Section

Corporate Debt

139 posts

Who's Smarter? Stocks or Corporate Bonds?

by Dana Lyons, J. Lyons Fund Management, Inc. One of the Wall Street platitudes often repeated is that…

May 11, 2015

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Could the Search for Income Lead to Instability?

by Daniel Loewy and Morgan Harting, AllianceBernstein Years of quantitative easing has pushed yields on government bonds down…

March 20, 2015

Guy Haselmann: "Fading Smiles"

Out There Beyond the Wall by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM • Germany, France, Japan…

August 13, 2014

Don’t Skip the Homework: High Yield’s Overlooked Risks

by Gershon Distenfeld, AllianceBernstein Many investors have taken on more risk in their quest for higher returns—especially as…

June 12, 2014

Corporate Credit Fundamentals Worsening?

by Sober Look US corporate credit markets, particularly high yield bonds, are becoming quite frothy, as risk/reward dynamics…

June 9, 2014

David Rosenberg: 10 Macro Indicators That Point to No Recession

by Cullen Roche, Pragmatic Capitalism In a recent research note David Rosenberg of Gluskin Sheff checks in on…

June 6, 2014

Here Comes QE In Financial Drag: Draghi's New ABCP Monetization Ploy

by David Stockman via Contra Corner blog, You can smell this one coming a mile away: The European…

June 2, 2014

Deborah Frame: Why Do We Accept Volatility as a Measure of Risk?

Not Your Grandfather’s Risk Measurement by Deborah Frame, Vice President, Investments, Cougar Global Investments Why Do We Accept…

April 28, 2014

Junk Bonds Have Distanced Themselves From Other Bonds

Junk Bond ETF Far Outperforming Other Bonds by Hale Stewart, The Bonddad Blog Above is a one year…

March 14, 2014

Tom Brakke: Three Ways

by Tom Brakke, Research Puzzle As explained in the item below, I’ve been thinking in seven-year periods lately,…

January 2, 2014

The Economy and Bond Market Radar (November 18, 2013)

The Economy and Bond Market Radar (November 18, 2013) Treasury bond yields fell by a few basis points…

November 18, 2013

The Economy and Bond Market Radar (October 21, 2013)

The Economy and Bond Market Radar (October 21, 2013) Treasury bond yields fell this week as the government…

October 21, 2013

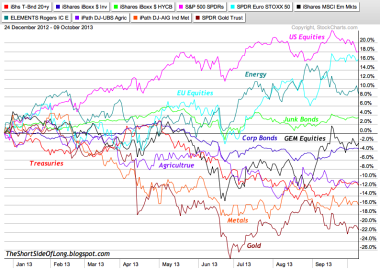

A Look at Year-to-Date Asset Class Performance

Chart 1: Year To Date Performance Of Various Asset Classes Source: StockCharts (edited by Short Side of Long)…

October 11, 2013

High Yield and Bank Loan Outlook - October 2013

Fundamental factors underlying the corporate sector continue to underscore our constructive stance on leveraged credit, however, investors should…

October 9, 2013

Jeffrey Saut: "Thank You!"

“Thank You!” by Jeffrey Saut, Chief Investment Strategist, Raymond James September 23, 2013 Thank you Franklin Templeton for…

September 24, 2013