by Joseph G. Paul, AllianceBernstein

What’s the long-term outlook for oil in a world shifting to renewable energy? Oil majors publicly say supply-and-demand dynamics will support the market. But their investment choices suggest that they’re preparing for a much weaker oil price in the distant future.

Forecasting long-term oil trends is very complicated work. Demand is affected by variables, including the economic growth of emerging markets and the global push to improve energy efficiency. The cost of new supply is driven by industry cost, investing trends and access to low-cost resources. It’s hardly surprising that 10-year projections for oil supply and demand are often riddled with errors.

Peak Oil: Will Demand Growth Decline?

In recent years, there’s been increasing talk about “peak oil” demand. At some point, the argument goes, global oil demand will stop growing and will eventually decline. Why? China is no longer fueling demand growth, as its economy is decelerating. The push for energy efficiency is gathering momentum. And oil is being replaced by cleaner energy as cars, trucks, mining equipment—and even oil-producing machinery—are increasingly electrified.

These trends have led to predictions that oil demand is likely to peak sometime in the mid-2030s, according to industry consultants such as Wood Mackenzie and Rystad Energy. Organizations such as the International Energy Agency and OPEC also predict that oil demand will peak over a wider range of time frames. It may sound far off. But in an industry that requires massive long-term investments, and where profitability is dependent upon the oil price, it’s just around the corner.

Oil Executives Say Demand Is Here to Stay…

So, what do global oil executives say? Their public statements suggest that oil demand is insatiable. Darren Woods, CEO of ExxonMobil, said in March that global demographic and macroeconomic growth trends over the next two decades will fuel a 25% increase in energy demand. “When you factor in depletion rates, the need for new oil grows at 8% a year,” he said. Mike Wirth, Chevron CEO, offered similar projections in a meeting with analysts in March. Oil and gas will represent “roughly the same share of the total energy mix in 2040 as it does today,” he said. Both executives say significant industry investment is needed to meet growing demand.

Of course, investment is still needed, even if oil demand will peak in 15–20 years. But, if we’re headed toward a peak, we would expect oil companies to start preparing for a structural downshift in demand and prices. That means national oil companies might consider boosting production to monetize assets in the ground. Countries like Saudi Arabia and Kuwait have more than 100 years of oil in the ground, which could become stranded assets if demand growth wanes.

…but Their Actions Suggest Otherwise

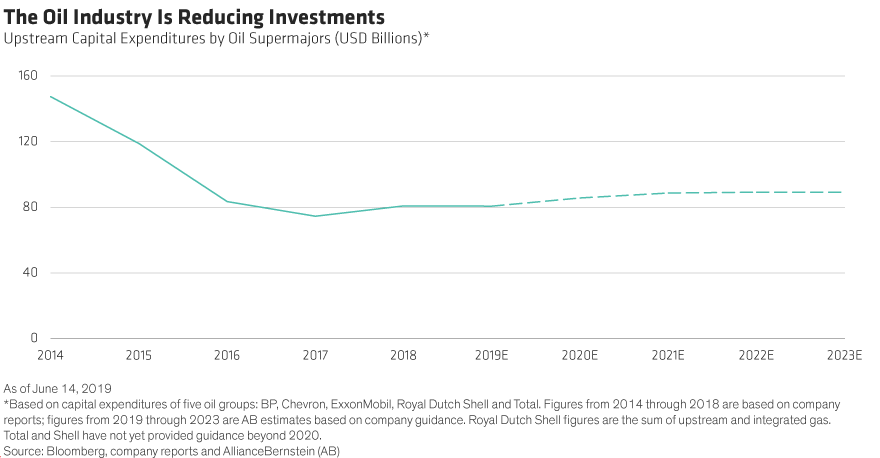

But what are oil companies actually doing? After studying their investment patterns, we believe that the oil majors are preparing for a long-term structural change. In aggregate, the five supermajor oil companies have been reducing capital expenditures dramatically (Display).

What’s more, the changing mix of these investments is unmistakable. The following trends suggest that big oil is making strategic preparations for peak demand:

-

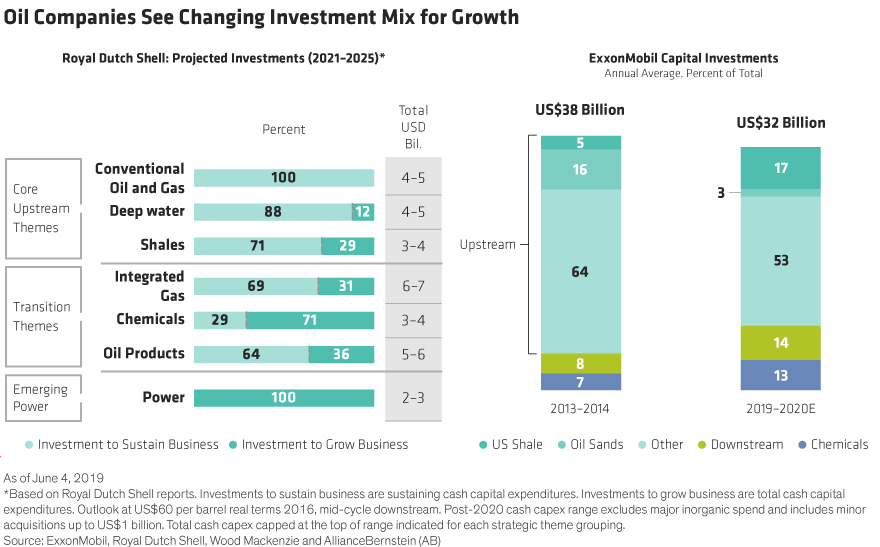

Reduction in investments in medium- to long-term oil—across the board, with very few exceptions -

Shift toward near-term projects—oil majors are focusing more on shale projects, where a relatively small investment of about $6 million in a well today can yield production in six months. In contrast, it costs billions to build a new oil basin using traditional drilling techniques and can take years before a drop of oil is pumped. For example, both Royal Dutch Shell and ExxonMobil have significantly increased investments in downstream projects, as well as in shale and chemicals, to generate future growth (Display). -

Natural gas projects are preferred—as the cleaner substitute for coal, amid increasing pressure to reduce greenhouse emissions. -

Green energy is gaining currency—particularly in Europe, where oil companies are investing in alternative energy such as wind and solar power. Are these investments just PR stunts to show commitment to the environment and reduce a company’s aggregate emissions, or a genuine acknowledgement that oil demand won’t grow forever? It’s probably a bit of both. We think big oil has yet to demonstrate its competitive advantage in renewables and that the returns on offer may be disappointing by upstream standards.

So what does this mean for oil prices? While peak oil demand might still be 20 years away, if oil majors restrain investments in longer-term projects, it could push oil prices upward in the early 2020s, especially amid geopolitical pressures and continued demand growth for some time.

But over the longer term, the investment patterns suggest that oil majors actually buy into the concept of peak oil. That means they expect a lower risk-adjusted oil price over time, which makes it harder to justify costly long-term oil projects that need higher prices to be profitable.

To be successful, oil companies must prove that they can position themselves for these complex trends in the energy markets. That means they need to continue delivering attractive cash returns to investors in the short term, while investing enough to benefit from a potentially stronger oil price in the early 2020s. At the same time, oil companies must lay foundations for staying relevant if oil demand peaks after 2030. It’s a challenging tightrope to walk, but companies that develop a coherent strategy to balance short-, medium- and long-term energy-market dynamics will be able to win investor confidence.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

This post originally appeared at the AllianceBernstein blog

Copyright © AllianceBernstein