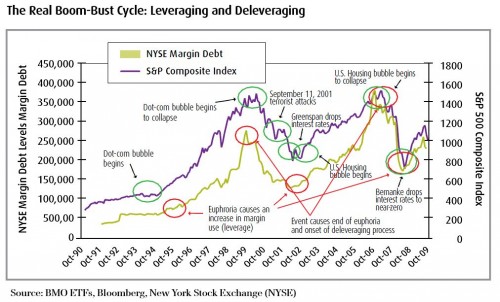

Nobody said it was going to be easy. After surviving one of, if not the most catastrophic financial crisis in history, investors were perhaps under the false impression that we were set for yet another bull-run after last year’s massive rally. Heading into the new year, we expected a tug of war between good and bad news as market expectations were revised to more realistic levels, whereas last year, expectations were set very low making surprises on the upside easy. As we have discussed in previous reports, the use of margin is a key driver to higher equity prices in almost all bull-markets. This was especially true for the two bubbles we experienced in the last decade. As illustrated in the chart below, there is a strong relationship between margin usage (as indicated by NYSE margin debt) and the performance of U.S. equities (represented by the S&P 500 Composite Index). As a result, bull and bear markets have become processes of leveraging and deleveraging that are highly impacted by investor greed and fear. We aren’t arguing that markets have all of a sudden become irrational, as they clearly have always been as pointed out by Charles Mackay in his 1841 classic, Extraordinary Popular Delusions and the Madness of Crowds. However, access to easy credit, low interest rates and, to a much lesser degree, technological advances are making margin trading more accessible. These factors may be amplifying emotional investing in the market. While noting that this shows the relationship in margin debt and U.S. equities only, increased globalization has increased the correlation between markets. News flow out of the U.S. also continues to drive global markets.

So how is this relevant to the current state of affairs in the market? While the use of margin is far shy of its 2008 highs, the run-up in equity prices last year, along with record low interest rates again encouraged market euphoria and the development of another asset bubble. Though currently we aren’t overly concerned about the level of margin debt in the system, the pace at which margin debt returned last year was indeed alarming.

Comments are closed.