by Gershon Distenfeld, CFA, Will Smith, CFA, & Robert Schwartz, AllianceBernstein

Stock and bond markets were shaken by the recent banking crisis in the US and Europe. Although both US and European authorities took prompt action to prevent damage to the financial system and dampen market volatility, these episodes highlight the importance of risk management and the worth of proven investment strategies that can both mitigate risk and generate worthwhile returns.

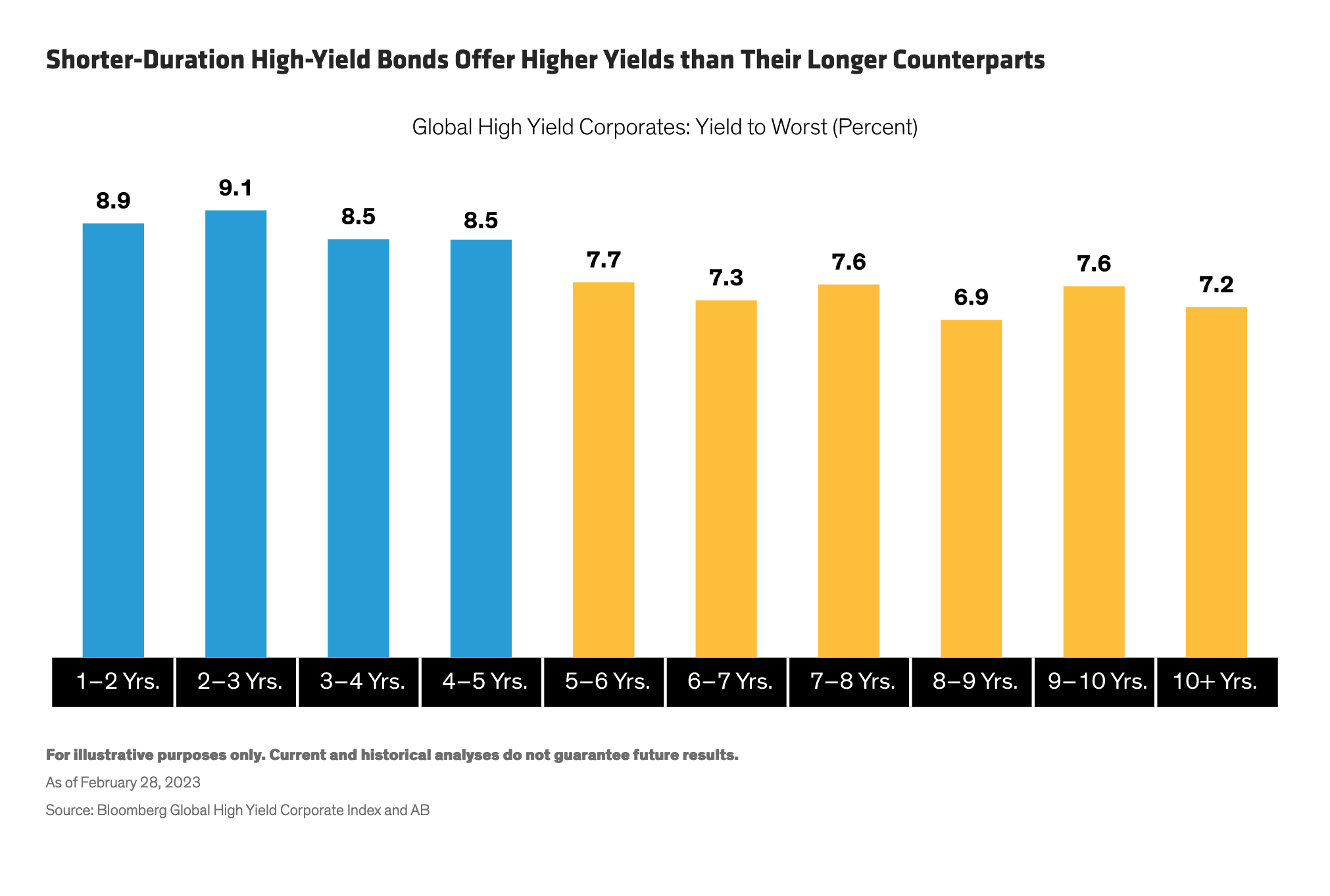

Historically, higher-rated short-duration high-yield bonds have provided strong returns with defensive characteristics. Now, with yield curves inverted across North America, Europe and parts of Asia, investors no longer need to increase interest-rate risk (duration) to earn extra income.

