- BMO Emerging Market Equity Index ETF (ZEM): Since China has managed to bring down inflation over the last six months, as indicated by its Consumer Price Index (CPI) falling from 6.5% in July to 4.5% in January, this should give the Bank of China (PBOC)some flexibility in easing monetary policy over the next few months. With a number of other emerging market nations also looking to reduce interest rates, the equity markets should fare well in the short-term. Investors looking to tactically increase their weighting to emerging markets can do so efficiently through an exchange traded fund (ETF). As emerging market indices are trading at lower valuations than other broad measures, we see this as providing the biggest multiple expansion potential. Given the many macro-economic risk items on the horizon however, investors should note that emerging markets are the most sensitive when we experience a sell-off in equities. As we stated at the onset of the year, keeping risk in check will be critical this year and again we recommend limiting allocation to emerging markets. (Core Position).

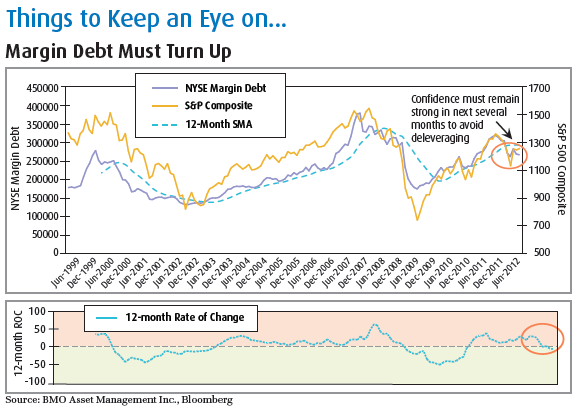

Why we remain cautious: Last year, in August, the downgrading of U.S. Treasuries caused margin debt levels to dip below its 12-month moving average (MA), suggesting a market deleveraging. Consequently, we recommended that investors tactically overweight fixed income. While equity markets have rallied, even more so this year, we have remained overly defensive. Though we have increased our equity allocation this month, we remain cautiously optimistic as margin debt levels remain below its 12-month MA and its rate of change (year over year), is dangerously close to moving negative. Policy measures in the Eurozone will be critical in keeping the recent investor optimism buoyant, and thus avoiding a deleveraging event. We continue to keep track of intra-market correlations, which have a tendency to rise during deleveraging events. Recommendation: Trailing stop-loss orders will be the key to help investors mitigate risk. In addition, investors should not excessively overweight risk assets, despite the New Year rally. Stay diversified among asset classes.

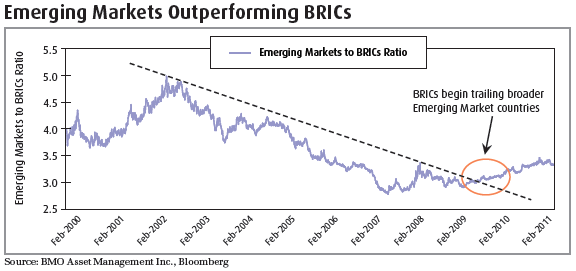

Avoiding a hard landing: Last year, investors became increasingly concerned that the Chinese economy would experience a hard landing. Recent readings on China’s Purchasing Managers Index (PMI) came in at 50.3 in December and rose again to 50.5 in January, which has eased those concerns. A reading above 50 is expansionary while a reading below 50 suggests a contraction. Nevertheless, concerns of a slower economy still remain and the Shanghai Stock Exchange Composite Index has yet to break out of its downtrend. Furthermore, of the BRIC nations, only Brazil has broken out of its downtrend channel. Recently, the BRICs (Brazil, Russia, India and China) have begun to underperform broader emerging market equities.