by Carl Tannenbaum, Executive Vice President, Chief Economist, Northern Trust

Markets are no longer shocked by central bank tightening.

When I began working in the financial services industry, I was shocked to learn that banks actually like to make loans. All of the imagery I had seen in movies and television depicted hard-bitten credit officers who delighted in turning borrowers down. They sought to be so intimidating, in fact, that applicants thought twice about even asking for a loan.

As I have come to appreciate, arranging financing is one of the ways that companies like ours earn money. Banks actively solicit lending and underwriting business, subject to standards for credit quality. The intermediation is not only important for the firm, but also for the economy in general.

The Federal Reserve has complained recently that the conditions under which this financing is occurring have gotten too easy. The concern is not bad credit decisions, but rather that accommodative credit terms are working at cross purposes with efforts to tame inflation. But a close look at financial conditions suggests that this concern may be misplaced.

Monetary policy works by modulating the level of reserves in a financial system. Once created, reserves cascade through the economy through strings of transactions. Credit is one of the binders that sustains the string: new liquidity created by a central bank is lent, spent, deposited and then lent again. The more willing that creditors are to provide financing, the greater the length of the economic chain.

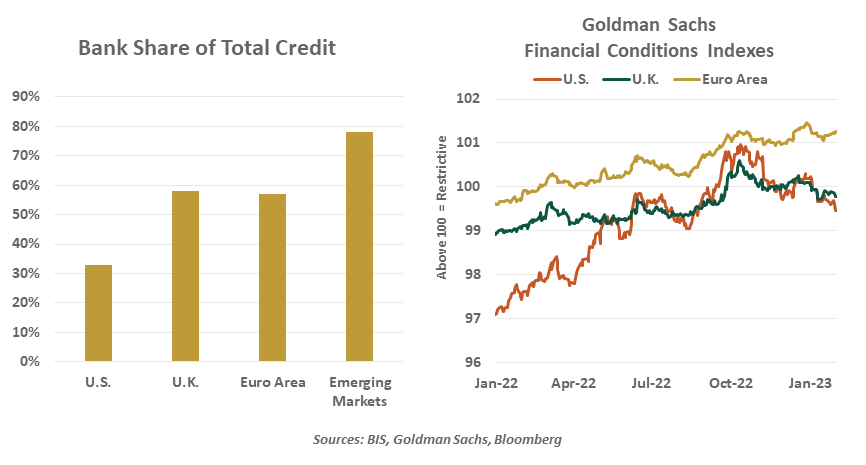

In traditional models, banks are the main financial intermediaries. In many parts of the world, they still are: in Europe, for example, banks still account for almost 60% of the credit received by businesses and households. In the United States, capital is more often raised in the bond and stock markets, where investors and borrowers meet more directly. Market-based sources account for more than 60% of the financing used by American businesses and households.

To recognize the role of markets, measures of financial conditions combine bank lending standards with indicators like equity prices, credit spreads and market volatility. These latter elements are intended to capture the ease of access to capital that comes directly from investors. The resulting Financial Conditions Indexes (FCIs) are mathematically intricate, but interpretively simple: if readings are above a certain level, conditions are tight. Below that level, they are easy.

When the pandemic arrived, credit froze. Officials took steps to restore the flow: interest rates were reduced to very low levels, special lending programs were initiated, and central banks offered backstops for debt issuance. Financial conditions had eased substantially by the end of 2020, and they were still easy coming into last year.

Positive markets have been a negative for central bankers.

