by Tristan Sones & Tom Nakamura, Co-Heads of Fixed Income, AGF Investments

Diversification of Fixed Income Asset Classes

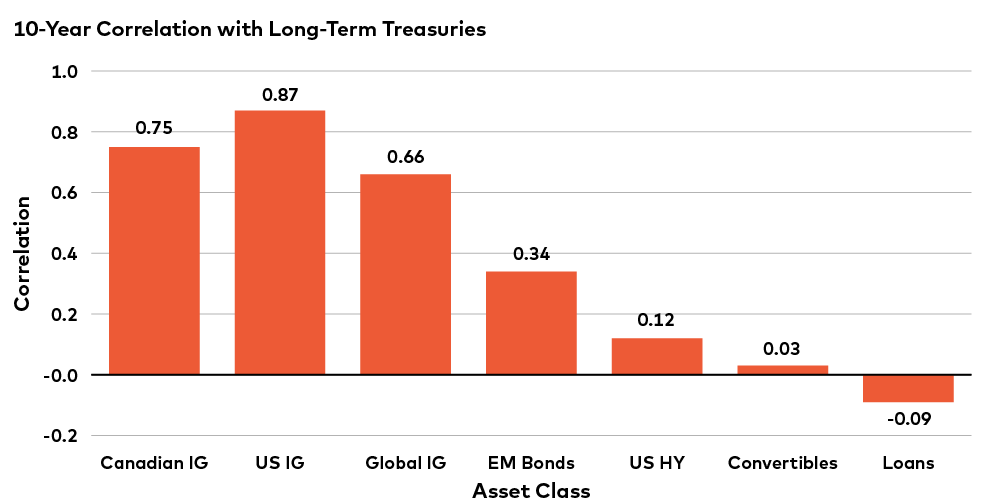

A crucial takeaway from the past year is the importance of asset class diversification within the fixed income universe. Diversifying fixed income not only geographically, but by asset class, can potentially help contribute to portfolio outcomes over the long term as different types of debt have unique risk and return profiles and most importantly – act differently at different times. Traditional fixed income portfolios that are comprised of core investment grade (“IG”) debt, such as Canadian, US or Global IG, or long dated government bonds, such as Long-Term US Treasuries, tend to have high correlations with each other.

Source: AGF Investments Inc. and Morningstar Direct as of April 30, 2023. Long-Term US Treasuries represented by the Bloomberg US Treasury 20+ Yr Index, Canadian IG by the Bloomberg Canada Aggregate Index, US IG by the Bloomberg US Aggregate Index, Global IG by the Bloomberg Global Aggregate Index, Emerging Markets (EM) Bonds by the JPM EMBI Global Core Index, US High Yield (HY) by the Markit iBoxx Liquid High Yield Index, Convertibles by the Bloomberg US Convertibles Index and Loans by the Bloomberg USFRN 5-Yr. Correlation is a statistical measurement of the relationship between two variables. In this case, compared to Long-Term US Treasuries. A correlation of less than one is considered a favourable correlation. Returns shown are hypothetical based on backtested data of the indices, as mentioned above, historical returns and provided for illustrative purposes only. One cannot invest directly in an index. Past performance is not indicative of future results.

AGF Total Return Bond Fund has the ability to invest in bonds outside of North America and other fixed income asset classes which have historically demonstrated lower correlations to long-term U.S. treasuries.

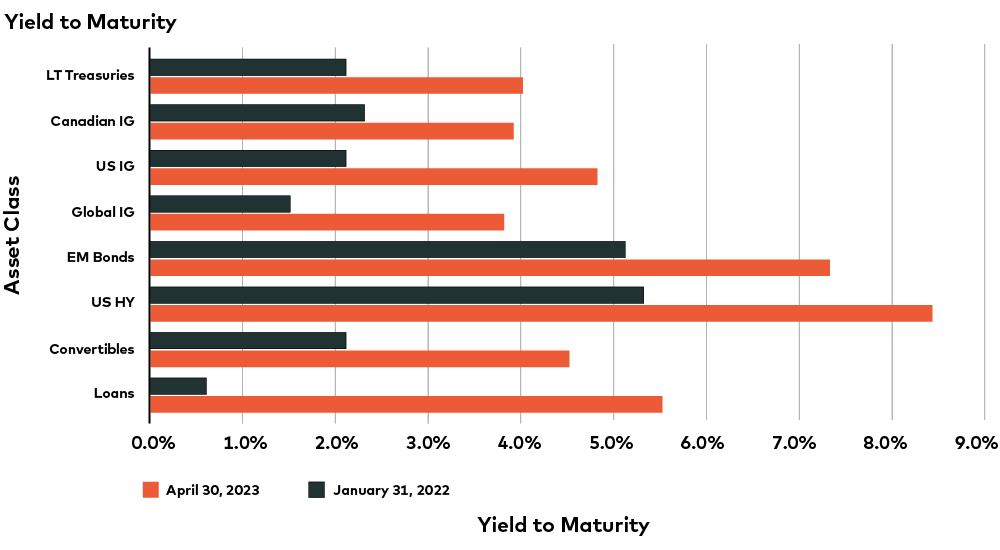

The very factor that led to challenging fixed income returns last year, rising interest rates, has also led to more attractive yields for bonds. As demonstrated below, the yields to maturity are very elevated compared to last year and when added to a portfolio offers the potential for higher returns.

