by Raffaele Sevi and Jeff Shen, Systematic Investing, BlackRock

After a strong start to the year, equity investors are assessing whether a range of escalating risks will lead to continued volatility ahead. In this quarter’s Systematic Equity Outlook, we’ll explore macro and micro risks through a systematic lens, and how we’re positioning portfolios to harness alpha opportunities ahead.

Key points

- The macro: Alternative data points to a continued slow pace of normalization in services inflation that could keep interest rates higher for longer. After focusing largely on growth and thematic opportunities through the outset of 2024, consecutive upside inflation surprises and rising geopolitical tensions may force equities to take emerging risks more seriously.

- The macro in the micro: The persistence of themes like AI has contributed both to high equity index concentration and strong performance of the momentum factor—raising questions over the potential for a reversal. While the magnitude and duration of the recent rally poses risks, our analysis suggests that the positive exposure of momentum to current macroeconomic trends and the breadth of stocks driving momentum returns are keeping those risks relatively contained barring a major macro shift or deterioration in earnings.

- The micro: Equity investors can seek to diversify market cap concentration by taking advantage of broadening performance themes—for example identifying AI beneficiaries outside of the technology sector. Today’s expanded opportunity set comes with much higher dispersion in company results than in recent decades, making effective stock selection crucial for generating alpha.

The macro: more than a “bumpy” inflation path?

While stalling inflation progress this year caused bond markets to significantly recalibrate policy expectations, equities largely continued to climb as solid earnings and AI excitement overshadowed renewed concerns. But that has shifted in recent weeks with a third consecutive monthly upside inflation surprise and rising geopolitical risks beginning to dominate the equity market narrative.

