Section

Interest Rates

1013 posts

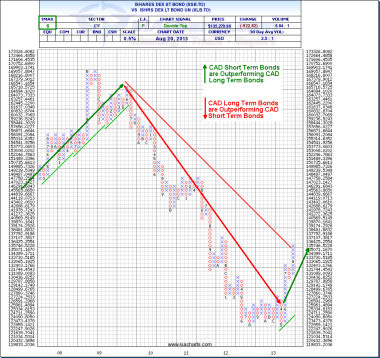

Technical Analysis: Long-Term Interest Rate Direction Has Changed Significantly

by SIACharts.com For this week's SIA Equity Leaders Weekly, we are going to take a look at a…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The Safe Haven Bubble has Popped – What Comes Next?

by MacroBusiness The safe haven slaughter goes on. You might read elsewhere that what is transpiring in emerging…

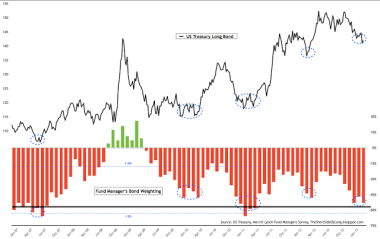

Why the Big Move in Bonds May be Over

by UKarlewitz, The Fat Pitch The main points in this post are: Individual and professional investors have already…

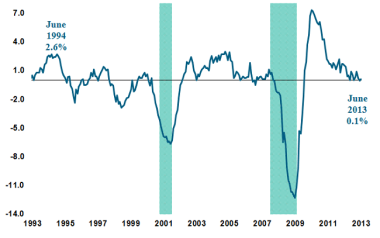

Is the Interest Rate Outlook Closer to 1994 or the Post-World War II Era?

August 21, 2013 by Kathy A. Jones, Vice President, Fixed Income Strategist, Schwab Center for Financial Research Key…

Determined to Taper

The release of the July Federal Open Market Committee meeting minutes today and the Jackson Hole Economic Policy…

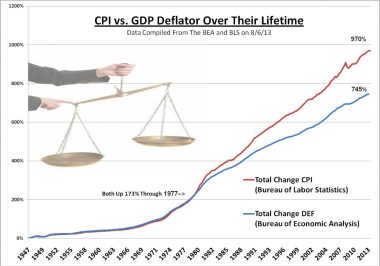

Peter Schiff: Inflation And The GDP Distractor

Submitted by Peter Schiff of Euro Pacific Capital, Albert Einstein, a man who knew a thing or two…

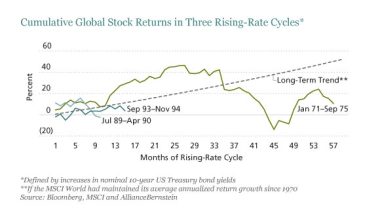

When Rising Rates Hurt Stocks, How Bad Did It Get?

by Chris Marx, AllianceBernstein By Chris Marx and Alison Martier A reader of our recent blog post about…

Preparing Equity Portfolios for Rising Rates

by Russ Koesterich, Chief Global Strategist, Blackrock While Russ doesn’t foresee a bond market meltdown, he does expect…

The Economy and Bond Market Radar (August 19, 2013)

The Economy and Bond Market Radar (August 19, 2013) Treasury yields moved sharply higher this week as both…

Taper Tantrum Two?

by Jeff Rosenberg, Blackrock iShares The buzz surrounding the upcoming Federal Reserve meeting is centered on two questions:…

Guest Post: The Ghost Of Inflation Future

by Brigitte Granville, originally posted at Project Syndicate, With all of the problems afflicting the world economy nowadays,…

The Economy and Bond Market Radar (August 12, 2013)

The Economy and Bond Market Radar (August 12, 2013) Treasury yields moved modestly lower this week as global…

This Rate Cycle Is Different, but Stocks Should Still Do Well

by Chris Marx, AllianceBernstein By Chris Marx and Alison Martier Stocks have generally performed very well in rising-rate…

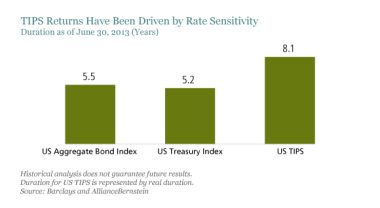

Rising Rates? Keep the Tips, Leave the Duration

by Greg Wilensky, AllianceBernstein Treasury Inflation-Protected Securities (TIPS) have been popular in recent years with investors worried about inflation,…

Eric Sprott: The Detroit Template

by Eric Sprott and Étienne Bordeleau, Sprott Asset Management On July 18 2013, the city of Detroit officially…