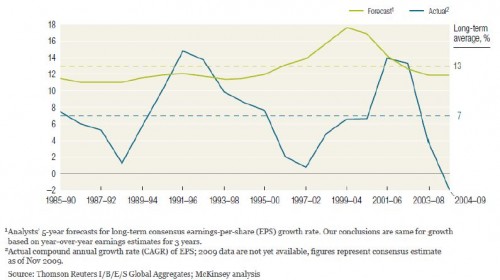

Sell-side analysts offer another example of herding (see chart 2). Analysts are prone to herding and so are investors relying on those estimates to drive investment decisions. The result? Performance which fails to live up to expectations.

Yet another factor impacting the relative performance of active managers is the so-called ‘size premium’. Let me illustrate this phenomenon with a simple example(3): The largest stock in the S&P500 is Exxon with a market cap of $293 billion. The smallest one is New York Times which is valued at just over $1 billion. An index fund would allocate $293 to Exxon for every dollar allocated to New York Times. An active manager would never go to that extreme in terms of how the money is allocated. This has the potential to cause large deviations in relative performance between active and passive managers. In periods where large cap stocks outperform small cap stocks – as has been the case in recent years – the active manager will underperform the index.

Chart 2: Earnings Growth for S&P500 – Actual vs. Forecast

A somewhat more technical factor is what statisticians call skewness – the fact that in most years stock returns are not normally distributed but skewed to the right (more positive than negative observations). This asymmetry causes a headache for active managers, because they tend to hold only a small subset of the underlying market. Again, this is best illustrated through a simple example: In a given year, imagine that 499 of the 500 stocks in the S&P500 are flat, whereas the last one is up 500%. Consequently, the index will be up 1%. Now consider two active managers who each elect to invest in 50 of the 500 stocks. One is lucky/smart enough to include the high performer; the other one is not. The first one will be up 10% whereas the second one will show a performance of 0% for the year.

Although the example is not entirely realistic, it illustrates the ‘dangers’ of small portfolios. The academics amongst us would say that, because of the right skewness of returns, the median return in the portfolio will underperform the mean return. This is another way of saying that it is hard to beat the market!

Enough said about the reasons most active managers underperform. If you want to read more about this topic, go to the research library on our website www.arpllp.com, where I have filed some research. Now to the solutions, and this is where things get interesting. In the following, I will offer two possible solutions to investors who are struggling to beat the index. Both are universal in nature, so don’t stop reading just because you are based in Timbuktu. They work everywhere.

The first one is based on the Fundamental Index® concept. The problem with a normal index fund is that capital is disproportionately allocated to overvalued stocks. The higher the stock price goes, the higher the weight in the index fund. In effect, investors chase yesterday’s winners all the time.

The Fundamental Index concept has been developed by Research Affiliates in Newport Beach, California, under the guidance and leadership of Robert Arnott, one of the leading lights of our industry. The Fundamental Index approach uses other measures of size instead of market cap. Interestingly, it matters less which one(s) you choose. As you can see from chart 3 below, book value, cash flow, sales and dividends, when used as index weights, have all outperformed the S&P500 significantly over the past half century.