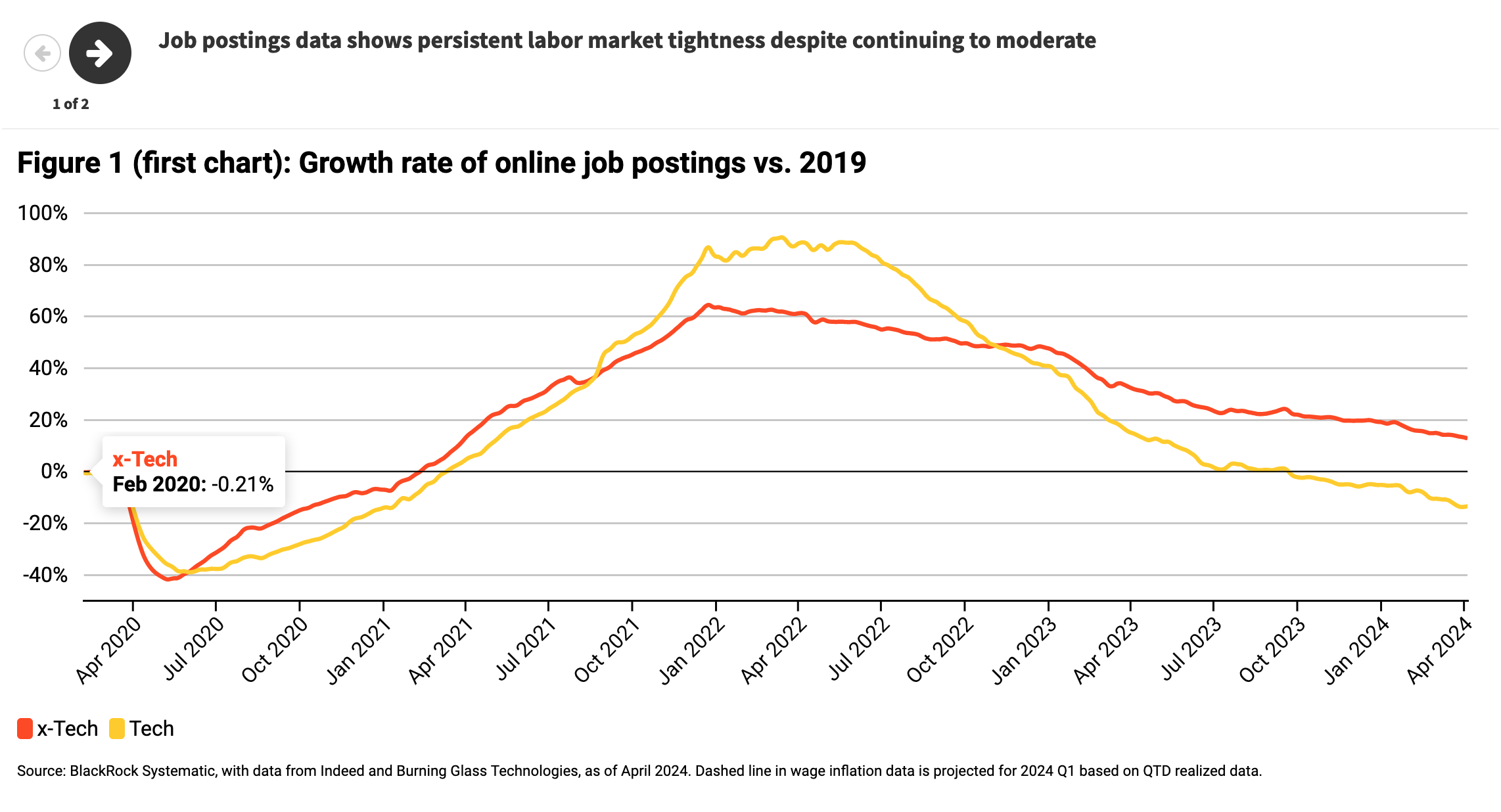

Alternative inflation data helps us track the evolution of price pressures ahead of official releases. Services inflation has remained the most stubborn, driven in part by continued strength in labor markets. The charts in Figure 1 use data from online job postings for a real-time view of labor market trends. The first chart shows that labor demand represented by the growth of online job postings remains above pre-COVID levels outside of the technology sector. This has contributed to ongoing labor market tightness despite supply-side dynamics like increased labor participation and immigration helping to restore better balance. This persistent tightness is reflected in the second chart through the wage growth of job postings, which remains above levels consistent with 2% inflation.

