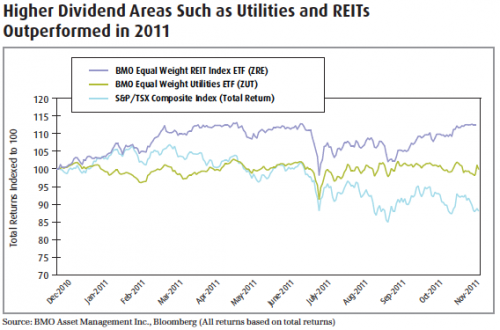

4) “Increase Dividends to Negate Volatility:”

As equity markets became increasingly volatile, investors gravitated toward dividend paying stocks. In addition, with the U.S. Federal Reserve launching “Operation Twist1” in September and pledging low interest rates until 2013, investors were led to increase allocations to yield-oriented assets.The BMO Equal Weight REITs (ZRE) and BMO Equal Weight Utilities ETF (ZUT) delivered 12.6% and -0.8% year-to-date respectively on a total return basis, outperforming the -10.7% decline in the S&P/TSX Composite Index.

5) “Merger and Acquisition (M&A) Activity is Back:”

At the onset of the new year, we believed rising M&A activity and slowly recovering U.S. housing market would lead U.S. banking stocks higher. This trade however did not work as many U.S. banks faced significant headwinds especially with the Fed flattening out the yield curve with ‘Operation Twist’ which impacts the profitability of the banks.

Fixed Income and Credit Themes:

1) An Exposure to Non-Traditional Fixed Income:

As we remain in a low interest rate environment, investors have had to look beyond government bonds to source higher yields. Non-traditional fixed income areas such as U.S. high yield bonds and emerging market debt have provided investors with higher yield. Although these areas offer more attractive yield, they are more volatile than Canadian federal and provincial fixed income and as such are more volatile. Given this, we have recommended exposure to these areas in moderation. Both of these areas in non-traditional fixed income can be accessed through our BMO U.S. High Yield U.S. Corporate Bond Hedged to CAD Index ETF (ZHY) and BMO Emerging Market Bond Hedged to CAD Index ETF (ZEF) respectively.

2) Low volatility fixed income:

As mentioned, Bank of Canada bonds are yielding much lower rates than they have historically. However, we have recommended that investors maintain an allocation to government bonds, using them as a portfolio volatility mitigation tool. In addition, as non-traditional bonds at times react to macro-economic risk in the same way as equities, exposure to federal and provincial bonds would help offset some of that risk.