Shorter Bonds Make for Lower Risk

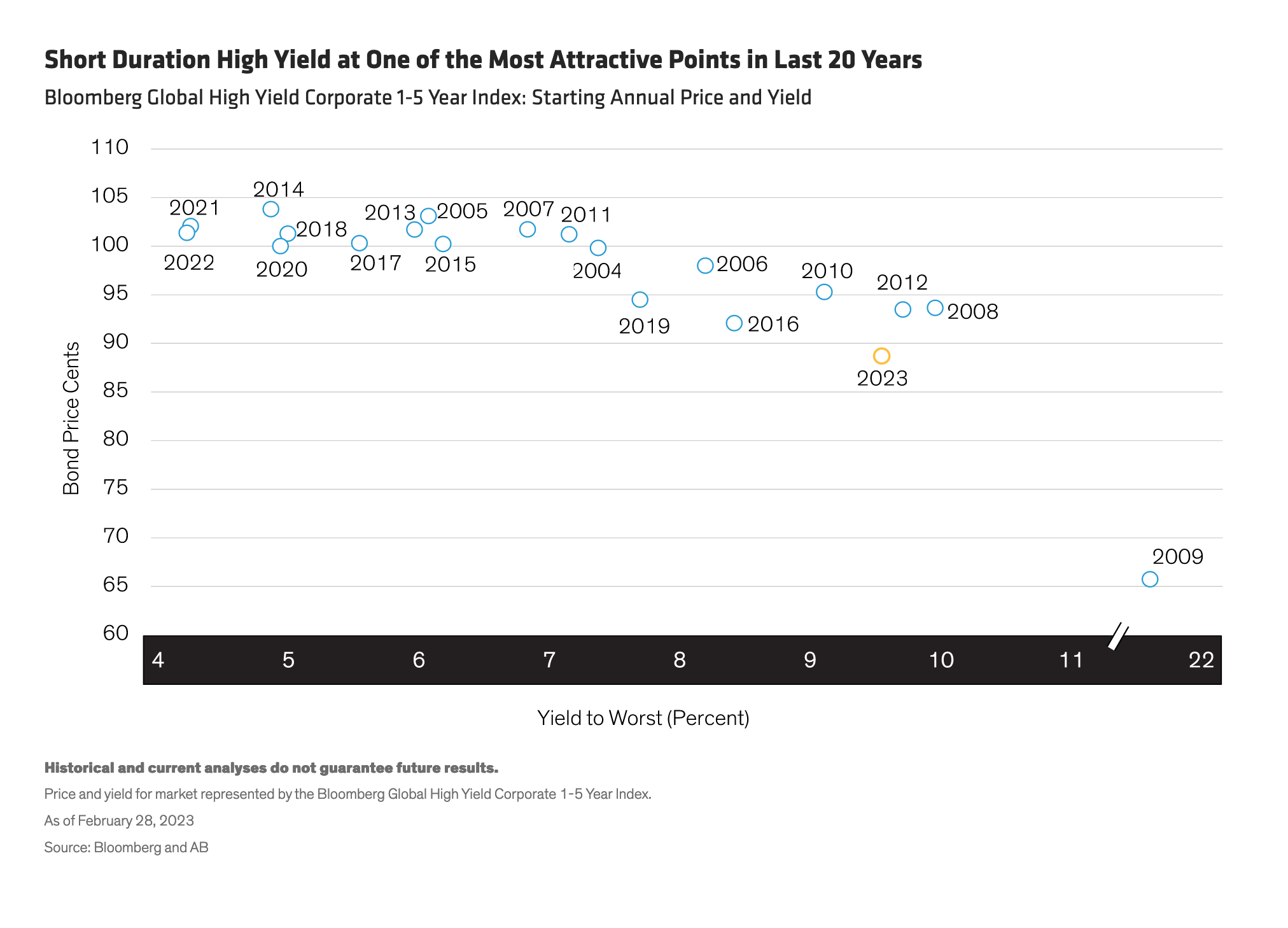

Short-dated high-yield bonds are intrinsically less risky than longer-dated counterparts, as their shorter maturities leave them less exposed to both default- and interest-rate risk. Further, as these bonds currently trade below par (Display), their prices will likely rise as they approach maturity, generating capital gains.

