Though we began the year preferring shorter-term federal bonds anticipating that the Bank of Canada would raise rates, as the year progressed, we extended our call on duration to mid-term federal bonds with a weakening economy even leading some economists to expect rate cuts in 2012.

Commodity Themes:

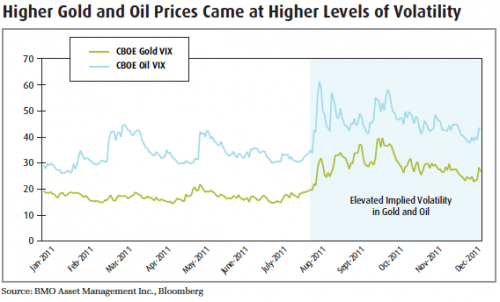

1) “Higher Commodity Prices Would Come With Higher Volatility:”

As we anticipated last January, gold and oil prices continued to move higher with an elevated level of realized volatility due to a growing number of push-pull factors in 2011. Gold and oil (Brent Crude) finished the year 13.7% and 12.6% higher respectively. Broad commodities as indicated by the S&P/GSCI Commodity Index (Spot) also finished the year higher gaining a slight 0.4% and also experiencing a higher volatility level than the previous two years.

2) “Exposure to Gold:”

The price of Gold continues to climb, as bullion is headed for its 10th straight winning year. The yellow metal got a lift as investors flocked to the precious metal during the year as a hedge against fiat currencies. Given the strength of the U.S. dollar as of late however, the precious metal has been selling off aggressively in late December, plunging through its

200-day moving average. Nevertheless, the long-term trend in gold remains intact at the time of this report.

3) “Junior Gold:”

Though we had much success with this trade last year, it was significantly more difficult in 2011. Gold stocks tend to under-perform bullion when markets fall significantly and as we experienced considerable equity market volatility, it made for a difficult year for investors taking a buy-and-hold approach for small-cap gold companies. We did, however, find that for the majority of the year our BMO Junior Gold Index ETF (ZJG) followed a trading range where it would fall to roughly $20 and trade up to $24 forming what is technically called a “bullish spring pattern.” On July 5, when ZJG fell out of this range, we recommended investors buy the ETF and implement a stop-loss order and as ZJG moved towards our $24 price target, we later recommended using a progressive stop-loss order, to protect profits.

Although it has been a challenging year for investors, many of the issues that weighed on the market remain today. As a result, investors should take a close look at their overall portfolio and ensure they are well diversified across asset classes. A lesson learned from 2011 is that investors need to focus on portfolio construction and implement a strategy that allows for discipline while being tactical enough to capitalize on short-term trends. Going forward, investors may want to consider dedicating the core of their portfolio to a long-term strategic asset mix and utilize the remaining portion for more tactical shifts. The tactical portion would allow for investors to better control risk and systematically provide potential alpha, while the core provides long-term discipline. Next month, in our January BMO ETF Monthly Strategy Report, we will highlight our new year outlook and the themes we favour in 2012. Until then, we wish you and your family a safe and happy holiday.

Footnotes

1 “Operation Twist”: The name given to a Federal Reserve monetary policy operation that involves the purchase and sale of bonds. “Operation Twist” describes a monetary process where the Fed buys and sells short-term and long-term bonds depending on their objective. In the recent example in September of 2011, the Fed performed Operation Twist in an attempt to lower long-term interest rates. In this operation, the Fed sold short-term Treasury bonds and bought long-term Treasury bonds, which pressured the long-term bond yields downward and thus flattening the yield curve.