by Christopher Dhanraj, Head of ETF Investment Strategy, Blackrock

Chris discusses the key international events the iShares Investment Strategy team have been tracking this month.

International events seem to matter more than ever for investors. From trade tensions to conflict in the Gulf to increasing populism, geopolitical events have at times roiled the markets in recent years. But geopolitical uncertainty is no reason to avoid international investing, which offers access to world class companies, potential growth and diversification for a portfolio.

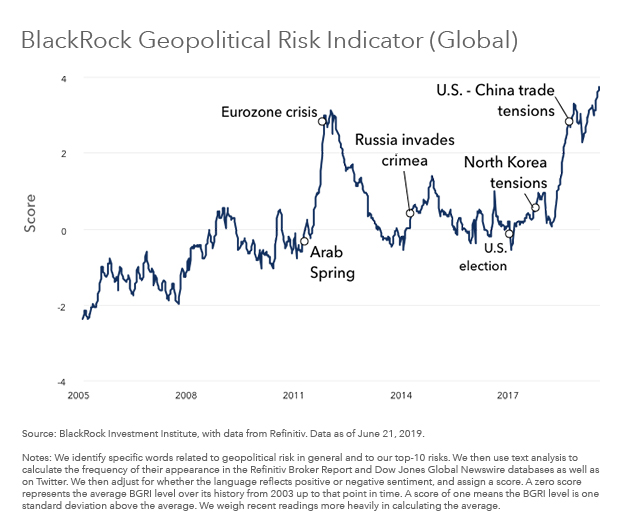

Investors certainly have had their hands full in tracking the key events that can impact portfolios. A helpful resource that my colleagues at the BlackRock Investment Institute offer is the geopolitical risk dashboard, which measures and tracks the risks of major geopolitical events (see Chart 1).

From the standpoint of the iShares Investment Strategy team, here are the key events we are tracking:

1. China trade tensions

The results of the “extended meeting” between U.S. President Trump and his Chinese counterpart Xi Jinping on June 28 at the G-20 summit will likely take some time for the markets to full digest Given the recently contentious negotiations between the two countries although investors are hopeful this meeting will set a path towards a future deal. If not, President Trump has threatened tariffs on $300 billion of additional Chinese imports. Lack of a final trade deal may continue to drive uncertainty globally.

2. Iran

Tensions with Iran ratcheted up even further after the U.S. accused Iran of downing a $130mn drone over international Gulf airspace last week. This followed the U.S. accusing Iran of attacking two tankers in the Gulf of Oman the week prior. President Trump has stepped up the economic-pressure on the country, and signed an order authorizing new sanctions on the supreme leader’s office and top officers in the Islamic Revolutionary Guard Corps. The market feedback loop has extended beyond the Middle East to commodities – the price of WTI oil is up 16% in the past two weeks since the tanker incident, as of June 26, 2019, according to Bloomberg.

3. United Kingdom

Theresa May officially stepped down as leader of the Conservative Party on June 7th. She will remain as PM until her successor is chosen. The list of candidates has now been whittled down to the final two: Boris Johnson and Jeremy Hunt. The new leader will be announced the week of July 22. Initially, front-runner Johnson threatened a no-deal Brexit if necessary while Hunt has signaled a more flexible approach. However, recently Johnson’s comments around Brexit and the logistics of leaving without a deal have left many confused as to his full understanding of how the process works or where he really stands with regards to leaving the EU. Watch this space as election uncertainty may create volatility for the region in the next few months

4. Mexico

A last-minute deal on Friday, June 7th prevented the US from imposing tariffs on all Mexican exports to the US worth ~$350 billion. In exchange for removing the tariffs Mexico agreed to increase enforcement to stop illegal migration and to expand the “Remain in Mexico” plan for asylum seekers. The measures taken by Mexico will be evaluated in mid-July. Terms of additional provisions will be finalized in 90 days from the deal. While Trump has bipartisan support for the China trade negotiations that was not the case with the tariffs threatened on Mexico, whereby Trump threatened to implement an economic lever in response to an unrelated foreign policy goal.

Geopolitical risk tends to drive market volatility–especially given the backdrop of slowing global growth. Which other countries are you watching? Let me know your thoughts in the comment section.

Related iShares Funds

iShares MSCI China ETF (MCHI)

iShares MSCI Saudi Arabia ETF (KSA)

iShares MSCI United Kingdom (EWU)

iShares MSCI Eurozone ETF (EZU)

iShares MSCI Mexico ETF (EWW)

Chris Dhanraj is the Head of the iShares Investment Strategy team and a regular contributor to The Blog.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/developing markets and in concentrations of single countries.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2019 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

ICRMH0619U-885429-1/1