A greater emphasis on cross-asset class diversification rather than simply diversification within an asset class was suggested as a means of mitigating some of these volatility shocks.

Equity Themes:

1) “U.S. Equities to Outperform:”

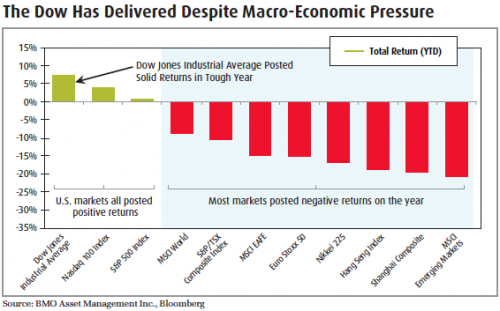

Heading into the year, we expected U.S. equities to outperform, citing the fundamental strength of many U.S. large cap companies. Strong cash balances and a trend of increasing dividend hikes, share buy-backs and low market expectations led us to recommend an overweighting to U.S. equities. On January 20, we put out a report “Dissecting the Dow,” recommending investing in U.S. equities through the Dow Jones Industrial Average (the Dow) for its blue-chip, multi-national characteristics. The Dow was the top performing market index this year, assisted by many of its constituent companies such as McDonalds Corp., International Business Machines (IBM) Corp., and

Coca Cola Co. recently making multi-year, if not all-time highs in 2011 despite significant equity market headwinds. Our BMO Dow Jones Industrial Average Hedged to CAD Index ETF (ZDJ) allows investors to access the Dow while mitigating currency risk.

2) “Long-term Story for Emerging Markets Still Intact:”

Over the long-term, the jury is still out on this one, but as we previously noted, there are some concerned that China is headed toward a hard-landing, illustrated by its escalating credit default swap (CDS) prices. However, we suggested that over the short-term, emerging markets would likely face headwinds as they shifted their focus to tightening monetary policy and away from growth in 2011. As a result, we recommended allocating assets from emerging markets to Canadian and particularly U.S. equities last January, which proved to be the correct call. Over the year, our BMO Dow Jones Industrial Average Hedged to Cad Index ETF (ZDJ) and our BMO Dow Jones Canada Titans 60 Index ETF (ZCN) outperformed our BMO Emerging Markets Equity Index ETF (ZEM) by 22.5% and 4.3% respectively on a total return basis.

3) Canadian Banks Continue to Look for Acquisitions:”

A number of Canadian banks continued to acquire businesses in 2011, targeting asset managers to the retail brokerage units of foreign institutions. We anticipated this to be a good long-term business move but with the possibility that the stock prices of Canadian banks over the short-term would be depressed. On February 11, we issued a report “Banking Income,” recommending our BMO Covered Call Banks ETF (ZWB) as a way to enhance yield while maintaining exposure to the sub-sector that would likely face short-term headwinds.