Section

Fixed Income

3288 posts

Guest Post: The Magnificent Fed

Originally posted at Monty Pelerin's World blog, The Fed’s decision not to taper surprised the financial world. Markets…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

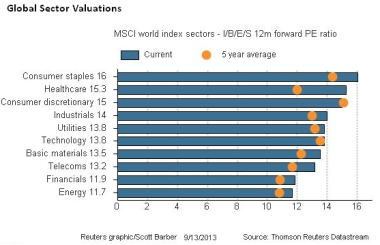

Global Equity Sectors Appear Fairly Valued

by David Templeton, Horan Capital Advisors A recent report by Thomson Reuters' AlphaNow provides a chart review package…

Many Bullish Indicators, But ...

Yesterday I wrote about how this rally off the August 27th low had good breadth, a bullish tailwind…

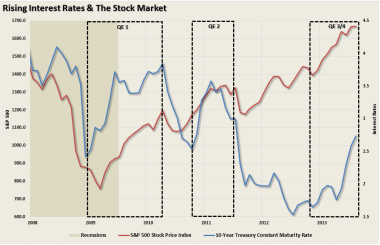

Rising Interest Rates Must End Soon

Why now may be the most opportune time to buy bonds than at any time in the past…

Time to Bench the Equity Benchmark Too?

by Patrick Rudden, AllianceBernstein While fixed-income investors are growing increasingly aware of the risks of benchmark-oriented bond portfolios…

Guest Post: Yellen In, Syria Done, 8 Risks That Remain

Submitted by Lance Roberts of Street Talk Live blog, It was quite a busy weekend for breaking news…

James Paulsen: Investment Outlook (September 13, 2013)

Where’s the Juice ... for Economic Growth? by James Paulsen, Wells Capital Management Most conventional U.S. policies have…

El-Erian: What's Happening To Bonds And Why?

by Mohamed El-Erian, originally posted at PIMCO, To say that bonds are under pressure would be an understatement.…

Guest Post: Bond CEFs Still Say Liquidity is in Trouble

Bond CEFs Still Say Liquidity is in Trouble by Tom McClellan, The McClellan Market Report September 10, 2013…

Jeffrey Gundlach: Annaly, Mortgage REITs Look Cheap, Attractive Now

by Michael Aneiro Speaking during a presentation this afternoon, DoubleLine Capital‘s Jeff Gundlach was again praising mortgage real-estate…

When Rates Rise – What Happens if Rates Rise Another 100 BPS?

by Tom Brakke, Research Puzzle Continuing the celebration of the return of a tablet, here’s another edition with…

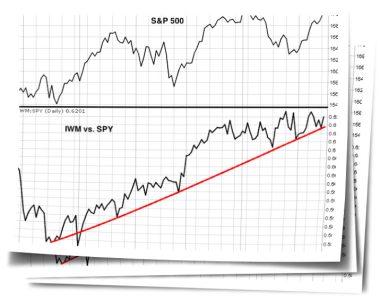

Why the Credit Market Matters to US Equities – Financials Rolling Over Relative to Broader Markets

From a fundamental point of view, stock prices can advance for two reasons. Either earnings rise, or the…

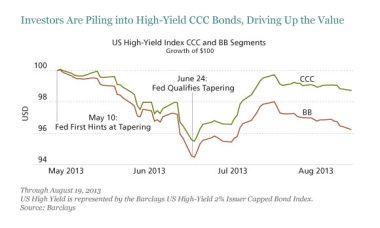

Beware the Dangerous Stretch for Yield

by Ashish Shah, AllianceBernstein The US Federal Reserve talked in early summer about tapering its quantitative easing plan…

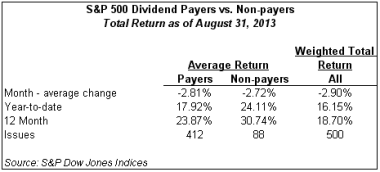

Dividend Payers Outperforming the S&P 500 Index But Not The Equal Weighted Non Payers

by David Templeton, Horan Capital Advisors On a capitalization weighted basis the dividend payers in the S&P 500…

The Economy and Bond Market Radar (September 9, 2013)

The Economy and Bond Market Radar (September 9, 2013) Treasury yields moved higher this week with the 10-year…