Section

Credit Markets

588 posts

Keep an Eye on Credit Spreads

by Cam Hui, Humble Student of the Markets To be honest, I did not expect a December taper.…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The Economy and Bond Market Radar (November 18, 2013)

The Economy and Bond Market Radar (November 18, 2013) Treasury bond yields fell by a few basis points…

Jim Rogers: "This is Absolute Insanity"

"It's not just the Fed, it's central banking," Jim Rogers exclaims to Reuters in this brief clip, "this…

The Economy and Bond Market Radar (October 21, 2013)

The Economy and Bond Market Radar (October 21, 2013) Treasury bond yields fell this week as the government…

The Economy and Bond Market Radar (October 7, 2013)

The Economy and Bond Market Radar (October 7, 2013) Treasury yields rose modestly this week as attention was…

Simon Lack: Bonds Are Not Forever (The Crisis Facing Fixed Income Investors)

by Brenda Jubin, Reading the Markets As you might guess from its title, Bonds Are Not Forever: The…

Why the Credit Market Matters to US Equities – Financials Rolling Over Relative to Broader Markets

From a fundamental point of view, stock prices can advance for two reasons. Either earnings rise, or the…

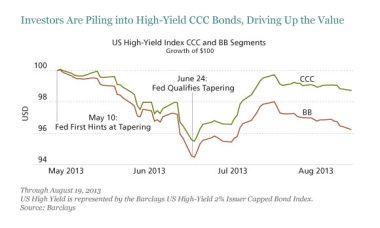

Beware the Dangerous Stretch for Yield

by Ashish Shah, AllianceBernstein The US Federal Reserve talked in early summer about tapering its quantitative easing plan…

The Economy and Bond Market Radar (September 2, 2013)

The Economy and Bond Market Radar (September 2, 2013) Treasury yields moved lower this week. This was particularly…

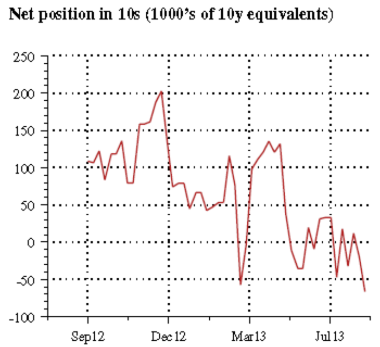

Speculative Positions in Treasuries Are Now Net Short and Growing

by Sober Look Speculative money has become visibly short rate products. As discussed this weekend (see post) there…

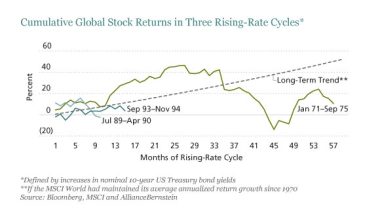

When Rising Rates Hurt Stocks, How Bad Did It Get?

by Chris Marx, AllianceBernstein By Chris Marx and Alison Martier A reader of our recent blog post about…

China and the Outlook for Financial Crises

China’s elevated and rising debt levels appear to be one of the largest risks to the global economy…

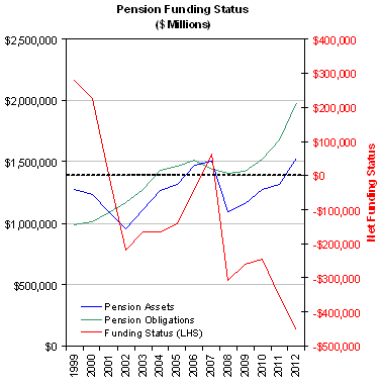

Pension Underfunding Continues

In spite of strong equity market returns over the last four years, company pension fund underfunding continues to…

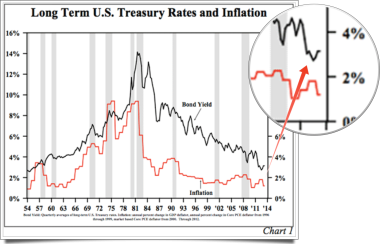

Hoisington: "The Secular Low In Bond Yields Has Yet To Be Recorded"

by Lacy Hunt and Van Hoisington via Hoisington Investment Management, Lower Long Term Rates The secular low in…

The Decline and Fall of Detroit

The Decline and Fall of Detroit (via Market Shadows) The Decline and Fall of Detroit Courtesy of Yves…