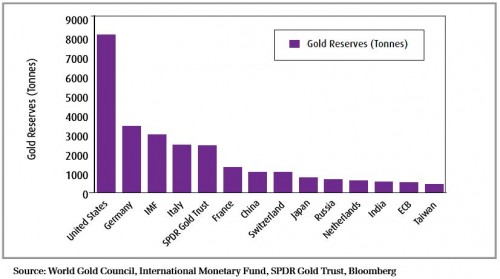

Some of this may be in yuan, while a portion could be in currencies of other sound emerging market nations and perhaps even gold. The Chinese central Bank, after all, has perpetually been rumoured to be increasing its gold reserves. Furthermore, gold bullion ETFs such as the SPDR Gold Trust (GLD – NYSE), unofficially known as “the People’s Central Bank”, currently holds close to 1300 tonnes of gold bullion, more than all but four central banks and the International Monetary Fund (IMF).

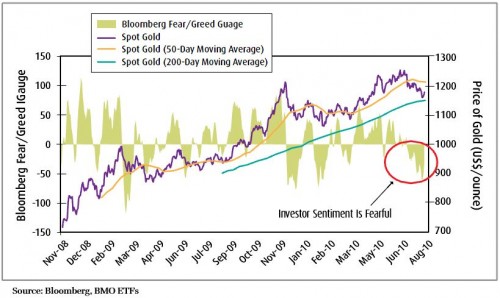

Perhaps billionaire investor Warren Buffett put it best when he said “be fearful when others are greedy and greedy when others are fearful.” When investors are optimistic, assets tend to be overpriced and conversely when investors are fearful, assets can be scooped up for cheap. The Bloomberg Fear/Greed Indicator, a good gauge for short-term trends, shows that the current sentiment has moved toward the former for both bullion and the Dow Jones North American Junior Gold Index. The charts

below illustrate how Mr. Buffet raises a good point since rallies have generally followed when the indicator suggests investors are fearful.