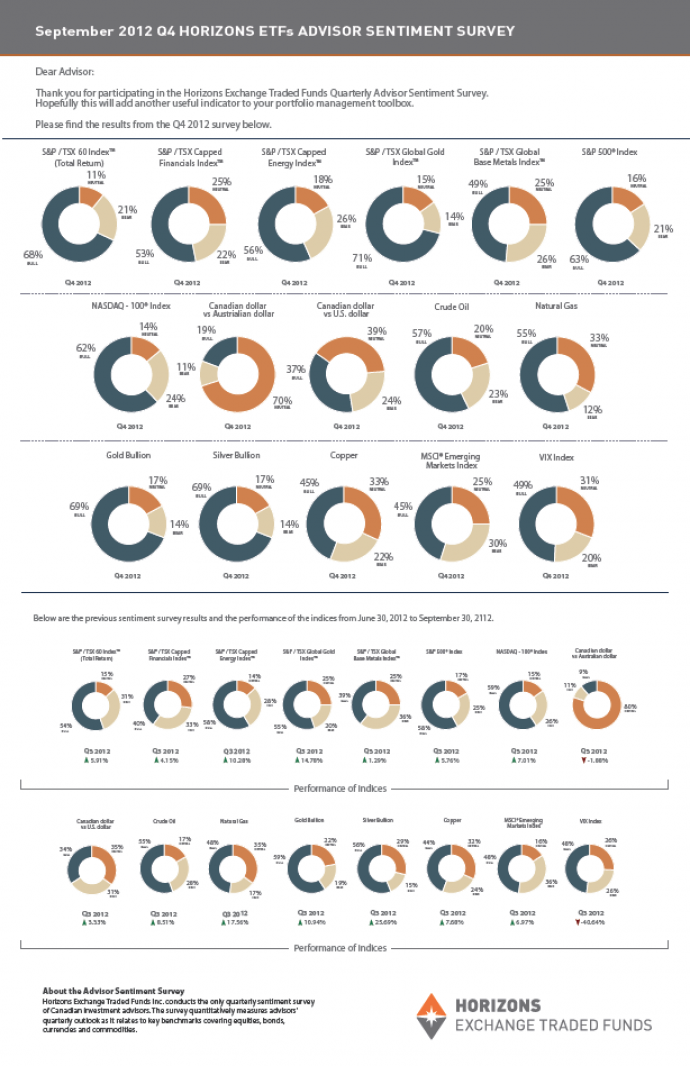

The Q4 Survey asked Canadian investment advisors to give their outlook on 16 distinct asset classes. Advisers responded whether they were bullish, bearish or neutral on the anticipated returns for these asset classes over the next quarter.

The majority of the almost 200 advisors who responded to the Q4 Survey are very bullish on stocks. Bullish sentiment on the S&P/TSX 60™ Index increased from 54% in Q3 to 68% for Q4 Survey after a 5.9% return on that index last quarter. A similar uptick in confidence was observed with the S&P 500® Index after it returned 5.8% last quarter, with 63% of advisors now bullish on the benchmark U.S. index. Bullish sentiment on the technology heavy NASDAQ 100® Index also increased from 59% to 62% after a 7.0% gain on the quarter.

Even certain stock sub-sectors received strong votes of confidence, such as the S&P/TSX Capped Financial Index™, which saw bullish sentiment rise 13 percentage points from 40% in Q3 to 53% for the Q4 Survey. Also gold stocks, where bullish sentiment increased even higher, by 16 percentage points to 71%, after the S&P/TSX Global Gold Stock Index™ delivered a 14.8% return in Q3.

Only the MSCI Emerging Markets Index saw a decline in advisor confidence where bullish sentiment dropped from 48% in Q3 to 45% for the Q4 Survey even though the index generated a 7.0% return in Q3.

