by Russ Koesterich, Portfolio Manager, iShares

With investor risk appetite often driving market performance these days, it’s important to know where current sentiment is when making investment decisions.

With investor risk appetite often driving market performance these days, it’s important to know where current sentiment is when making investment decisions.

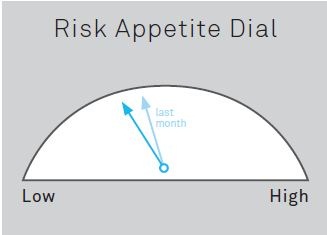

To help with this task, my team has created a new “Risk Appetite Dial” that we’re publishing monthly in our Investment Directions market commentary. Here’s how the dial looks this month:

The bolded arrow shows where we believe current market risk appetite is now versus last month. Since last month, the measure has turned slightly more negative, signaling a more cautious mood in the markets.

The bolded arrow shows where we believe current market risk appetite is now versus last month. Since last month, the measure has turned slightly more negative, signaling a more cautious mood in the markets.

So how do we come up with this measure? We determine where risk appetite lies monthly on a scale of -3 (low risk appetite) to 3 (high risk appetite) by analyzing and combining data about equity market returns, corporate credit spreads and expectations for future US economic growth.

Equity Market Returns: We consider equity market returns (as measured through the monthly performance of the MSCI All Country World Index) in our analysis as investors’ risk appetite is heavily dependent on the market prices they are observing.

Corporate Credit Spreads: We also look at the spread between the average yield of Moody’s Aaa-rated and Baa-rated corporate bonds. This spread is widely considered to be one of the most representative measures of how much investors are fleeing for safety by reallocating their corporate credit exposure. When this spread is high, investors are scrambling to exit lower quality corporate debt and vice versa. For instance, over the past 20 years, the average Baa and Aaa yield spread has been roughly at 150 basis points. But at the height of financial crisis in 2008 and 2009, this spread skyrocketed to 350 basis points.

Future US Growth Expectations: Finally, to measure growth expectations, we use the Chicago Fed National Activity Index (CFNAI), which is our preferred real-time gauge of US economic activity. It’s an excellent measure of current quarter US gross domestic product growth and offers a good prediction of next quarter’s GDP growth as well.

When taken together, high equity returns, narrow credit spreads and a good growth outlook tend to coincide with positive investor sentiment and stronger appetite for risky assets, while low equity returns, wide credit spreads and a poor growth outlook tend to mean investors don’t want to take on as much risk.

Currently, risk sentiment is at -0.6 on our dial scale, down from -0.4 last month, as investors have turned more cautious toward risky assets, as indicated by widening US corporate credit spreads and falling expectations for US growth amid heightened macroeconomic uncertainty.

So what does this mean for investors? As I write in the latest Investment Directions, in light of today’s uncertain and volatile market environment, I continue to favor investments that potentially offer some downside protection while still potentially producing a reasonable yield and allowing for participation in market gains. These include:

1.) Dividend-paying stock funds such as the iShares High Dividend Equity Fund (NYSEARCA: HDV) and the iShares Emerging Markets Dividend Index Fund (NYSEARCA: DVYE).

2.) Defensive sectors such as global telecommunications, accessible through the iShares S&P Global Telecommunications Sector Index Fund (NYSEARCA: IXP).

3.) Minimum volatility funds such as the iShares MSCI All Country World Minimum Volatility Index Fund (NYSEARCA: ACWV).

In addition, besides viewing the measure as a helpful guide for tactical portfolio tilts such as those mentioned above, investors can also use the risk sentiment measure to help them on tactical selection decisions such as which countries to invest in. For example, if risk appetite is low, investors may want to consider avoiding more risky countries such as those I recently highlighted in my post, “Where in the World is Risk Today.”

Source: Bloomberg, Investment Strategy Group Research

The author is long HDV and IXP

Russ Koesterich, CFA is the iShares Global Chief Investment Strategist and a regular contributor to the iShares Blog. You can find more of his posts here.

Investing involves risk, including possible loss of principal. There is no guarantee that dividends will be paid.

In addition to the normal risks associated with investing, narrowly focused investments typically exhibit higher volatility. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. ACWV may experience more than minimum volatility as there is no guarantee that the underlying index’s strategy of seeking to lower volatility will be successful.

Copyright © iShares