by Daniel Loewy and Morgan Harting, AllianceBernstein

Years of quantitative easing has pushed yields on government bonds down to record lows, and income-starved investors are being pushed out the risk spectrum, forced to choose between more volatile assets to find income. Finding acceptable levels of income exposes portfolios to greater instability ahead—we believe a multi-asset approach can help.

Multi-asset income strategies can be a one-stop solution for investors looking for high current income and some potential for capital growth. But many of the most popular strategies don’t fully exploit advantages that come with greater diversification and dynamic risk-management.

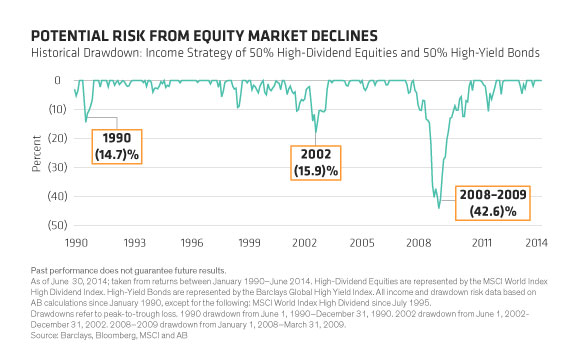

For example, simplistic mixes of high-yield bonds and high-dividend equities generate income, but they also have very high correlations to broad equity markets. This lack of diversification leaves investors vulnerable to big portfolio losses when equity markets decline. That’s not the type of performance pattern most income-oriented investors expect (Display). We think there’s a more comprehensive approach to balancing income and downside risk.

Take an Unconstrained Approach to Income

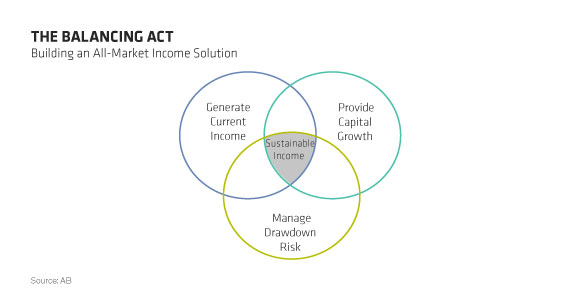

For starters, multi-asset solutions should draw on the broadest universe of asset classes and strategies, adding investments that move less directionally with equity markets. We think it helps to group these investments based on their role in generating sustainable portfolio income:

- Income producers can generate high levels of current income. They include not only high-yield bonds but also emerging-market debt, preferred stocks and mortgage-backed securities. In exchange for high current yields, investors take on credit risk—which makes these investments sensitive to the economic cycle and broad market movements.

- Income growers have the potential to build income over time. They include real estate investment trusts (REITs) to go along with high-dividend-yielding stocks. These strategies are more volatile than income producers and are highly sensitive to the broad market.

- Income diversifiers are the missing link in most multi-asset income strategies. These investments can provide income with very little sensitivity to equity-market movements. So they can boost portfolio diversification while reducing drawdown risk.

Think Outside the Box with Income Diversifiers

Income diversifiers can bring a lot to the table in terms of a better balance for income strategies (Display). Government bonds from various countries are a familiar example. Historically, they’ve been an effective counterbalance to equity exposure, and in normal times they generate income, too. But allocations to sovereign bonds present a dilemma today—very low yields.

So investors need to look outside the box to find income diversifiers. Take call-option overwriting. If an investor owns a stock, he or she can sell a call option that allows another investor to buy the stock if its price rises to a certain level. Other investors pay a premium to buy these options, which generates income. Selling call options on part of an equity portfolio can add income from an alternative source while still allowing participation in rising stock markets.

There are other “off-the-beaten-path” diversifiers, however. For example, active strategies that overweight high-yielding currencies and underweight low-yielding currencies can boost income. Similar strategies in the bond market seek to take advantage of yield differences among individual bonds without adding market risk or duration risk—these help diversify, too.

By carefully building a strategy that harnesses all three categories—producers, growers and diversifiers—we think investors can design a more comprehensive multi-sector income solution.

Be Dynamic in Making Trade-Offs Between Yield and Risk

But there’s more that can be done. Even a well-designed portfolio requires ongoing trade-offs between yield potential and risk as market conditions evolve. That’s why it’s important to monitor and adapt the mix, looking across asset classes to optimize the design for a given environment. What assets and income categories are in the portfolio? What exposures do the asset allocation and security selection present? Does the overall mix make sense right now?

The collapse in energy prices illustrates why dynamic management is critical. Energy company bonds account for a large share of the broad high-yield index, and they took it on the chin when energy prices tumbled recently. Likewise, many oil-related stocks suffered steep sell-offs during this time. Those risks need to be managed. Simply owning broad, “market-like” allocations to these investments would have increased downside risk.

Multi-asset strategies have the potential to generate significant, sustainable income today. But in this low-yield environment, a less-constrained income solution that thinks outside the box can help avoid the unintended risks of focusing too narrowly on the small set of traditional assets that still have yield.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Daniel Loewy (pictured) is Chief Investment Officer and Co-Head of Multi-Asset Solutions and Morgan Harting is lead Portfolio Manager for Multi-Asset Income Strategies, both at AB (NYSE:AB).

Copyright © AllianceBernstein