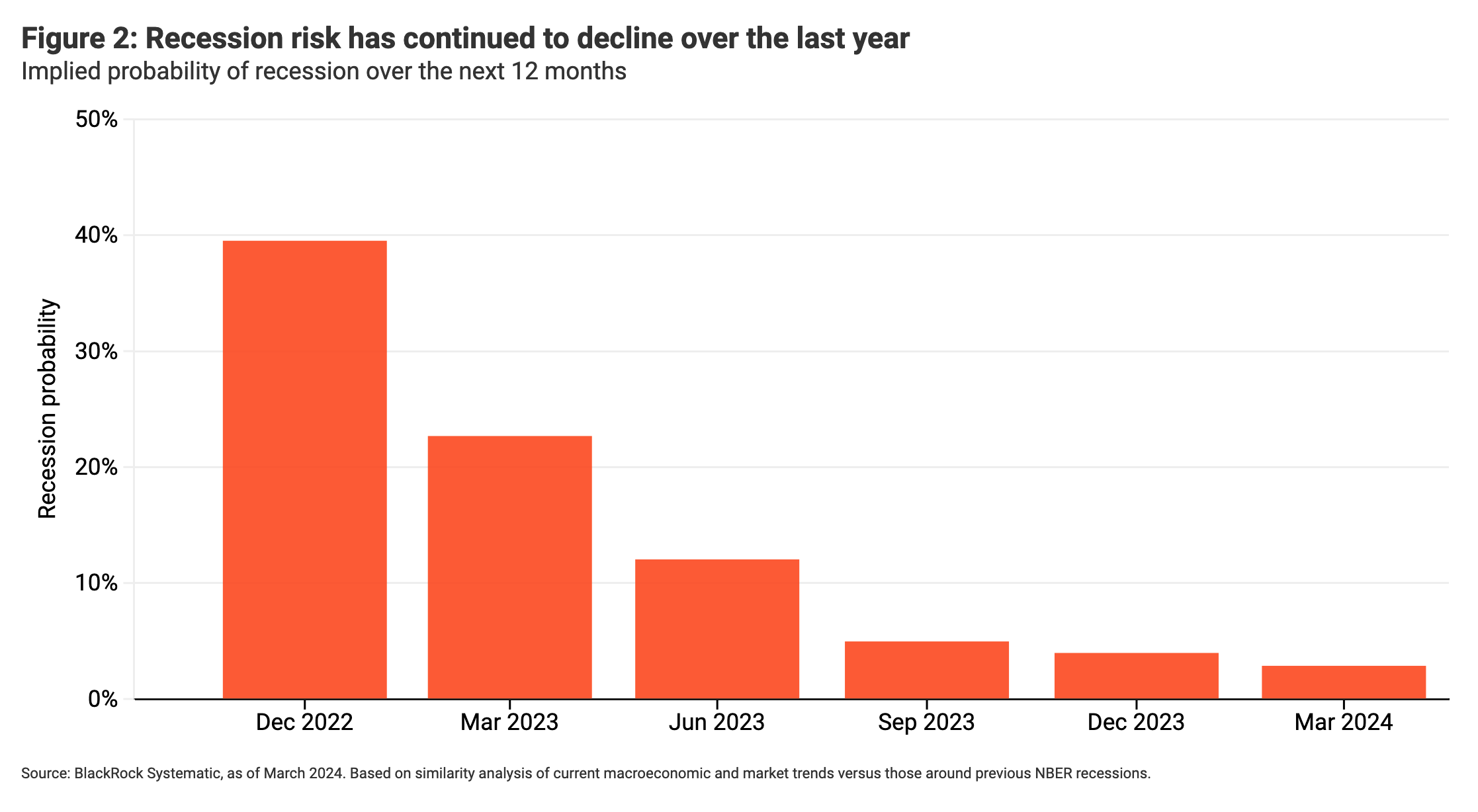

Taken together with measures of shelter inflation lagging the recovery that has taken place in real-time rental data, a return to 2% inflation appears to be further out of reach than many had hoped at the beginning of the year. And with growth remaining robust and our estimated recession probability continuing to fall (Figure 2), demand-side inflationary pressures are likely to keep interest rates higher for longer as the Fed looks for evidence of restrictiveness. This could force equities to mirror the evolution of policy expectations that has played out in bond markets. At the same time, heightened conflict in the Middle East adds a layer of uncertainty that could continue to challenge risk assets should it persist.

The macro in the micro: breaking down equity momentum

Equity market performance this year has been largely driven by a continuation of persistent market themes including AI. This played out both in strong returns to the momentum factor (stocks continuing to move in the same direction) and high equity index concentration as part of that momentum has come through the continued outperformance of mega cap technology stocks. The persistence of these performance dynamics and level of market concentration has raised concerns over whether recent trends will reverse—especially given the headwinds discussed in the previous section.

