Where’s the Juice ... for Economic Growth?

by James Paulsen, Wells Capital Management

Most conventional U.S. policies have recently turned, or are about to turn, restrictive for economic growth. Mortgage rates have surged by almost 1.25% since May, the government sequester has produced a significant tightening in fiscal policy, and the Federal Reserve seems poised to soon begin tapering its quantitative easing program. This rather abrupt change in policy leaves many questioning why the pace of economic growth should improve in the coming year. Indeed, the economic policy mix already adopted or about to be employed could arguably be expected to slow the economic recovery.

So, as we begin to ponder 2014, the question is “Where’s the juice ... for economic growth?” Throughout, the speed of the contemporary recovery has been constrained by aging demographics.

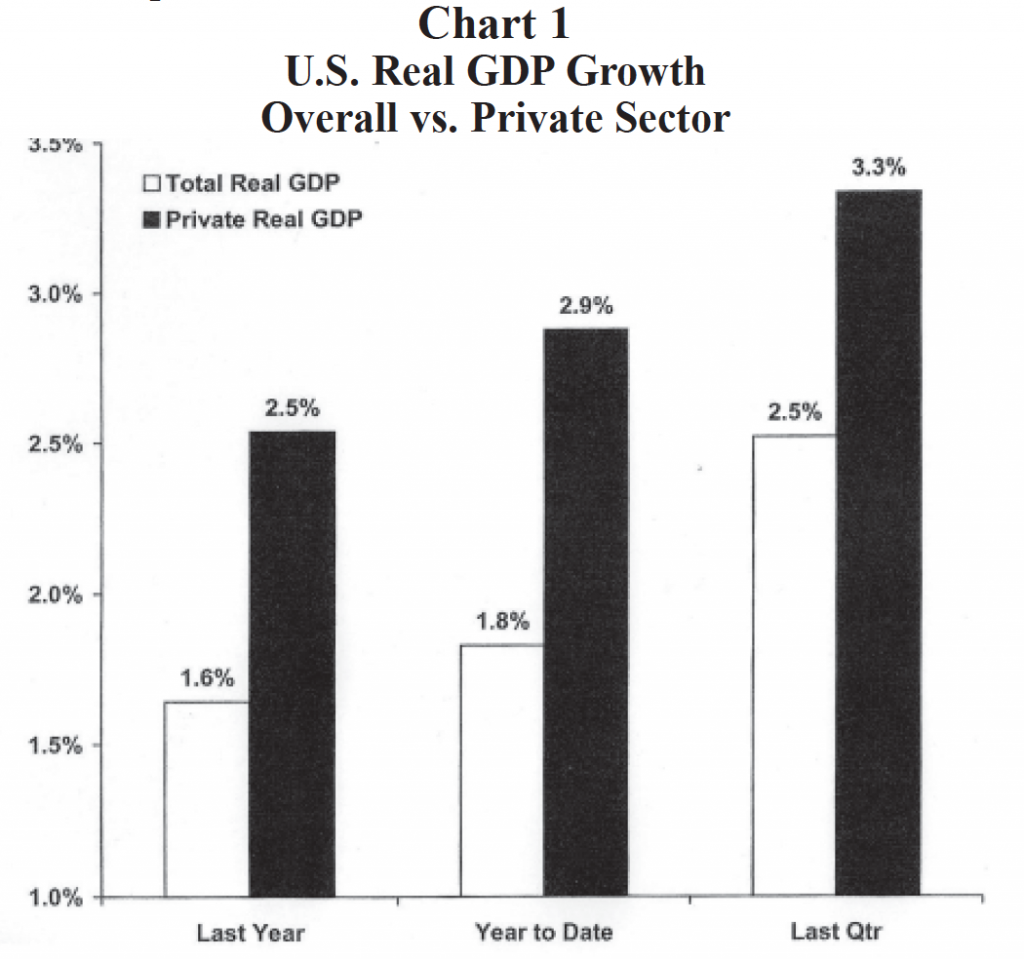

Because of anemic growth in the working age population, at its best, annual real GDP growth may fail to reach even 4% during this recovery. However, despite real growth of only 1.8% so far in 2013, economic growth may reach about 3% in the coming year. Indeed, the private sector grew 2.9% in the first half of this year. Moreover, although traditional policies have become more restrictive, they remain more conducive to economic growth than widely appreciated. Finally, several unconventional and unrecognized forces have emerged which are poised to begin “juicing” economic activity.

Private sector already growing at 3%

So far in 2013, aggregate real GDP growth has increased at a paltry 1.8% pace obscuring a much healthier 2.9% rise in private sector economic growth (Chart 1). Indeed, in the latest quarter, private activity rose at a 3.3% annualized pace!

Economic growth may surpass expectations in the coming year because outside of the government sector, the economy is already growing much faster than widely appreciated. Private sector growth should accelerate towards 3.5% and combined with a slower contraction in the public sector, overall real GDP should improve to one of its best annual growth rates of the recovery around 3%.

Copyright © Copyright ©