by Larry Adam, Chief Investment Strategist, Raymond James

Key Takeaways

- Like Batman, investors cannot resort to superhuman powers when investing. Instead, knowledge, analytical skills and ingenuity are paramount for success.

- Asset allocation, diversification and risk management are essential dynamics to consider as volatility moves higher.

“I’m Batman!” Well, not really, but on the thirty-year anniversary of the re-birth of this superhero on the big screen (Batman played by Michael Keaton), I am reminded that investors should have a little Batman in them.

[backc url='https://sendy.advisoranalyst.com/w/2CbO3sXqwUF8u2dyl69Y5Q/763n6KPErrIdSKvj9ggLLKKQ/4rrQfUZD763Wi892lTBlz1pOUQ']No Superhuman Powers Needed. Batman was unlike any other superhero in that he did not have any superhuman powers. He was not the strongest (Superman), the fastest (The Flash), and did not have an early warning “Spidey Sense.” Instead, he used his knowledge, analytical skills and ingenuity to solve problems and keep Gotham City safe. Batman’s attributes are similar to those of successful investors:

Knowledge, or a keen awareness of history, can help investors gain an edge. Our expectation is that a proactive Federal Reserve (Fed) will make two insurance cuts this year (in July and October), which will likely extend this current longest expansion in the history of the U.S. for at least the next twelve months, if not longer. Upon studying other time periods when the Fed orchestrated insurance cuts (1984, 1987, 1995 and 1998), the result was positive for economic growth (i.e., no recession). These insurance cuts provided a positive backdrop for equities, and interest rates rose slightly. This is consistent with our outlook going forward.

Analytical Skills in the form of fundamental and technical analysis provides insights. As an example, current valuations for the S&P 500 make us cautious on the equity market until we see a pullback or an acceleration in earnings growth. In fact, last week, with equity markets at all-time highs and near our year-end S&P 500 target (2946), we cautioned against inflated optimism as the market was priced to perfection regarding progress with a China trade deal and expectations of multiple future Fed rate cuts. With the potential for underwhelming progress (likely, just a near-term ceasefire) at the upcoming G20 meeting and the possibility for the Fed not being quite as aggressive as the market was expecting (three cuts this year), we offered a more cautious tone on the market. Additionally, technical indicators (RSI, moving averages, breadth, sentiment indicators, etc.) that helped us identify buying opportunities in late April had turned more cautious, affirming our view.

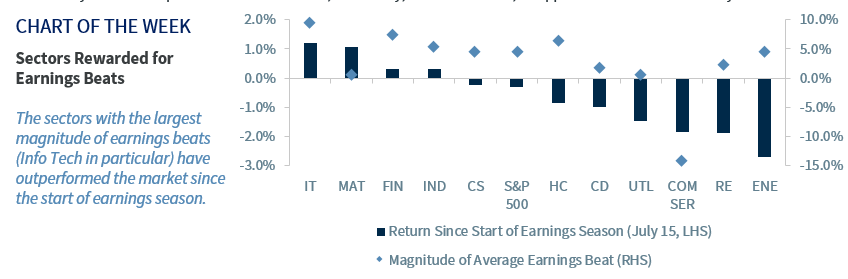

Ingenuity in the form of selectivity is critical given elevated valuations in both the equity and fixed income markets. With earnings growth expected to be at a premium, we favor cyclical sectors such as Technology, Consumer Discretionary and Communication Services. Our favorite defensive sector is Health Care, where we believe the political cloud of “Medicare for All” (unlikely to pass according to Ed Mills, our Washington Policy Analyst) has weighed on the sector. From a capitalization perspective, we favor large cap over small cap. In the fixed income asset class, we favor investment grade over high yield, as the potential for a modest uptick in corporate defaults will hamper the high-yield space.

Training, Planning and Risk-Taking. Batman never used a gun because of the gut-wrenching memories he had of his parents being shot. Instead, to protect himself and fight the forces of evil, he enhanced his athletic prowess by working out and learning defensive skills through martial arts. Detailed, well-thought out plans to foil his enemies were paramount and helped him avoid unnecessary risks. Similarly, investors should not take “shot-gun,” undisciplined risks with their portfolio. It is more prudent to build a diversified portfolio that matches an investor’s risk tolerance, so he can remain committed in both good and bad times. Diversification can also mitigate risk in times of heightened volatility. As an example, the recent downside volatility in the equity market in May was alleviated by exposure to Treasury bonds, which rallied.

Beware of Villains. Batman was hypervigilant to potential threats from his nemeses. This is no different for investors as they need to be cognizant of market risks and, more importantly, their potential impact to portfolios. From trade to politics to economic data, the list over the next several months will continue to grow. However, it is important to differentiate noise from fundamental changes in the economy or financial markets. Let us be your Alfred Pennyworth, Batman’s butler, as we assist you in navigating through what will be a more challenging market environment going forward.

*****

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Copyright © Raymond James