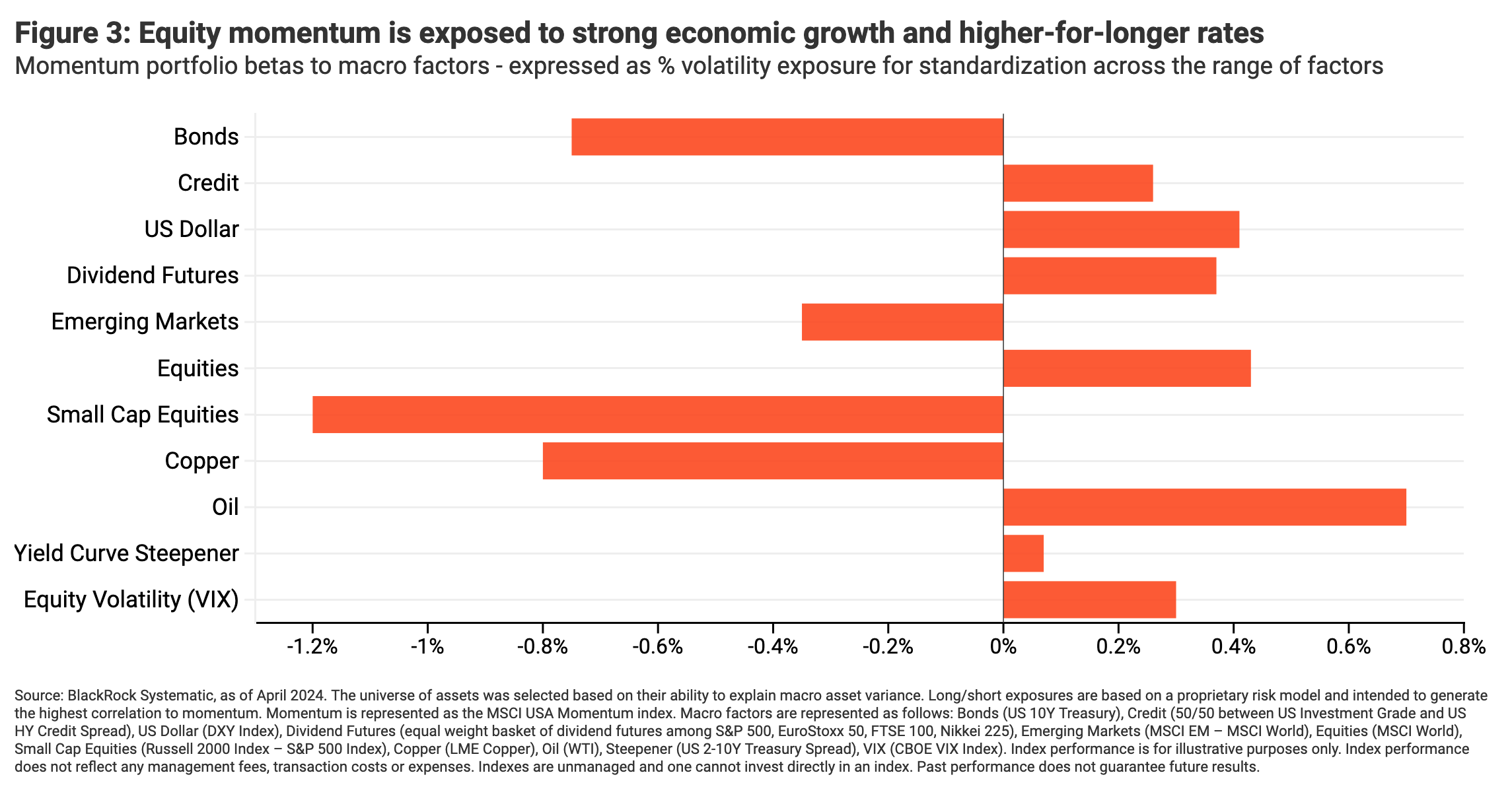

To help understand and manage these risks, the framework in Figure 3 explains the composition of momentum exposure through the lens of macro factors. At a high level, we find that momentum is currently exposed to strong economic growth (longs in credit, equity, dividends) and interest rates remaining higher for longer (short bonds, long US dollar, long oil). This suggests that the risk of a momentum reversal should remain lower in the absence of a significant macro shift or escalation of Middle East conflict leading to continued risk-off sentiment.

