by Russ Koesterich, Chief Global Strategist, Blackrock

While Russ doesn’t foresee a bond market meltdown, he does expect that rates will rise in coming years and he offers three suggestions for positioning equity portfolios in preparation.

Even if the Federal Reserve (Fed) begins tapering its asset purchases next month, I don’t believe a bond market meltdown is imminent thanks to the many factors helping to keep a lid on interest rates.

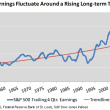

Still, as I write in my new Market Perspectives piece, “Investing in a Rising Rate Environment”, the yield on the 10-year Treasury is up about 100 basis points from last summer’s all-time low and yields are likely to continue to moderately rise over the next two to three years.

This begs the question: How should investors adjust their portfolios for slowly rising rates? Probably the simplest prescription may be to shift the portfolio mix toward stocks, which historically have improved portfolio performance during periods of rising rates, as my colleague Daniel Morillo recently pointed out, while considering the increased risk of such a change.

And within a larger equity allocation, here are three more specific ideas to consider.

1. Lessen exposure to bond market proxies like utility companies. These segments have historically responded poorly to rising real rates. For instance, when real rates rise, the relative valuation of utility companies, as measured by sector’s price-to-earnings ratio relative to the broader market, compresses as investors become less willing to pay up for each dollar of earnings.[1] This suggests that if utility valuations are high, as they are today, the sector could underperform in a rising rate environment.

2. Consider the US technology sector, which generally has had a tendency to perform well, relative to the broader market, when real rates are rising. This is partly because technology companies carry little debt so they are less vulnerable to margin compression from rising rates. In addition, as I write in my Market Perspectives piece, real rates generally rise in the context of a strengthening economy, a regime favorable to cyclical companies like tech firms. The US technology sector is accessible through funds such as the iShares U.S. Technology ETF (IYW).

3. Consider Overweighting US mega caps relative to US small caps. Small companies, along with other risky assets, have been shown to generally perform best in an environment when monetary policy is very accommodative and investors are in a risk seeking mode. Historically, during these periods, small- and mid-cap companies have tended to trade at higher valuations than larger, more stable companies. But as real rates rose, small-cap valuations relative to those of large-cap firms tended to decline, as evident in an analysis of US real rates levels and small cap relative valuations from 1997 to the present using Bloomberg data as of July 15.

Today, small-cap indices are trading at a relatively expensive level versus large-cap companies. When real rates were negative, this premium was more justified. However, this premium will be harder to justify as real rates continue to rise, unless small-cap companies can generate significantly faster earnings growth. This suggests to us some compression in the valuation of small caps relative to large caps over the next couple years. It also suggests that larger firms are likely to do better in an environment of higher real-interest rates. One way to access larger US firms is through the iShares S&P 100 ETF (OEF).

To be sure, there is one major cost associated with increasing exposure to equities: Higher volatility. As always, there is no free lunch. Investors must decide just how much more risk they are comfortable taking in exchange for potentially better results if rates do continue to rise.

Russ Koesterich, CFA, is the iShares Global Chief Investment Strategist and a regular contributor to The Blog. You can find more of his posts here.

Source: Bloomberg. Market Perspectives September 2013: “Investing in a Rising Rate Environment”

Copyright © Blackrock