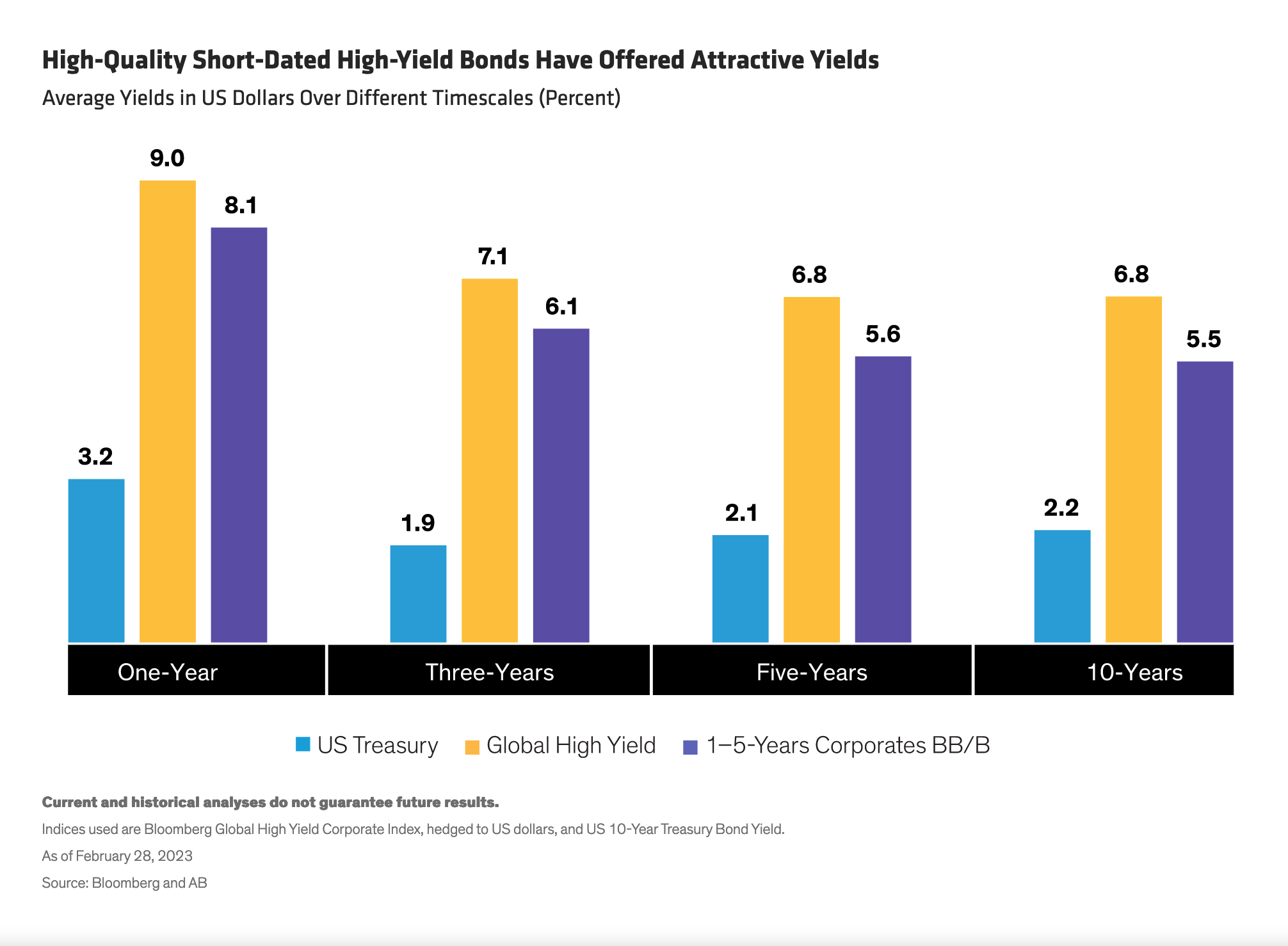

What’s more, by concentrating on the higher-quality segment of short-dated high yield, investors can create more defensive portfolios for a relatively small reduction in yield (Display).

