If you don’t get excited about an annual outperformance in the region of 2-2.5% per year you miss the point. A good friend of mine with strong actuarial skills recently told me the following tale: Imagine you divide up your life into 3 parts – 0-30, 30-60 and 60-90. Almost all your retirement savings will by definition fall into the second stage. If you can increase the annual return on your retirement portfolio by just 1% per annum during that 30 year period, you will have saved 1/3 more by the time your reach retirement. Wouldn’t you take that any time?

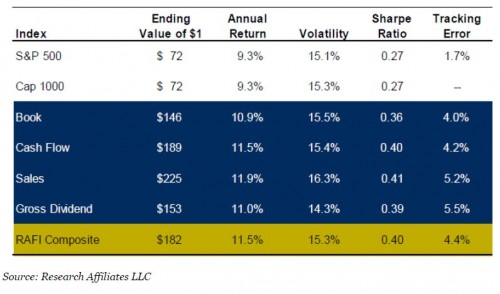

Chart 3: Fundamental vs. Traditional Indexing – 1962-2009

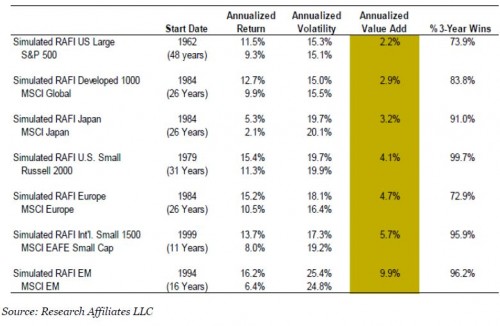

Outside the United States, the concept works even better. Chart 4 contains data for different regions of the world and, as you can see, the value added has been substantially bigger in both Europe and Asia. Emerging markets have done best of all with an annual outperformance of almost 10%.

This does not imply that a Fundamental Index approach always outperforms traditional indexing. As you can see on the right hand side of chart 4, there are times when it underperforms. In momentum driven markets for example, it may underperform – perhaps even significantly so. In that respect, a Fundamental Index approach is not unlike value investing which often underperforms in momentum markets.

Some high profile academics have actually criticised the Fundamental Index approach for being no more than value investing in disguise. Whilst it is correct that there is a value tilt in a Fundamental Index portfolio, just as there is a growth tilt in a traditional index portfolio, there are also fundamental differences. For example, in the strong growth years of 1962 to 1969, a fundamentally weighted portfolio outperformed conventional indexing, whereas value investors underperformed growth investors(4).

It has even been suggested that the Fundamental Index concept will not stand the test of time. Admittedly, should the entire world convert from conventional to fundamentally weighted indices, the two will become one and the same thing and the excess returns will disappear. However, given the enormous amounts currently invested in traditional index products, it will take many years before we approach that situation. Therefore the negativity surrounding the Fundamental Index concept emanating from certain quarters smacks of sour grapes. It is quite simply an idea which is simple and brilliant in equal measures.

Chart 4: Global Performance of Fundamental Indexing (Dec. 2009)

The second solution (which I will call REAP in the following - the Real Equity Alpha Portfolio), is based on the assumption that the true value of a company is difficult to establish. This is due to the fact that almost all investors base their investment decisions on forward looking estimates rather than real facts as input. Value investors tend to focus more on the quality of the balance sheet (they look for what they call intrinsic value) and put less emphasis on earnings power. Growth investors, on the other hand, focus almost exclusively on earnings power. REAP focuses on both earnings power and financial strength through a highly disciplined quantitative approach.