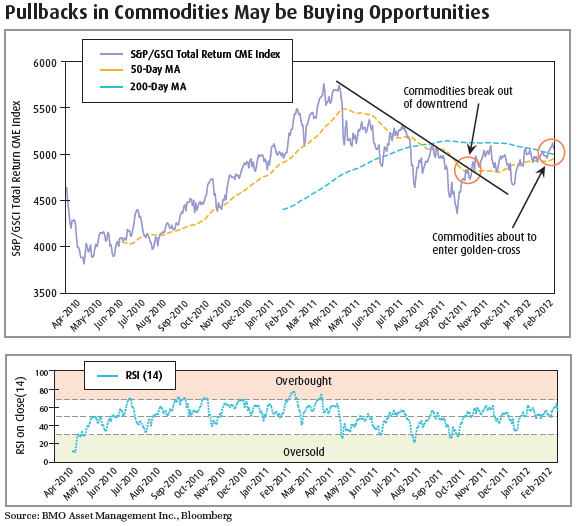

Coming into the new year, we believed the co-ordinated swap lines initiated by six key central banks, including the Fed, would continue to drive the demand for U.S. dollars higher over the first quarter. However, the Fed’s decision to maintain lower interest rates for at least another year has likely reinitiated the game of global competitive currency devaluation, as no country wants higher relative interest rates and thus, a stronger currency. We believe lower currency values should favour hard assets over the long term, leading us to increase our allocation slightly to commodities to neutral and reposition our allocation within the commodity complex, again using trailing stop-loss orders. (See Cross Asset Mix Table). Despite the U.S dollar looking oversold in the short term, price action in the U.S. dollar has indicated that the greenback has lost some of its upside momentum since the Fed announcement of its pledge to low interest rates.

Some Notable Changes to the Mix

- Asset Allocation Changes: As we stated at the onset of the year, we anticipate that 2012 will be a year where investors have to be increasingly tactical. Though many risk assets have broken out of their downtrend channels, many of the shorter-term indicators suggest they are overbought. While Eurozone officials approved a second bailout for Greece, this does not mean default risk looks to have been removed. However, the Greek debt situation has been inoculated in the short-term, which could give risk-assets a tailwind if the investors continue to have the perception that the proverbial can has been kicked further down the road. For that period, we are less bearish and we would use the potential short-term pullbacks over the next several weeks to decrease our fixed income allocation and reallocate to equities, with a small allocation to commodities. (See Cross Asset Mix Chart to see new allocations) With the VIX showing a slight reaction to negative headlines a few weeks ago however, investors should remember not to get overly optimistic by excessively overweighting risk assets. In addition, while the swap lines and the ECB’s LTRO have provided improved liquidity which could lead to the rally continuing over the next few months, the ongoing solvency concerns are far from being resolved.

New Positions:

- BMO S&P/TSX Equal Weight Global Base Metals Index ETF (ZMT): Improving economic data out of the U.S and lessening concerns of a hard landing in China has led to gains in base metal prices over the last several weeks. In addition, copper inventories tracked by the London Metal Exchange sits at a two-year low as global mine output dropped significantly last year. As a result, investors may want to consider increasing their exposure to base metal equities over the next several months. Investors should mitigate risk by using trailing stop-loss orders and limit exposure to no more than 10% of a portfolio, for a more aggressive investor. (Satellite Position).