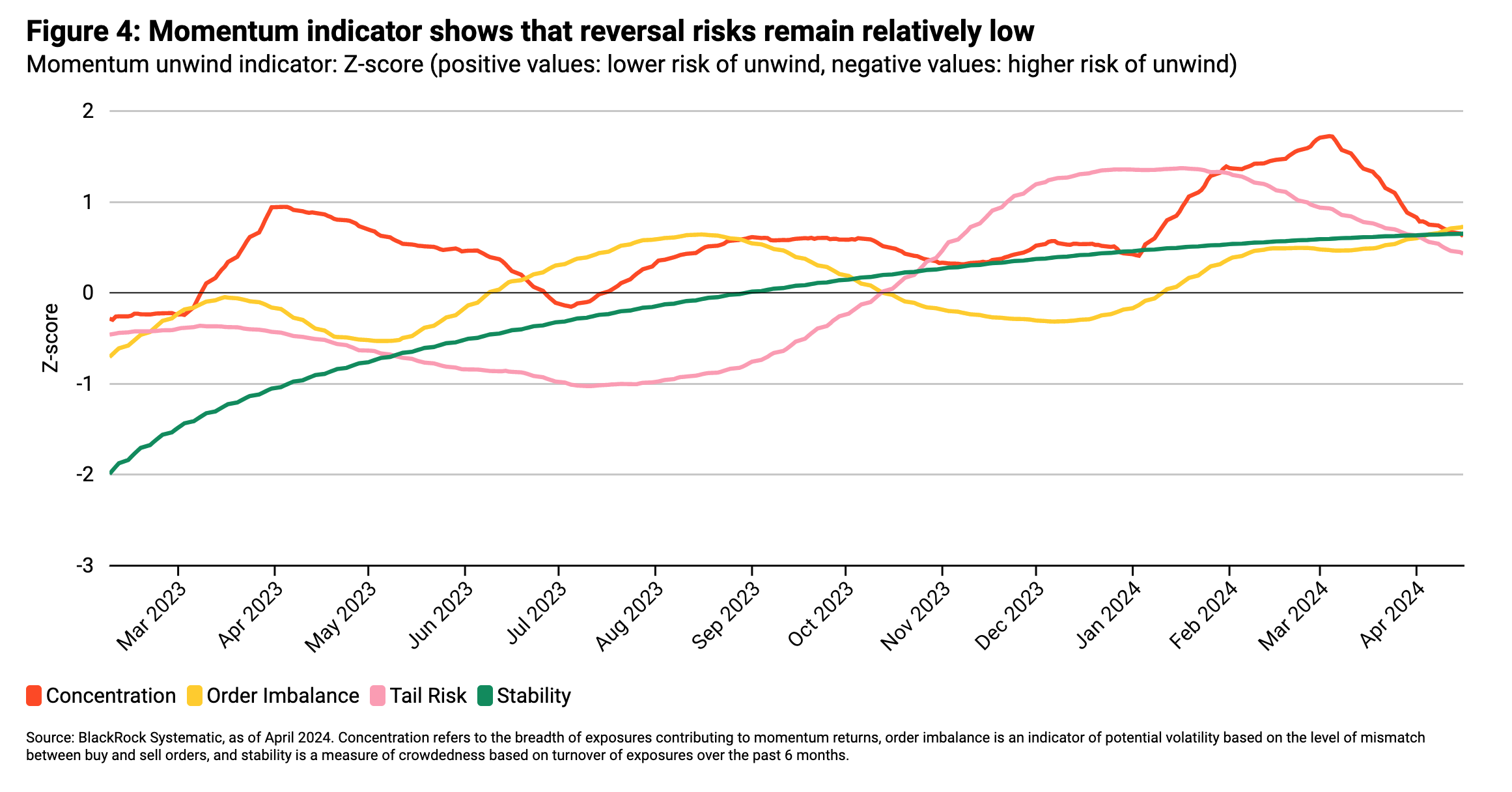

Figure 4 shows our momentum unwind indicator which tracks a range of risk measures associated with momentum drawdowns that we’re closely monitoring. Our latest observations reflect relatively muted risks based on the breadth in momentum constituents, normal levels of order imbalance, low tail risk, and reasonable stability (measured by momentum turnover as an indicator of crowdedness).

Aside from a macro shift or unwind in the indicators above, the length of momentum outperformance could be cause for concern as it approaches that of historical periods. And while the relative growth of mega cap tech stocks has continued to reflect strong fundamentals, a deterioration in the earnings growth of these market leaders would pose a risk to equity beta (given their weight at the index level) and momentum factor returns (given their central role in market themes).

The micro: the evolving AI trade and opportunity amid higher dispersion

For investors concerned about index concentration and the dominance of a handful of companies in the AI trade, looking under the hood we see opportunities to generate alpha by complementing mega cap tech exposure with AI beneficiaries outside of the technology sector as the theme continues to broaden.

