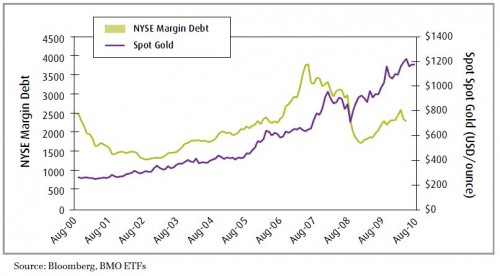

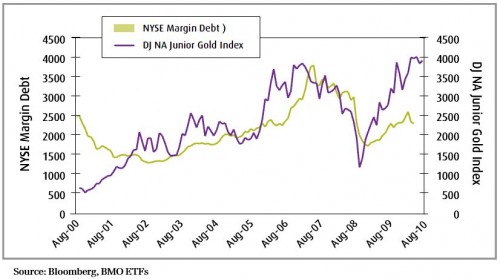

Recently, however, it has pulled back to $15.47 which we view as an attractive entry point. However, at this point, we also suggest investors consider coupling this trade with bullion given that the level of broker leverage, indicated by NYSE margin debt levels, has heightened since February. Should we see a large enough negative headline, deleveraging could potentially result, causing equities to sell off. Gold companies at the end of the day do behave like stocks and are therefore more susceptible to deleveraging than bullion. Investors can also efficiently access gold bullion through exchange-traded funds (ETFs).

With growing evidence that the U.S. recovery is running out of steam, some have been calling for another round of stimulus. Since much of U.S. economic policy is of Keynesian nature, it’s not impossible that we’ll see the Obama administration oblige and try to reflate their way out, should economic fundamentals continue to lag. This would kick-start the stock markets and put downward pressure on the U.S. dollar, with the “risk-on” trade being favoured. Gold would then likely revert to an inverse correlation with the U.S. dollar and once again be used in its more traditional sense, a hedge against a declining greenback. The recent drop in the U.S. dollar should also encourage gold buying at this point and the price of the precious metal could move higher should the U.S. currency continue to fall. Furthermore, the recent announcement by China that it would loosen the peg to the U.S. dollar would require the People’s Republic to buy less U.S. Treasuries in the open market. However, as China would still likely be a net exporting nation, the current account surplus must be saved in some other currency, if not greenbacks.