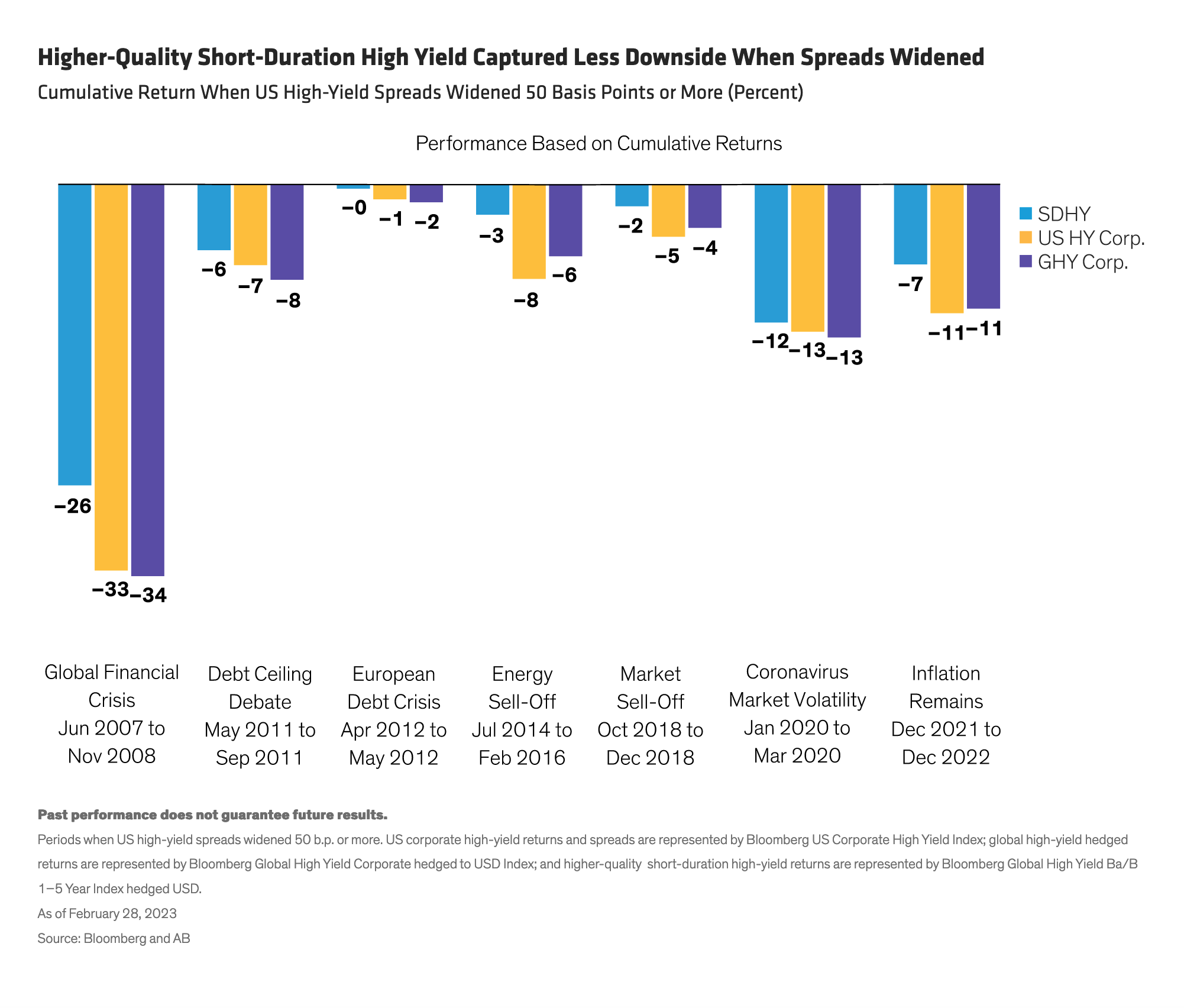

Over the 20 years ending September 30, 2022, BB- and B-rated high-yield bonds between one and five years to maturity captured more than 80% of the broader high-yield market return, while experiencing approximately 50% of the average monthly drawdown. Consequently, they have provided better risk-adjusted returns than their longer-dated (five- to ten-year) high-yield counterparts. But they have really come into their own during periods of extreme market stress. At these times, higher-quality, short-duration high yield has exhibited much lower downside capture than both the global and US high-yield markets (Display).

