This article is a guest contribution by Alfred Lee, Investment Strategist, BMO ETFs.

August 2010

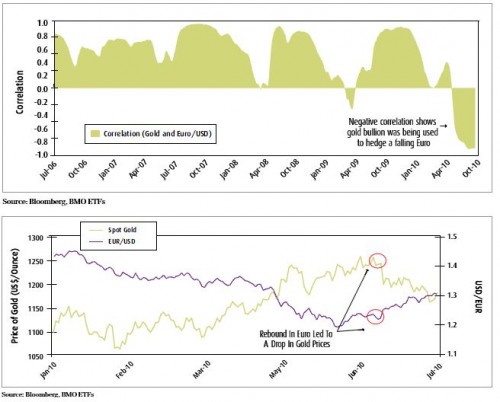

The recent drop in gold prices has investors concerned over whether the precious metal is losing its lustre. As a result, we wanted to use this month’s strategy report as an opportunity to give our readers an update on our views of the yellow metal. While the recent technical patterns in the gold market may not seem appealing, from a fundamental perspective, this drop in price should have been widely anticipated. Last November, when news of Dubai World’s debt problems emerged and subsequently Greece’s sovereign default issues arose, the market gravitated towards gold as a hedge against the Euro. An examination of the relationship between the price of gold bullion and the USD/Euro spot would show this trend. Historically speaking, the spot price of gold is typically seen to be inversely correlated with the greenback and positively correlated with the Euro. For most of 2010, when much of the focus was on the default risk of the PIIGS (Portugal, Ireland, Italy, Greece and Spain), the relationship between gold and the two major currencies inverted. Since gold is still viewed by many as a quasi-currency, many investors headed toward precious metals as a hedge against a rapidly deteriorating European currency. In May, when civil unrest broke out in the streets of Greece and a rash of other negative headlines compounded the reasons to be risk averse, money poured into safe-havens and the market quickly shifted to the “risk-off” trade.

Recently, the announcement of the establishment of the European Financial Stability Facility (EFSF) has helped to quell the anxiety of the market. While perhaps not a permanent solution to the sovereign debt issues, the EFSF will have the ability to extend emergency loans to Euro-zone countries over a three-year period, thus alleviating concerns and causing the Euro to rally 9.7% from its recent bottom on June 7. The betterthan-expected European bank stress-test results also helped create a tailwind for the unified currency. Consequently, much of the money that went into gold related investments as a hedge against the Euro is now being liquidated, explaining the recent drop in the prices of gold and gold-related companies. Our readers may recall from our previous strategy report that we are not “gold bugs”. We also would like to add nor are we “doomand-gloomers,” but we do continue to view gold-related investments as one of our favourite places to be for a number of reasons that we will outline below.

Opportunity:

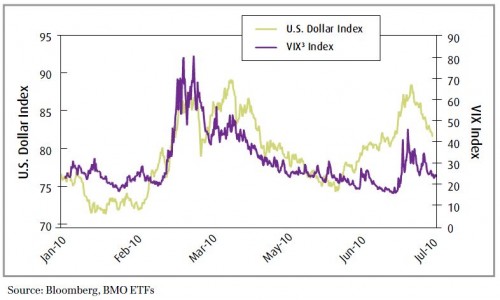

As we mentioned last month, the markets are driven by two very primitive emotions: greed and fear. Consequently, there are two basic trades which are the “risk-on” and “risk-off” trade and there are varying degrees of each. The “risk-on” trade is where the appetite for risk is elevated in the market. Hence, greed is the overwhelming emotion. During those instances, the market will favour cyclical stocks or those investments that have a higher beta1 than the market. Some examples of those trades are base-metals, high-yield debt, emerging markets and basically anything tied to global economic expansion.

Conversely, when the appetite for risk wanes, investors look for defensive areas, safe-havens or investments that have a lower beta relative to the market. Corresponding investments to this trade include utility and consumer staple stocks. Currencies such as the U.S. dollar and the Japanese yen also tend to rise, especially during panics, as their low relative interest rates make them the funding currencies for carry trades2. Furthermore, the greenback is still the world’s reserve currency and for that reason is viewed as a safe-haven currency during times of duress, despite ballooning deficits.

In a simplistic way of viewing the market, a particular investment will tend to do well in only one of either a “risk-on” or a “risk-off” environment. Gold bullion is the only investment that has shown a tendency to do well in both environments. Perhaps now is a good time to outline that there is a fundamental difference between gold and gold related stocks. While the price of gold has shown an ability to rise in both trade environments, it will outperform gold stocks at times when the market favours a “risk-off” trade but underperform gold companies during a “risk-on” environment. The BMO Junior Gold Index ETF (ZJG)4 traded as high as $17.35, a 38.8% return since we first recommended it in February.