Footnotes

1 Beta, a measure of the systematic risk of a security or a portfolio in comparison to the market as a whole. A beta of greater than 1 indicates that the security’s price will be more volatile than the market, while a beta of less than 1 indicates a security’s price will be less volatile than the market.

2 Carry trades involve borrowing in low yielding currencies such as the U.S. dollar and Japanese yen to fund purchases in higher yielding and sometimes foreign assets. When the price of the purchased asset declines in value, investors are forced to exit the trades and pay back the U.S. dollar or Japanese yen denominated loan. The funding currency tends to increase in value as the appetite for risk rises as the loan repayment involves purchasing the currency in which the loan is made.

3 VIX refers to the Chicago Board Options Exchange (CBOE) Volatility Index, a measure of implied volatility of S&P 500 Index options. It is commonly referred to as the “fear index” and has tendency to rise with market anxiety.

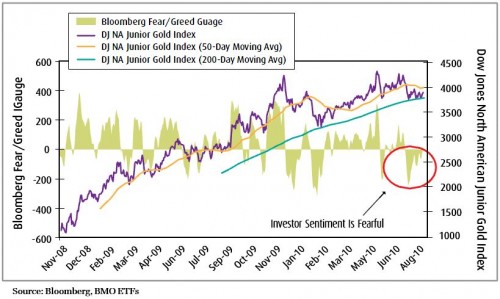

4 BMO Junior Gold Index ETF (ZJG). This ETF tracks the Dow Jones North American Junior Gold Index, a market-capitalization weighted index of 25 Canadian and U.S. listed gold companies. Small cap gold companies are more reactive to bullion prices than their large-cap peers. However, investing in individual junior gold companies involves political and company specific risk. Investors can mitigate a good portion of this risk through an ETF, while maintaining the benefits of the overall junior gold sector.

For more information on the 30 BMO ETFs, please visit our website www.bmo.com/etfs or contact your financial advisor.

To be added to the distribution list for our Monthly Strategy Report and BMO ETF: Trade Opportunities, please email alfred.lee [at] bmo.com with the subject line: “Add To Distribution List".

Download [Not-So-Golden-Month-for-Bullion-Lee, August 2010]

Copyright (c) BMO ETFs