by William Smead, Smead Capital Management

The list of glamorous growth stocks getting hit by what we call “minefield” price declines is getting fairly long. Some of the more influential names which have suffered sharp, swift declines include Nike (NKE), Chipotle (CMG ), Facebook (FB), Coinstar (CSTR), Starbucks (SBUX) and the King of the Glam stocks, Apple (AAPL). Is there a pattern here that matters? If earnings growth is hard to come by, what are the most important themes for long-duration common stock investors?

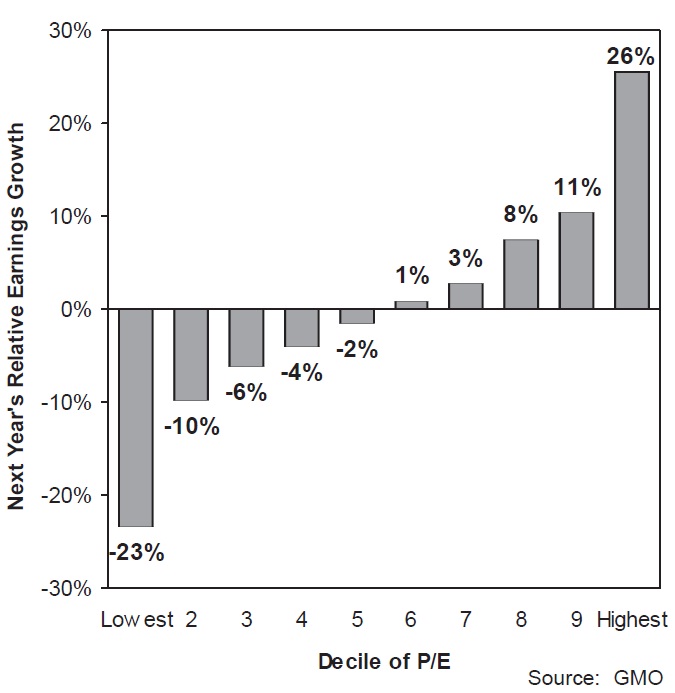

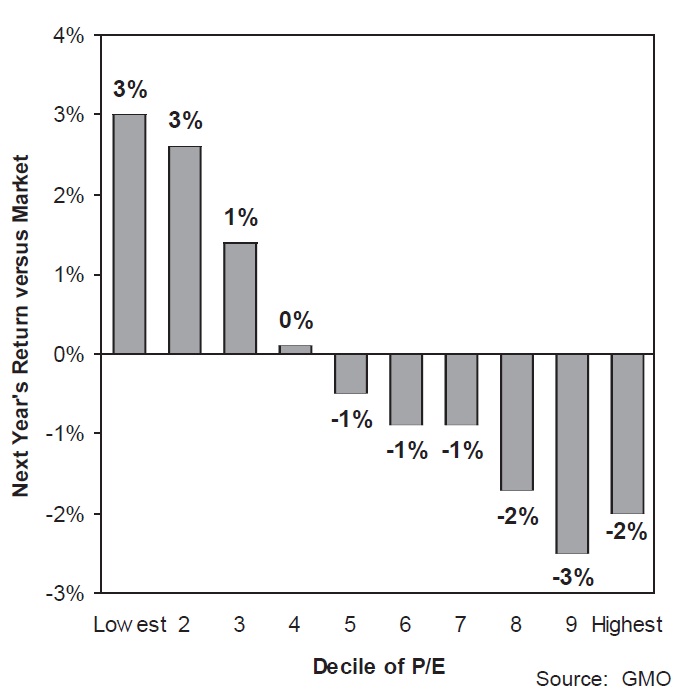

At Smead Capital Management (SCM), we are not surprised by the struggles of the high expectation stocks. Our first premise as money managers and stock pickers is that valuation matters dearly. In the talk we’ve done at many CFA Societies across the US and the Far East, we shared the following charts from GMO’s top-notch research director, Ben Inker. The first chart below shows that Wall Street Analysts (called so even though many aren’t working in Manhattan) are actually very good at figuring out who will produce the best earnings growth in the next twelve months:

The second chart gives us a clue as to why many of today’s great growth stocks are stumbling. Even though they produce superior one-year earnings growth, they underperform the index as a group in the next twelve months. Looking back to the first chart, the poorest performing companies on forward earnings saw more than a 20 percent contraction in earnings. However, a quick look below shows that you get index outperformance from the group of low PE stocks which saw earnings contract.

