by Tom Brakke, Research Puzzle

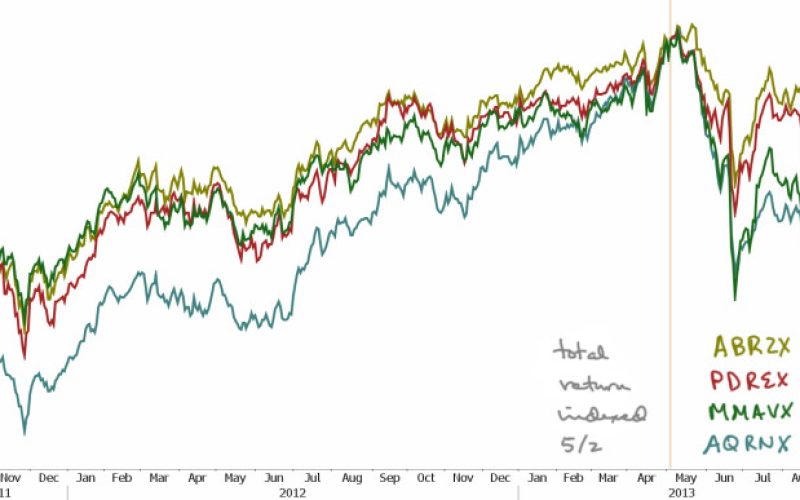

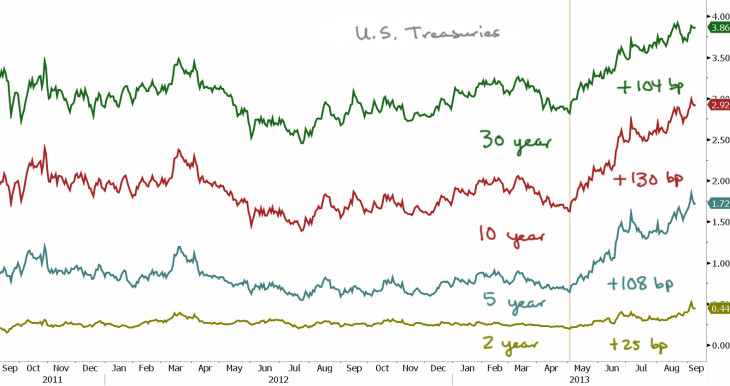

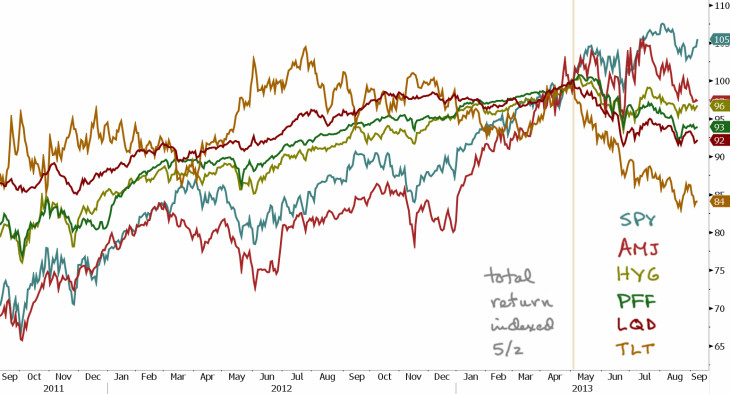

Continuing the celebration of the return of a tablet, here’s another edition with multiple charts. I’ve written a number of postings in the last couple of years about if/when interest rates rise. The main chart above shows the rise in rates since May 2, where you see the vertical line. Each of the three charts below updates an earlier one on the site and each is indexed to 100 on May 2, so that you can see the performance of the vehicles leading up to that recent bottom in rates and since then.

Continuing the celebration of the return of a tablet, here’s another edition with multiple charts. I’ve written a number of postings in the last couple of years about if/when interest rates rise. The main chart above shows the rise in rates since May 2, where you see the vertical line. Each of the three charts below updates an earlier one on the site and each is indexed to 100 on May 2, so that you can see the performance of the vehicles leading up to that recent bottom in rates and since then.

It’s always interesting to see how markets react when there is a bit of a regime shift. Last November, I asked what I thought was the big question, not just how the assets I charted would do in a rising rate environment, but what would happen that no one was talking about. The unambiguous winner of the group I had charted has been SPY.

One strategy that took it on the chin was risk parity. Here are the funds I highlighted in June when they looked more like the victims of risk disparity. (I doubt if they are the final answer to “the big question,” however.)

Also last fall, I had speculated that the new bonds — those high-paying dividend stocks that people were buying to pick up yield versus bonds — might take it on the chin when rates rose. I used three drug companies. Below they are shown relative to the S&P 500. Other than Pfizer (PFE), they have held in there pretty well.

So, what do you think will happen after the next hundred basis points? (Charts: Bloomberg terminal.)

Copyright © Research Puzzle