by David Templeton, Horan Capital Advisors

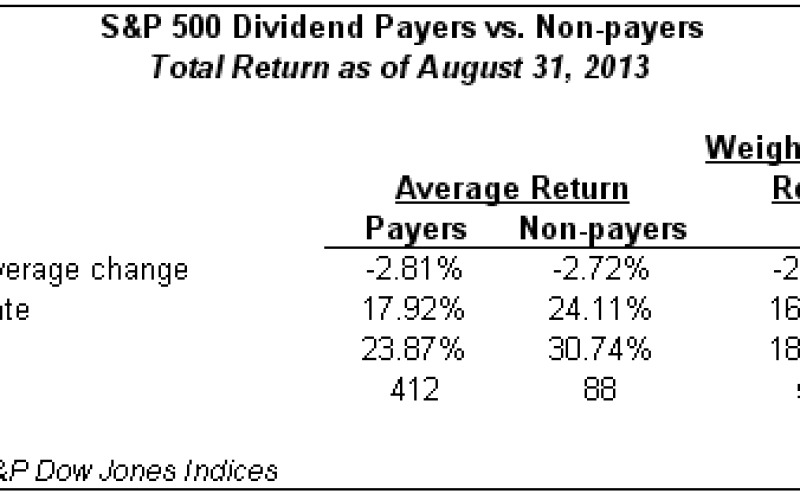

On a capitalization weighted basis the dividend payers in the S&P 500 Index have done a respectable job of outperforming the broader S&P 500 Index as noted in the below table. However, when one looks at the performance of the payers versus the non payers on an equal weighted basis, the payers have lagged the non payers by a significant margin. On an equal weighted basis the non payers have generated a return of 24.11% while the payers have returned 17.92%.

This return difference is attributable to the fact the smaller cap stocks within the index have outperformed the larger cap stocks. Investors can see the return difference by comparing the Guggenheim S&P 500 Equal Weighted Index (RSP) to the cap weighted S&P 500 ($SPX) detailed in the below charts.

The below chart shows the recent outperformance of small cap stocks (Russell 2000 Index) relative to the larger cap S&P 500 Index.

One important question for investors that are underweighted in small cap equities, is now the time to really increase their allocation to small caps. At our firm within our U.S. equity strategy, we currently are overweight in large cap relative to small cap. Directionally, as we noted in last quarter's Investor Letter, we have begun to increase our exposure to international developed equities on the margin.

Copyright © Horan Capital Advisors