There could be other forces at work as well. In a column at barrons.com in May, Mark Hulbert pointed out that growth stocks as a category had outperformed value the most in the last five years than all but two other five-year periods in the last ninety years. One of the only similar stretches of outperformance was the five years from 1995-2000. Here is how Hulbert explained it in his column entitled, “Don’t Give Up on Value Stocks”:

Take heart, value investors!

Every other time over the last nine decades when your patience was as sorely tested as it has been in recent years, your sector was on the verge of an incredible comeback.

Over the last five years through March 30, a portfolio of value stocks has lagged a growth portfolio by 4.7 percentage points per year, on average, according to data compiled by Eugene Fama and Kenneth French, two finance professors at the University of Chicago and Dartmouth College, respectively.

Most investors define value based on PE ratios and price-to-book value ratios. This growth stock popularity of the last five years presents a problem to the low turnover investor who started with a stock at a value price and has held it into the stage where investors are considering the security glamorous. For this reason, it is good to keep track of the stock market’s thermometer, the market for initial public offerings (IPOs).

Here is how we use the thermometer of the stock market. First, companies go public when the stock market is most receptive. Secondly, the stock market is most receptive when growth stocks are popular in comparison to value stocks. We have seen a number of multi-billion dollar IPOs in the last year from LinkedIn (LNKD), Zynga (ZNGA), Pandora (P), Groupon (GRPN) and Facebook (FB). Third, when those IPOs aren’t met by a warm reception the first six months of trading, we believe it tends to be a sign that the over-pricing of growth stocks is in the process of being unwound.

Mark Hulbert shared in his article what history would tell us about what happens after growth stomps value for five years like it has recently. He first shared what is the historical norm over long-term stretches in the stock market.

Professors Fama and French have studied value and growth stock performance going back to 1926. To show their relative returns, they constructed two portfolios that, at the beginning of each year, invested in those stocks that then had the lowest P/B ratios (in the case of value) or the highest (in the case of growth).

Over the last 86 years, they found that the value portfolio outperformed the growth portfolio by an average of 3.9 percentage points per year.

It is normal for value to beat growth in the long run and that is why valuation matters dearly to us at SCM. Hulbert points out that it matters even more at extremes of popularity like the last six months.

But what’s important here is not how rare recent experience has been, but how the value portfolio came roaring back following that period in the 1930s when it lagged growth by as much as it has recently. For the five years ending in mid-1945, in fact, according to the professors’ findings, the value portfolio outperformed growth by an extraordinary 130.7%—more than 18% per year, on average.

This pattern was played out in spades during the Internet bubble. Over the five years through the peak of that bubble, for example, when the highest-flying stocks often were Internet start-ups with little book equity whatsoever, value stocks were out of favor. Over that five-year period, the value sector lagged growth by 36.3%, or nearly 9% per year on average.

Though many value investors lost faith in their approach and threw in the towel, subsequent events proved their impatience to have been just as ill-timed as it was in the late 1930s. Over the five years through mid-2005, value outperformed growth by more than 139%, or nearly 20% per year on average. So impressive was value’s return to grace, in fact, that the professors’ value portfolio actually made money during the 2000-2002 bear market.

Therefore, the dismal performance of IPOs and the “minefield” declines in glamorous high-PE stocks are symptoms of what you’d expect as value reasserts itself over the next five years. The irony of this is the institutional and financial advisory community is moving toward indexing in a big way just as the thing which historically helps stock pickers relative to stock indexes reasserts itself. When growth is popular, the index is loaded on a capitalization basis with growth stocks and under-weighted in the depressed value stocks.

Wayne Gretsky was great because, “he skated to where the puck is going to be.” If the recent action in the stock market is any guide and Mark Hulbert’s historical work is accurate, value will be the place to be for quite awhile.

Best Wishes,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. Only SBUX described in this missive is currently recommended for suitable clients as of the date stated in this missive. We do not and have not recommended any of the other securities for our clients. It should not be assumed that investing in any of these securities was or will be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

Copyright © Smead Capital Management