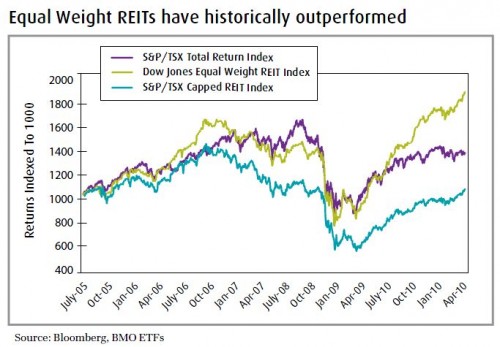

Exchange-traded funds (ETFs) are an efficient way to access REITs whether they use a market-cap weighted methodology or an alternative strategy such as an equal weighting. We prefer equal weighting as it places a higher emphasis on higher yielding names. Moreover this places less of an emphasis on any one larger holding which would have a more significant effect on the market-cap weighted ETF should that larger weighted company decide to cut its distribution or be negatively impacted by company specific risk. The BMO Equal Weight REIT Index ETF (ZRE) tracks the Dow Jones Equal Weight REIT Index, a collection of 17 Canadian based REITs using an equal weight methodology and a yield of 6.8%.

Opportunity #3: Mid-term Canadian corporate bonds

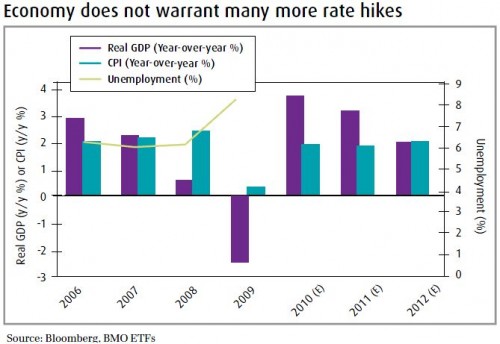

As mentioned above under the REIT strategy, we believe the BoC has nearly completed its interest rate hikes. The market consensus seems to be one more rate hike at most, as the central bank must be cognisant that a higher relative interest rate would place upward pressure on the Canadian dollar thus stunting its export industry. Considering this, we don’t currently feel the need to significantly reduce interest rate sensitivity and we recommend investors consider venturing further out on the yield curve. Investing in corporate bonds will allow investors to get a yield pick-up over government issues.

Investors looking to execute this strategy can efficiently do so through an exchange-traded fund. The BMO Mid- Corporate Bond Index ETF (ZCM) tracks the DEX Mid- Term Corporate Bond Index by holding a basket of bonds rated BBB or higher. Approximately two-thirds of the portfolio’s issues are of AA and A credit quality. Overall this index has a yield of 4.1%.

As mentioned earlier in the year, we remain positive about emerging market bonds and the equity of key emerging markets through American and Global Depository receipts. Despite the Leading Economic Indicators in some of these regions recently turning down, we believe they will still outpace developed nations. The continued urbanization in these areas will place a secular demand for commodities. The junior gold trade we mentioned last month worked out faster than we had thought, so we suggest investors consider buying only on pullbacks at this point. Over the nearterm, we advise clients to consider an increase to their defensive and yielding positions as we expect the market volatility to continue. We believe the recent uptick in indicators suggesting elevated risk levels has not yet been fully reflected in equity prices. At the same time, the higher yield on investments will provide income, while an increased allocation to bonds should provide capital preservation as we wait for the turbulence in the market to pass.

Comments are closed.