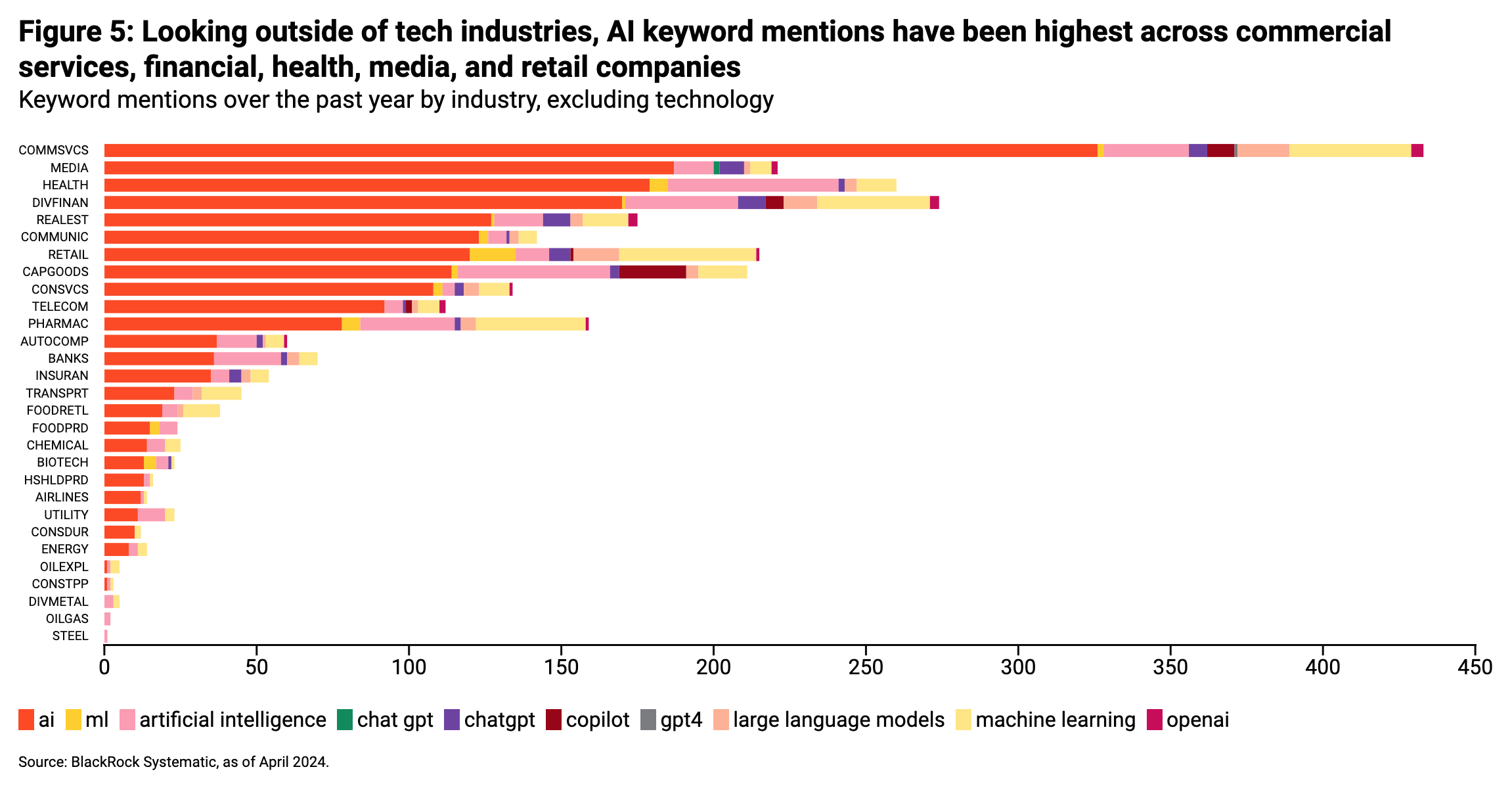

Figure 5 shows the number of AI-related keyword mentions across companies outside of core tech industries, which has grown roughly 250% since the end of 2022 and makes up around one-third of total AI mentions. We find that opportunities vary significantly by industry, with commercial services demonstrating a sizable lead in mentions, followed by financial, health, media, and retail companies.

To inform our positioning around the broadening AI theme, our own use of large language models (LLMs) helps us analyze vast text sources for a granular view of individual companies positively or negatively exposed. On the positive side, the outputs point to companies with automated ordering and warehouse management, those involved in content creation, and virtual assistant providers to name a few. Legal and advisory services companies, education service providers, and enterprise software companies are among the companies less likely to benefit. This insight has performed well in portfolios this year, helping to capture the wide-ranging implications of AI adoption and integration.