“The vast majority of Canadian advisors expect the rally in North American stocks we saw in the third quarter to continue through until the end of the year,” said Howard Atkinson, CEO of Horizons Exchange Traded Funds. “The exception being emerging market stocks which, despite strong returns last quarter, Canadian advisors clearly expect to underperform North American stocks.”

The bullish sentiment on stocks paled in comparison to the glimmer coming from precious metals. High levels of bullish sentiment in the Q4 Survey were seen with gold and silver bullion where both were at 69%. Gold bullion delivered a 10.9% return in Q3, while Silver bullion delivered a huge 25.7% return.

“The announcement last quarter by the U.S. Federal Reserve to engage in another round of quantitative easing, known as ‘QE3’, has, in my view, bolstered expectations that precious metals will rise as the U.S. Federal Reserve effectively prints more money,” said Mr. Atkinson. “The returns of both asset classes last quarter certainly support that assertion.”

Bullish sentiment on Natural Gas actually moved into majority territory, increasing from 48% in Q3 to 55% for the Q4 Survey. This comes on the heels of a 17.6% return in Q3. Similarly, sentiment on Crude Oil also increased from 55% to 57%, after delivering an 8.5% return in Q3. However, bullish sentiment on energy stocks represented by the S&P/TSX Capped Energy Index™ dropped slightly from 58% in Q3 to 56% for the Q4 Survey.

“Energy commodity prices keep ticking along upward, and so too does advisor’s sentiment on natural gas and crude oil,” said Mr. Atkinson. “It’s remarkable to note that the majority of advisors are now bullish on natural gas – we have not seen that for a long time. Natural gas was such a poor performer for so long, but it does look like its turning a corner in both sentiment and return.”

After decent gains against the U.S. dollar (3.3%) in Q3, bearish sentiment on the Canadian dollar dropped from 34% to 24%. More advisors (39%) now have a neutral outlook for the Canadian dollar versus the bulls and bears. Interestingly, for the first time since engaging the opinion of advisors on the Australian dollar, there is movement to the bullish side on the Aussie dollar versus the Canadian dollar, as neutral sentiment dropped 10 percentage points from 80% in Q3 to 70% for the Q4 Survey and bullish sentiment increased from 9% to 19%.

“As the loonie trades at or near par, advisors have tended to be neutral on its direction,” said Mr. Atkinson. “It’s interesting to highlight the slight shift in sentiment on the Australian dollar. The loonie and the Aussie dollar historically move in tandem, more advisors are expressing a view that this relationship is changing, with a slight edge to going to the Aussie dollar which currently offers higher interest rates on deposits and money markets.”

Advisors accurately predicted the direction of 14 out of the 16 asset classes surveyed last quarter, which is in line with their historical trend of making accurate predictions.

“Advisors were back to their winning ways this quarter. If they were baseball players, they batted over .850, which is an almost unbelievable batting average and shows a phenomenal level of accuracy,” Mr. Atkinson said.

About the Sentiment Survey

Horizons Exchange Traded Funds Inc. conducts the only quarterly sentiment survey of Canadian investment advisors. The survey quantitatively measures advisors' quarterly outlook as it relates to key benchmarks covering equities, bonds, currencies and commodities. Full survey results are available at http://www.horizonsetfs.com/sentimentSurvey.asp.

About Horizons Exchange Traded Funds Inc. (www.horizonsetfs.com)

Horizons ETFs is an innovative financial services company offering the Horizons ETFs family of ETFs. The Horizons ETFs family includes a broadly diversified range of investment tools with solutions for investors of all experience levels to meet their investment objectives in a variety of market conditions. With approximately $3.5 billion in assets under management and 79 ETFs listed on the Toronto Stock Exchange, the Horizons ETFs family makes up one of the largest families of ETFs in Canada. Horizons ETFs is a subsidiary of Horizons ETFs Management (Canada) Inc. and a member of the Mirae Asset Financial Group.

For further information:

Howard Atkinson, CEO, Horizons Exchange Traded Funds Inc., (416) 777-5167 hatkinson@horizonsetfs.com