Source: AGF Investments Inc. and Morningstar Direct as of April 30, 2023. Long-Term US Treasuries represented by the Bloomberg US Treasury 20+ Yr Index, Canadian IG by the Bloomberg Canada Aggregate Index, US IG by the Bloomberg US Aggregate Index, Global IG by the Bloomberg Global Aggregate Index, EM Bonds by the JPM EMBI Global Core Index, US HY by the Markit iBoxx Liquid High Yield Index, Convertibles by the Bloomberg US Convertibles Index and Loans by the Bloomberg USFRN 5-Yr. Returns shown are hypothetical based on backtested data of the indices, as mentioned above, historical returns and provided for illustrative purposes only. One cannot invest directly in an index. Past performance is not indicative of future results.

From an income perspective, non-traditional fixed income asset classes such as EM Bonds, US High Yield Bonds, Convertible Bonds and Loans can now provide investors with much higher distribution potential compared to traditional investment grade bonds.

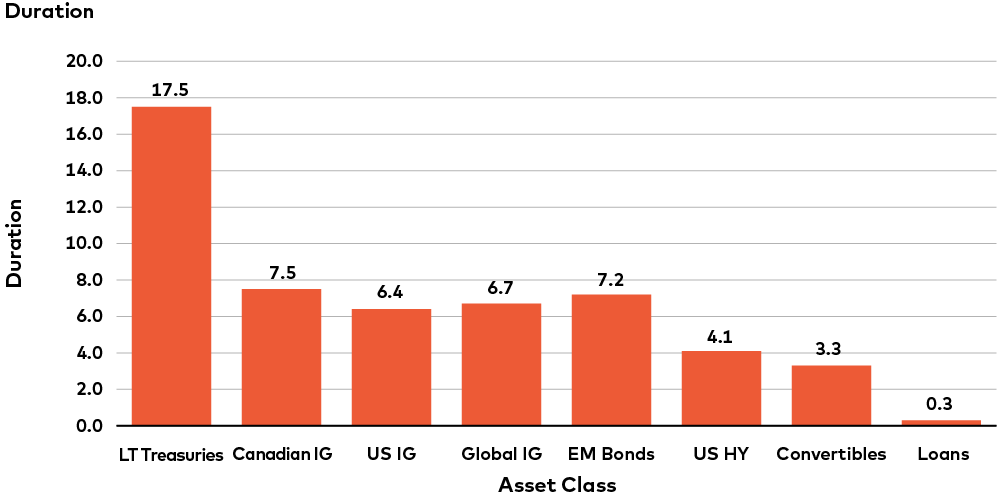

Duration Management

Traditional, core fixed income portfolios, particularly those with static allocations, have historically had longer duration exposure and higher interest rate sensitivity. The inclusion of non-core fixed income classes such as convertible bonds, loans and high yield bonds can diversify portfolios by providing differentiated sources of risk and return, different levels of duration risk and provide exposure to various interest rate regimes.

The duration figures in the chart below are all modified duration. Modified duration shows the approximate shift in a bond’s price an investor can expect per every 1% change in interest rates.

Source: AGF Investments Inc. and Morningstar Direct as of April 30, 2023. Long-Term US Treasuries represented by the Bloomberg US Treasury 20+ Yr Index, Canadian IG by the Bloomberg Canada Aggregate Index, US IG by the Bloomberg US Aggregate Index, Global IG by the Bloomberg Global Aggregate Index, EM Bonds by the JPM EMBI Global Core Index, US HY by the Markit iBoxx Liquid High Yield Index, Convertibles by the Bloomberg US Convertibles Index and Loans by the Bloomberg USFRN 5-Yr. Durations shown are hypothetical based on backtested data of the indices, as mentioned above, historical returns and provided for illustrative purposes only. One cannot invest directly in an index. Past performance is not indicative of future results.

