by Matt Brill, Head of North American Investment Grade, & Todd Schomberg, Senior Portfolio Manager, Invesco

Key takeaways

Move up in qualityWe believe the current environment argues for a move up in quality and defensive investment approach. |

Potential tailwindsU.S. banking sector turmoil could lead to slower growth, lower inflation, and lower interest rates — potential tailwinds for fixed income. |

Lock in yieldsNow is a good time to extend duration and lock in attractive yields before they move lower, in our view. |

Q: How would you summarize the current opportunity in U.S. investment grade fixed income?

U.S. investment grade fixed income has felt some effects of the recent turmoil in the global banking sector and, to be sure, we could see more market volatility in the coming weeks and months. But we believe this uncertainty argues for moving up in asset quality and adopting a more defensive investment stance.

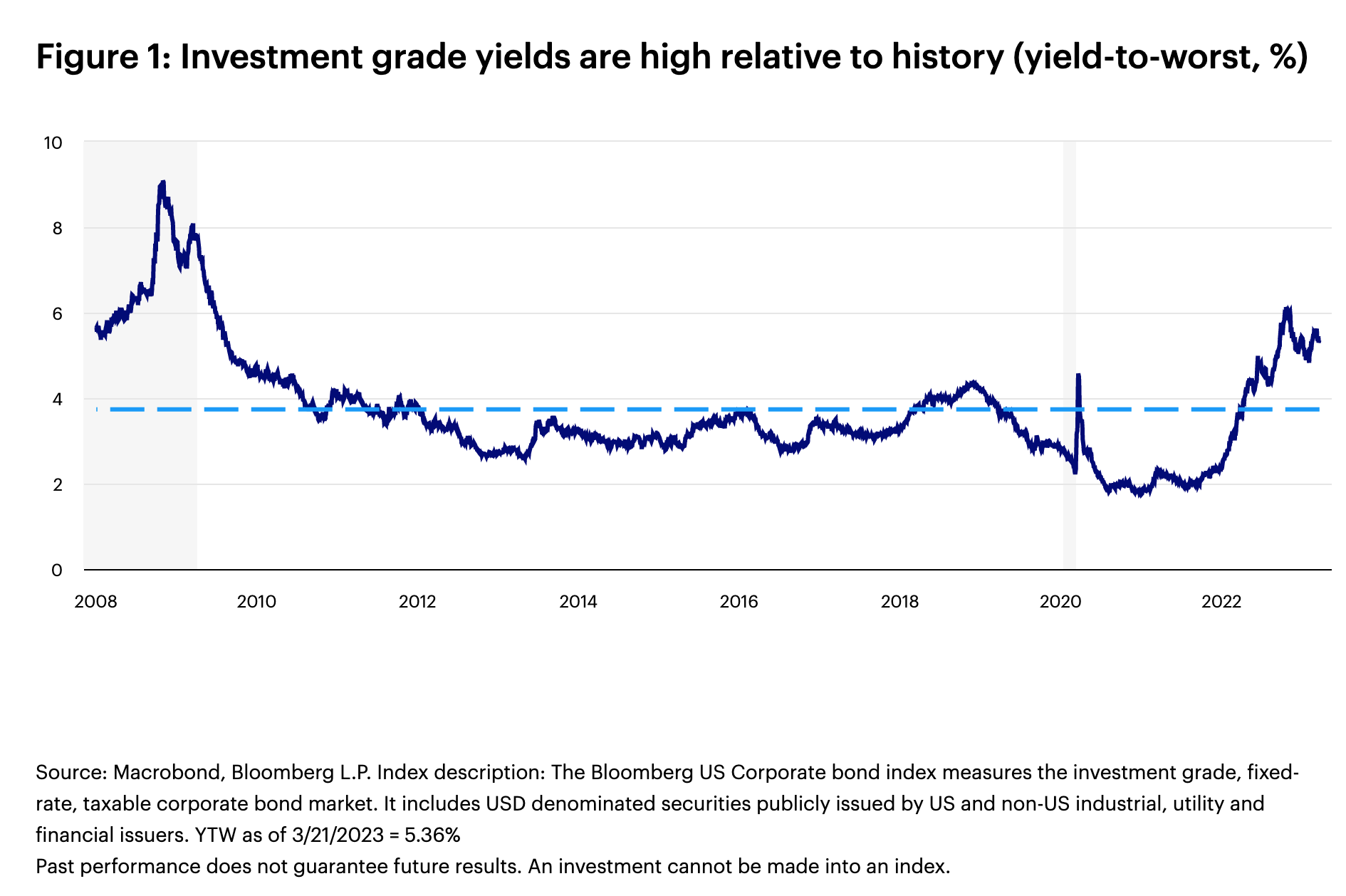

We think investment grade fixed income makes sense in this environment. Even after the flight to quality that followed recent banking sector events, U.S. investment grade yields remain as attractive as they have been since the 2008 global financial crisis. The yield on the U.S. investment grade index is currently 5.36%, well above the historical average (Figure 1). If the U.S. economy slows and inflation recedes, which is our base case, we believe this is an opportune time to lock in attractive yields before interest rates potentially move lower.

Q: What’s the likely impact of recent U.S. banking sector turmoil on the investment grade market?

Q: What’s the likely impact of recent U.S. banking sector turmoil on the investment grade market?

