Opportunity #1: Utilities

Utility stocks are the prototypical defensive stocks. Companies that provide services such as electricity, water, heating or hydro tend to have stable incomes and thus provide a steady dividend stream. Moreover, since the services these companies provide are essentials and not luxuries, their revenues tend to fluctuate less than those companies from sectors such as consumer discretionary.

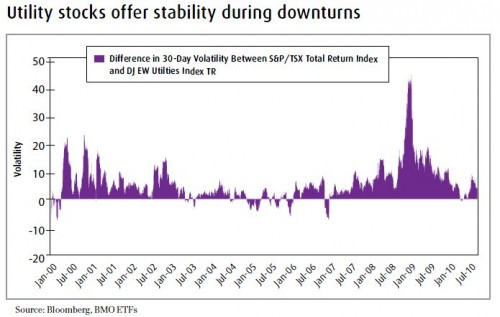

This stability in earnings is reflected through the lower volatility in share prices of these companies. The BMO Equal Weight Utility Index ETF (ZUT) tracks the Dow Jones Equal Weight Utilities Index, a collection of 17 Canadian utility companies. This index has a dividend yield of 5.7%, compared to the 2.7% of

the broader market S&P/TSX Composite Index. Also, the utilities index has historically had a lower 30-day volatility than the broad market which makes it suitable for our near-term strategy of reducing volatility and increasing income.

(click to enlarge)

Opportunity #2: REITs

With many remaining income trusts converting to corporations by year end, there will be a lack of assets producing a sizable and relatively stable income, especially in this low interest rate environment. As a result, investors may look to real estate investment trusts (REITs) since they are largely exempt from the 2011 income trust taxation ruling. Considering the aging demographics in developed nations, pension plans especially could place buying pressure on this asset class as a move to look for income to fund their obligations to aging participants. Though REITs tend to be interest rate sensitive and we are in a rising interest rate environment, we don’t envision the Bank of Canada (BoC) announcing many more rate hikes in the near term. As the central bank has gone on record saying that it will consider the global economy along with its own when setting interest rates, at most, the BoC will likely have only one more move. With no signs of inflation, we doubt the bank will risk stunting the growth of the economy considering it’s not yet on solid footing.

Comments are closed.