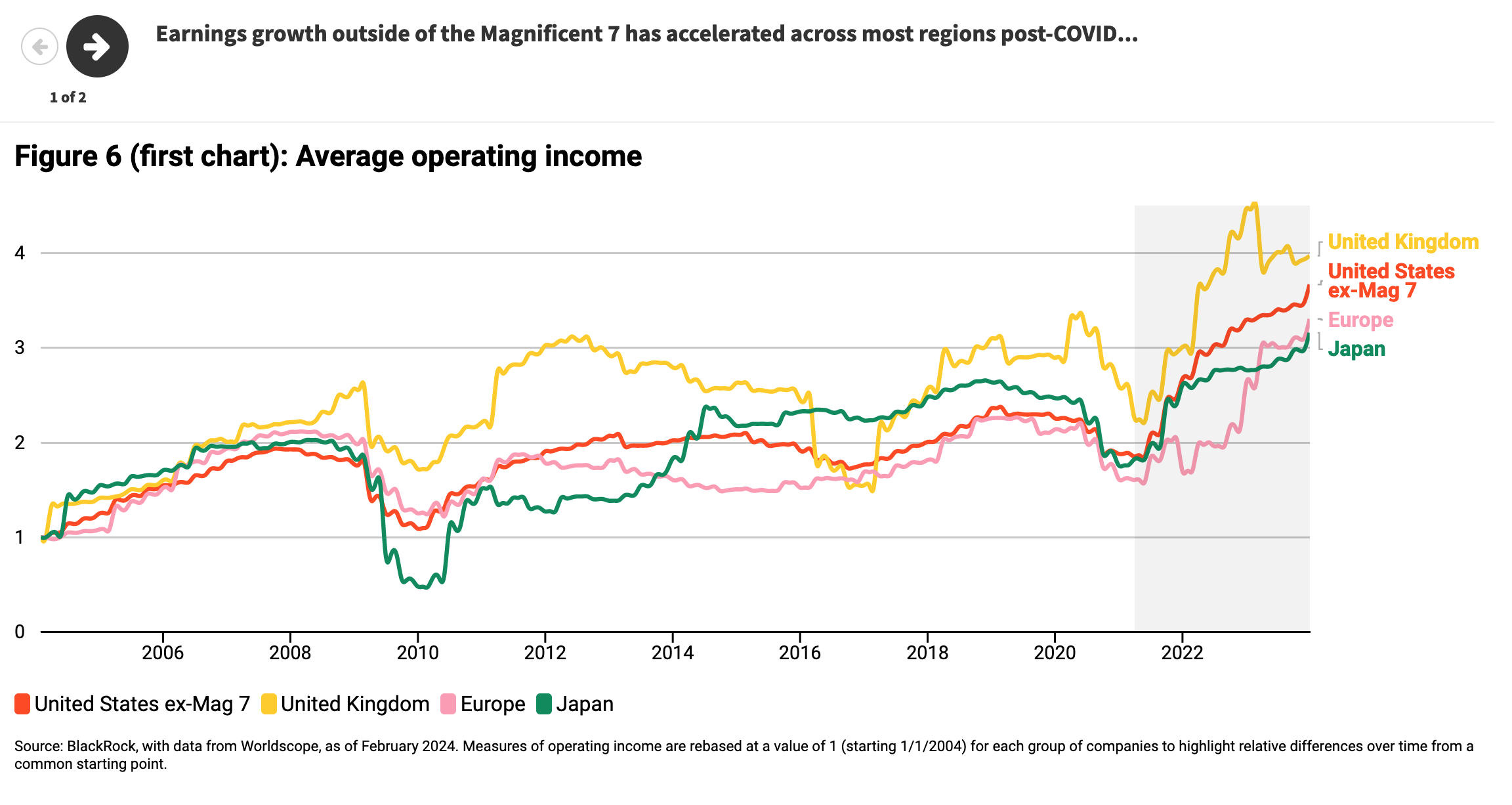

As investors look to take advantage of a broader opportunity set amid increased uncertainty, Figure 6 illustrates the importance of effective security selection. The first chart shows how post-COVID reflation and positive nominal growth has led to higher average earnings growth outside of the largest tech companies after years of stagnation in most regions. Equally important is the second chart, which shows how this has coincided with significantly higher dispersion in earnings. This makes stock selection crucial for navigating equity markets today. And for long/short equity investors, the ability to take advantage of relative performance differences across a broadening opportunity set creates an even richer environment for generating alpha.

Conclusion

Equity investors are facing a range of new risks across macro and micro dimensions. While recession risk remains low, macroeconomic uncertainty could be here to stay as inflation has pushed back on rate cut expectations and geopolitical risks have increased. And as equities continued climbing to new highs in the first quarter, strong performance of the momentum factor and high index concentration has sparked concerns over a potential reversal. While we think strong earnings growth should allow performance dynamics to persist, investors can manage concentration risk by taking advantage of broadening themes like AI to generate alpha. And importantly, high dispersion in earnings makes stock selection crucial in identifying winners and losers across the opportunity set.

Copyright © BlackRock