Browsing Category

Credit Markets

572 posts

Mid-Year Outlook: Fixed Income

by Kathy Jones, Global Fixed Income Strategist, Charles Schwab & Company Despite high volatility in the bond market…

June 12, 2023

Fund Insight: Explore AGF’s ‘Go-Anywhere’ Fund

by Tristan Sones & Tom Nakamura, Co-Heads of Fixed Income, AGF Investments Diversification of Fixed Income Asset Classes…

June 11, 2023

Defaults accelerating: Beware the coming credit crunch

by Michael Contopoulos, Director of Fixed Income, Richard Bernstein Advisors A quick PSA from RBA: Beware of the…

June 2, 2023

Why U.S. investment grade is attractive — and defensive

by Matt Brill, Head of North American Investment Grade, & Todd Schomberg, Senior Portfolio Manager, Invesco Key takeaways…

May 18, 2023

Will Banking Sector Issues Affect Corporate Bonds?

by Collin Martin, Fixed Income, Charles Schwab and Company Ltd. Corporate bond investors may be wondering if banking…

April 24, 2023

New Data Shows Fed Worried about a Credit Crunch Weeks Ago

by Brian Clark, Knowledge Leaders Capital The Fed’s concern about U.S. banks dominated last month’s FOMC meeting. According…

April 12, 2023

Fixed-Income Outlook: Getting a Grip in Slippery Markets

by Gershon Distenfeld, CFA, Scott Dimaggio, CFA, AllianceBernstein Market twists and turns challenged fixed-income investors in the first…

April 5, 2023

As Credit Goes, So Goes the Economy

by Joseph V. Amato, President and Chief Investment Officer—Equities, Jonathan Bailey, Head of ESG Investing, Neuberger Berman Credit…

April 3, 2023

From Anomaly to Opportunity: High Yields on Short Bonds

by Gershon Distenfeld, CFA, Will Smith, CFA, & Robert Schwartz, AllianceBernstein Stock and bond markets were shaken by…

March 27, 2023

Quick Thoughts: Banks and the butterfly effect—the global ramifications

by Stephen H. Dover, CFA, Chief Market Strategist and Head of Franklin Templeton Institute, Franklin Templeton Financial market…

March 16, 2023

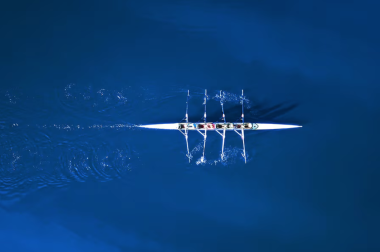

50/30/20 is the New 60/40

In today's investment climate, investors are facing significant challenges amid a volatile and uncertain economic environment. The 60-40…

February 24, 2023

A unique opportunity with deeply discounted corporate bonds

by Drew O'Neil, Fixed Income Strategist, Raymond James Drew O’Neil discusses fixed income market conditions and offers insight…

February 15, 2023

The credit hype machine is going to break

by Richard Bernstein, Richard Bernstein Advisors According to Bloomberg, January was a record month for investment grade (IG)…

February 9, 2023

Alfred Lee: 2023 Outlook & Strategy: 50 / 30 / 20

Listen on The Move In this podcast episode, Pierre Daillie, Managing Editor at AdvisorAnalyst.com, interviews Alfred Lee, Director,…

February 9, 2023

Central Banks vs. Financial Conditions

by Carl Tannenbaum, Executive Vice President, Chief Economist, Northern Trust Markets are no longer shocked by central bank…

February 8, 2023