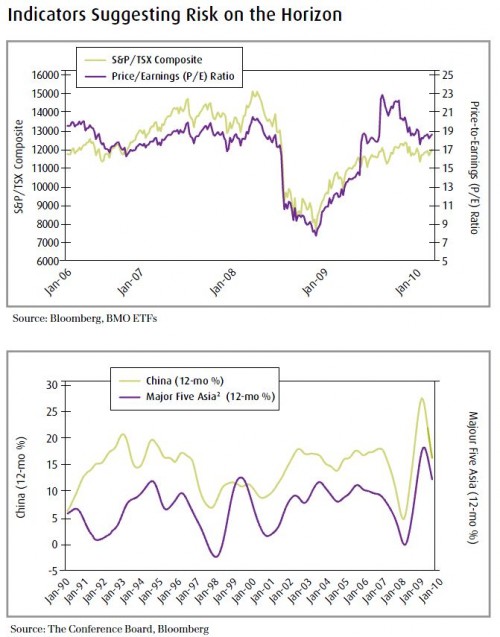

Considering the structural problems in the economy that persist, we believe equity valuations coming into the new year were high relative to their rolling three-year average price-to-earnings (P/E) ratios. The market volatility this year, while not enjoyable for investors, has shaken out some exuberance and thus some excess leverage as we have seen NYSE margin debt measures on the decline since April. Despite this shake-out, equity valuations both in Canada and the U.S still remain high relative to their rolling three-year averages. We believe therefore that downside risk remains since the current outlook does not warrant current valuations. We would also take a cautionary stance given China’s efforts to cool its economy which is proving to be effective as indicated by its falling Leading Economic Index (LEI)1. The slowdown of the Chinese economy will also more than likely affect its foreign trade with neighbours and this is important as the region has been a major growth engine to the global economy.

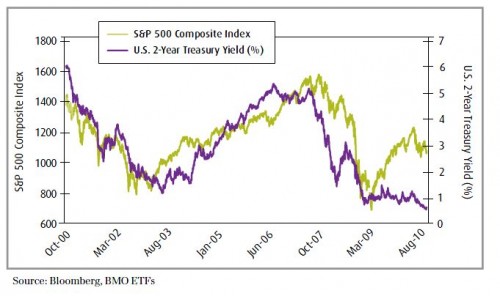

Furthermore, the yield on two-year U.S. Treasuries indicates fear with investors that have not yet been resonated in equity prices. However, as margin debt levels are not at extreme levels, we don’t foresee a major deleveraging event in equities similar to “post-Lehman”3 should the outbreak of bad news move us into yet another bear market. We do however expect much of the turbulence to continue, especially with the prices of credit default swaps (CDS4) rising for many of the PIIGS5 nations again. Given the continued downside risk, until we see a further decrease in margin levels, we suggest that investors consider

increasing their yield oriented positions which tend to exhibit less volatility than the market. We also suggest that investors consider increasing their fixed income exposure.

Comments are closed.