A major fallout of the recent banking sector turmoil is likely to be a downshift in growth. While we haven’t yet seen a problem with bank asset quality, U.S. banks will probably naturally pull back on their risk-taking and government regulators will likely impose more stringent rules to prevent future banking sector stress. As a result, lending standards across the U.S. economy are likely to tighten, causing a weaker “credit impulse” and potentially weaker growth.

With the credit impulse impaired, we believe the U.S. is now more likely to tip into a recession. While the U.S. still may not experience a “hard landing”, we believe escaping a recession altogether seems less likely now. On the bright side, slower growth or recession could mean lower inflation and lower interest rates. This would be a positive environment for high quality bonds, in our view. Inflation is the enemy of bond investors, and we view high quality fixed income as a more defensive asset class if the U.S. is entering a slower growth environment.

Q: What is your outlook for U.S. inflation and Fed policy?

The recent stresses in the banking system are likely to cause banks to further tighten lending standards, which will likely be a drag on growth and inflation. Fed Chair Powell highlighted in his post-rate decision press conference that the Fed had considered pausing at its March meeting given these stresses, but that inflation and economic data had still warranted a rate hike. We think the Fed will be very data dependent going forward and will likely be on hold for the near future. There is a good probability it’s finished its hiking cycle, with potential rate cuts later this year, as growth and inflation slow.

Q: How has U.S. investment grade traditionally performed after the end of Fed rate hiking cycles?

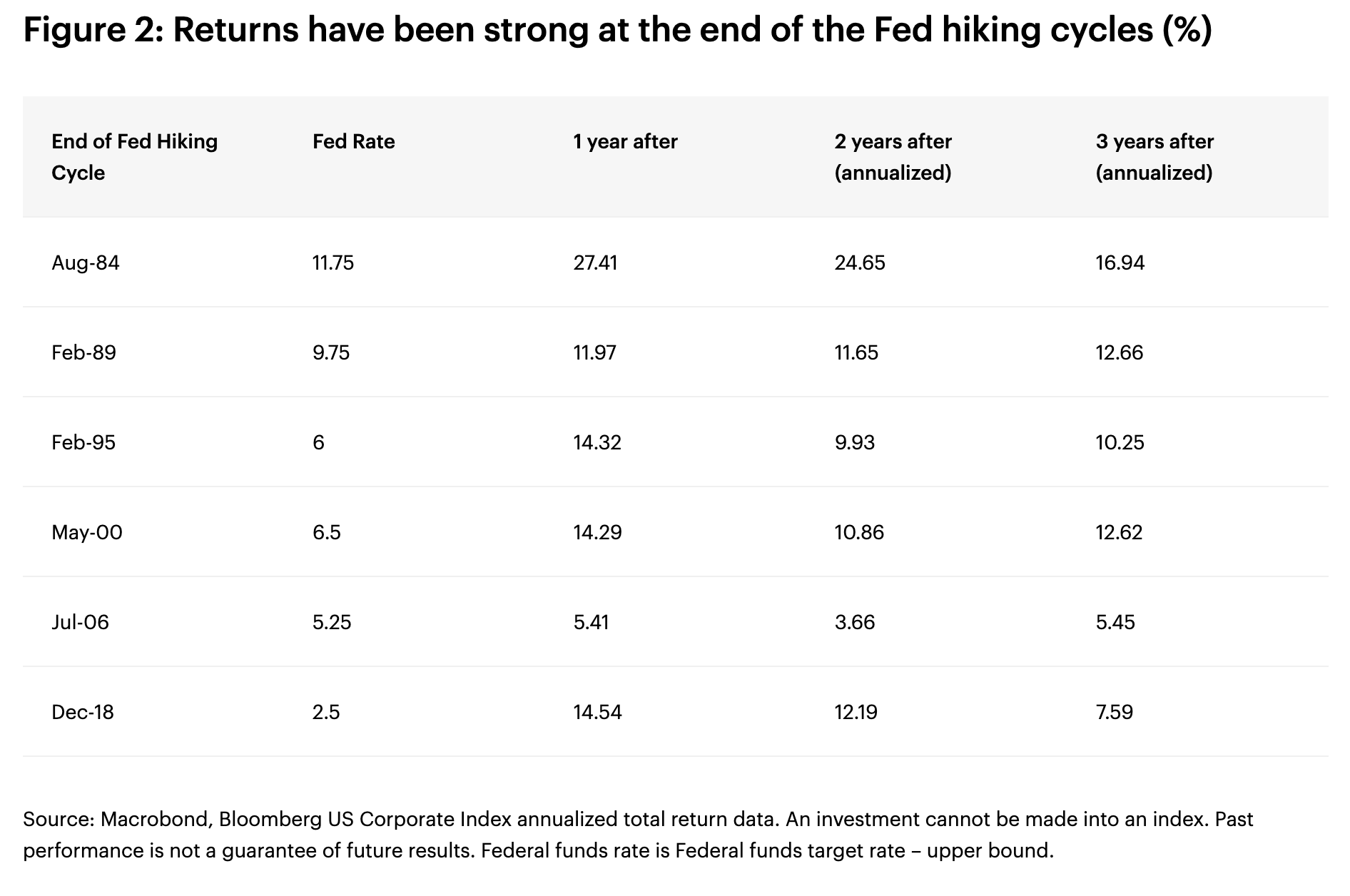

Historically, investment grade returns have been strongly positive after the end of Fed hiking cycles. In most years that followed the end of Fed hiking cycles, U.S. investment grade delivered double digit returns (Figure 2).

Copyright © Invesco