In our analysis, dynamically managed short-duration high-yield strategies that can allocate tactically to higher-rated assets, including investment-grade bonds, may achieve even more consistent performance. By varying the allocations to return-seeking and more defensive bonds as market conditions change, investors may have the opportunity both to capture higher returns in risk-on periods and to guard against downside risks in choppier markets.

Inverted Yield Curve Favors Shorter Bonds

Currently, owing to inverted yield curves, investors have a potentially highly attractive entry point for investing in short-duration high-yield bonds, as high-yield bonds with five or fewer years to maturity offer significantly higher yields than longer-dated counterparts (Display).

In an uncertain world, we think shorter-dated, higher-rated, high-yield strategies could be particularly well-suited to delivering attractive risk-adjusted returns.

*****

About the Authors Gershon M. Distenfeld, CFA

Gershon M. Distenfeld, CFA

Gershon M. Distenfeld, Senior Vice President, is Co-Head of Fixed Income, Director of Credit and a member of the Operating Committee. As Co-Head of Fixed Income, he is responsible for the management and strategic growth of AB’s fixed-income business. As Director of Credit, Distenfeld oversees all of AB’s credit-related strategies, including all global and regional investment-grade and high-yield strategies, as well as their associated investment strategy, activities and portfolio-management teams. In this capacity, he leads AB’s internal Credit Research Review Committee, the primary investment policy and decision-making committee for all credit-related portfolios the firm manages. Distenfeld also co-manages AB’s multiple-award-winning High Income Fund, named “Best Fund over 10 Years” by Lipper from 2012 to 2015, and the multiple-award-winning Global High Yield and American Income portfolios, flagship fixed-income funds on the firm’s Luxembourg-domiciled fund platform for non-US investors. He joined AB in 1998 as a fixed-income business analyst, and served as a high-yield trader (1999–2002) and high-yield portfolio manager (2002–2006) before being named director of High Yield in 2006. Distenfeld began his career as an operations analyst supporting Emerging Markets Debt at Lehman Brothers. He holds a BS in finance from the Sy Syms School of Business at Yeshiva University and is a CFA charterholder. Location: New York

Will Smith is a Senior Vice President and Director of US High Yield Credit. He is also a member of the High Income, Global High Yield, Limited Duration High Income, Short Duration High Yield and European High Yield portfolio-management teams. Smith designed and is one of the lead portfolio managers for AB’s Multi-Sector Credit Strategy, which invests across investment-grade and high-yield credit sectors globally. He leads the monthly High Yield portfolio-construction meeting, and is a member of the Credit Research Review Committee, which determines investment policy for the firm’s credit-related portfolios. Smith has authored several papers and blogs on high-yield investing, including one on the importance of using a probability-based framework to build better portfolios. He joined AB in 2012, and spent 2014 in London as part of the European High Yield portfolio-management team. Smith started his career with UBS Investment Bank, working as an analyst with the Credit Risk team and then later on the Fixed Income sales and trading desk. He holds a BA in economics from Boston College and is a CFA charterholder. Location: New York

Robert Schwartz, Senior Vice President and Portfolio Manager, joined AB in 2012 as a corporate research analyst, covering specialty finance, automotive, aerospace/defense and industrial companies. He analyzed the same industries as a senior credit analyst at Citadel Investment Group and Bell Point Capital Management. Schwartz started his career in Detroit as an automotive engineer, where he was awarded two patents.

AB's emphasis on differentiated research and its long-term focus drew Schwartz to the firm. Using automated tools—like the digitization of fundamental research—that convert research into trade ideas is key to this active management approach. “We focus on the range of possible outcomes,” he says. “We don't put weight on a single point forecast or on trailing metrics.”

Schwartz's motivations are twofold: curiosity about how businesses perform during various economic and industry cycles, and competitiveness to generate the best returns for clients. “It's not a sprint,” he says. “It's a lot of sprints.”

Copyright © AllianceBernstein