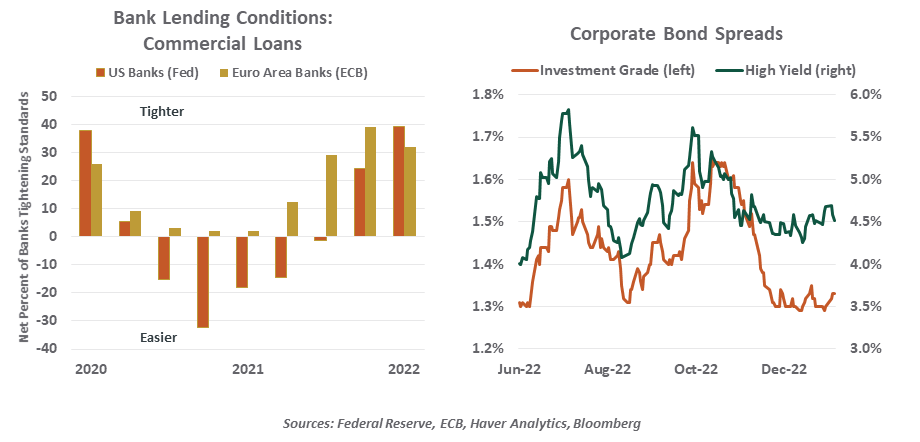

This posture became less desirable as inflation mushroomed. Monetary policy pivoted to become more restrictive through rate increases and reductions in liquidity supplied to the financial system. Bond and stock prices slumped, and bank lending standards tightened. Financial institutions and financial markets were working in concert with central banks to slow activity; some became concerned that the collaboration would lead to recession.

But starting last fall, the markets chose to go their own way. Asset prices began to rally, in spite of the steady stream of cautionary words and deeds emanating from central banks. Market volatility calmed. And the compensation demanded by investors for taking credit risk declined sharply.

The notion that markets were blunting efforts to contain inflation drew rebukes from central bankers. In December, Federal Reserve Chairman Jerome Powell said, “Financial conditions fluctuate in the short term in response to many factors, but it is important that, over time, they reflect the policy restraint that we are putting in place.” Observers wondered whether interest rates would be hiked by an additional increment to compensate for the market’s lack of cooperation.

But the concern over easing financial conditions may be overdone. The evidence from the real estate industry around the world clearly reflects a high degree of restraint. Initial public offerings of stock last year were the lowest in two decades. The amount of U.S. corporate bonds outstanding has changed little over the past year. Data on private financing is not easy to come by, but impressions among professionals in the field is that fundraising is not as easy as it was a year ago. These insights do not suggest that credit practices are overly aggressive.

Further, improving stock and bond prices reflect confidence that central banks will ultimately bring inflation back under control, and do so without significant damage to economic activity. Falling volatility, especially in the bond market, is a sign that communication from central banks is getting clearer: the road ahead for interest rates has become more certain over the past few months. Rather than viewing financial conditions as a threat, central bankers might see them as a vote of confidence.

Central bankers might view easier financial conditions as a vote of confidence, not a threat.

The Federal Reserve, the Bank of England and the European Central Bank all met this week. And while all three announced rate hikes, they also signaled that the end is in sight. Inflation is on the way down, and officials are gaining trust in projections that it will continue in that direction. The accumulation of interest rate increases has probably not reached full potency, so there is additional restraint in the pipeline. Ongoing quantitative tightening programs will reduce the volume of excess liquidity in the financial system.

Central banks are understandably hesitant to declare victory, and have cautioned investors against doing the same. The financial markets are implying interest rate cuts from the Fed and the Bank of England before the end of the year, expectations which we think are premature. We suspect that monetary officials will be persistent in their efforts to correct this apparent misconception.

One of the most nervous moments of my life was when I signed up for my first mortgage loan. While I was anxious, my lender was smiling; on that occasion, I had clearly misinterpreted financial conditions. I am trying not to make the same mistake in the present day.

Carl R. Tannenbaum

Carl R. Tannenbaum

Executive Vice President and Chief Economist

Carl Tannenbaum is the Chief Economist for Northern Trust. In this role, he briefs clients and colleagues on the economy and business conditions, prepares the bank's official economic outlook and participates in forecast surveys. He is a member of Northern Trust's investment policy committee, its capital committee, and its asset/liability management committee.