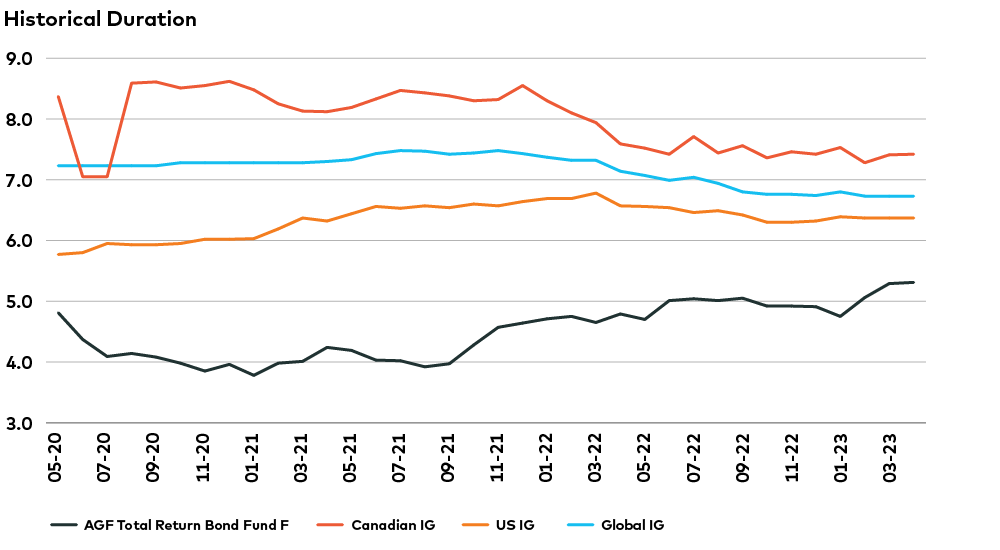

Duration considerations plays a large role in the portfolio construction process of AGF Total Return Bond Fund. Since the Fund uses an unconstrained approach, the duration profile has been quite dynamic over time, which makes it a potentially helpful addition to a portfolio to better navigate changing yield environments.

Source: AGF Investments Inc. and Morningstar Direct as of April 30, 2023, in Canadian dollars, net of fees. Canadian IG represented by the Bloomberg Canada Aggregate Index, US IG by the Bloomberg US Aggregate Index and Global IG by the Bloomberg Global Aggregate Index. Durations shown are hypothetical based on backtested data of the indices, as mentioned above, historical returns and provided for illustrative purposes only. One cannot invest directly in an index. Past performance is not indicative of future results.

Source: AGF Investments Inc. and Morningstar Direct as of April 30, 2023, in Canadian dollars, net of fees. Canadian IG represented by the Bloomberg Canada Aggregate Index, US IG by the Bloomberg US Aggregate Index and Global IG by the Bloomberg Global Aggregate Index. Durations shown are hypothetical based on backtested data of the indices, as mentioned above, historical returns and provided for illustrative purposes only. One cannot invest directly in an index. Past performance is not indicative of future results.

Drawdown protection

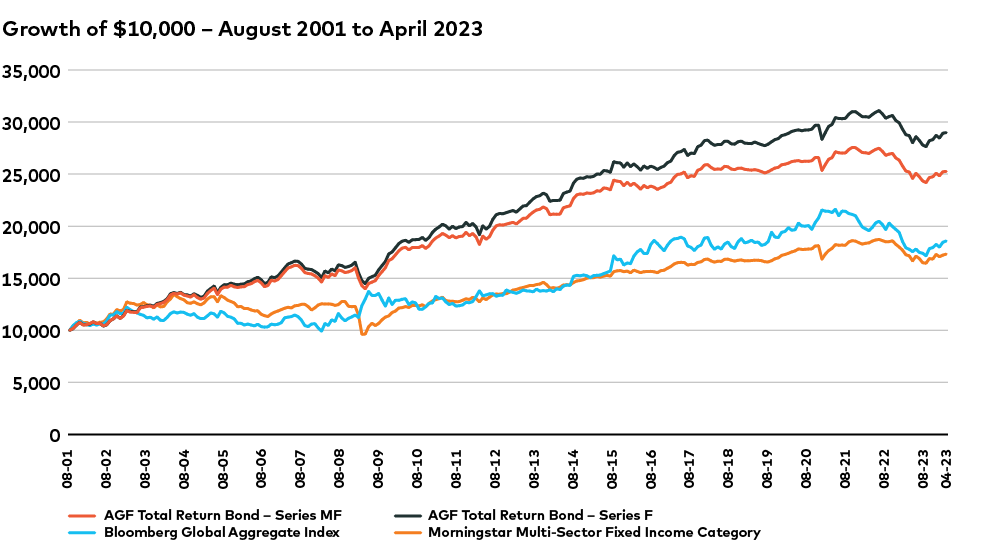

For the period ending April 30, 2023, the Fund has outperformed both the Bloomberg Global Aggregate Bond Index and the Morningstar Multi-Sector Fixed Income Category. We believe our outperformance is a result of having an active approach to capturing opportunities in and around the core fixed income universe which we believe can result in stronger outcomes.

Source: AGF Investments Inc. and Morningstar Direct as of April 30, 2023, in Canadian dollars, net of fees. The rates of return shown are used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the investment funds or returns on investment in the investment funds. Returns shown are hypothetical based on backtested data of the Bloomberg Global Aggregate Bond Index and Morningstar Multi-Sector Fixed Income Category historical returns and provided for illustrative purposes only. The Bloomberg Global Aggregate Index is a proxy for the global investable IG bond market. One cannot invest directly in an index. Past performance is not indicative of future results.

Copyright © AGF Investments