by Greg Wilensky, AllianceBernstein

Treasury Inflation-Protected Securities (TIPS) have been popular in recent years with investors worried about inflation, and returns have been strong. But TIPS have benefited from a long bull market for bonds and high interest-rate sensitivity. This could be a problem ahead—unless investors do something about it.

From 2007 to 2012, TIPS delivered a stellar 57% cumulative total return. That’s better than the general Treasury market, and certainly better than many broad bond-market indices. But inflation hasn’t been a big reason for these strong numbers—duration has.

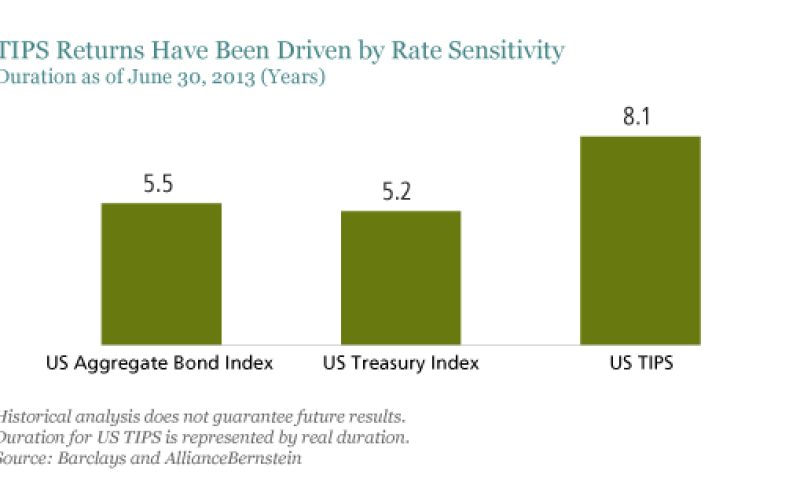

The TIPS market has an average duration of 8.1 years, more than 50% higher than that of the US Treasury market and almost 50% higher than that of the broader bond market (display). Why is duration important? It measures an investment’s sensitivity to changes in interest rates. A high duration provides a sizable tailwind to bond returns when rates are falling, but also a major headwind when rates are rising.

With rates still near record lows, a duration that’s “in the eights” is, frankly, a big source of concern. Just look at the recent experience of TIPS in a rising-rate environment: as of June 30, the year-to-date return of the Barclays Aggregate Bond Index was –2.4%; for the Barclays US TIPS Index, it was –7.4%.

With rates still near record lows, a duration that’s “in the eights” is, frankly, a big source of concern. Just look at the recent experience of TIPS in a rising-rate environment: as of June 30, the year-to-date return of the Barclays Aggregate Bond Index was –2.4%; for the Barclays US TIPS Index, it was –7.4%.

Fortunately, there are steps investors can take to address the problem. We think there are several approaches that may enable investors to hang on to valuable inflation protection while substantially reducing interest-rate risk.

The Appeal of Shorter-Duration TIPS

Maybe the simplest way to reduce interest-rate risk in TIPS is to stay with TIPS but move into shorter-duration securities. Shorter-duration TIPS offer the same degree of inflation protection as longer TIPS with potentially much less downside risk from rising rates, in exchange for modestly lower coupon income.

The display below shows how this approach might have worked in recent years. Of the 57% total return for the TIPS market from 2007 through 2012, only 15% came from inflation accrual. Inflation accrual is the added principal TIPS provided as inflation protection—when the Consumer Price Index (CPI) rose, principal increased, and when the CPI fell, so did principal.

Another 13% came from coupon income, leaving a nearly 30% return from declining interest rates. There’s no question that was a big benefit when rates were falling, but it could be an albatross as rates rise. Investors positioned in shorter-duration TIPS1 would have earned an identical inflation accrual and similar coupon. But they would have much less duration than that of TIPS overall (5.0 years versus 8.1). With rates likely to rise, we think this strategy can deliver inflation protection while substantially reducing rate exposure.

Don’t Overpay for Protection

It’s important to avoid too big a bill for obtaining inflation protection, in terms of the reduced yield of a TIPS-only strategy. A multisector approach combining TIPS (of an appropriate duration, of course) with corporate bonds, mortgages and other non-Treasury sectors may help offset that yield give-up.

For investors with taxable accounts, the impact of tax efficiency also needs to be addressed. Investors might want to consider combining municipal bonds with CPI swaps.2 For example, based on mid-year market yields, munis with the same maturity range and similar duration as intermediate TIPS3 could provide tax-exempt income of about 1.9%.

Depending on an investor’s tax bracket, this could be equivalent to a yield of about 2.6% to 3.3% on a taxable investment—better than TIPS. If this is combined with CPI swaps to hedge inflation risk, the resulting portfolio could potentially provide much of the inflation protection of a pure TIPS portfolio with more after-tax income.

In seeking inflation protection in broad TIPS strategies, many investors may unintentionally end up with substantial exposure to a different risk—rising rates. And they may end up paying too much. We think there are more effective and cost-efficient ways to handle both risks.

1As represented by Barclays 1–10 Year TIPS

2A CPI swap is a contract in which one investor periodically makes a fixed payment to another investor in exchange for a variable payment tied to the CPI. The contract is based on a stated principal amount.

3As represented by Barclays 1–10 Year Municipals

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio managers.

Greg Wilensky is a Director of US Multi-Sector Fixed Income at AllianceBernstein.

Copyright © AllianceBernstein