China - The Mother of all Black Swans?

To those who suffer from China Bubble Anxiety, I would say the following: China’s successes of the past 30 years are the real thing. The country’s economic reforms have brought about huge productivity benefits, and these have translated into a formidable competitive manufacturing advantage. China’s global creditor status and massive internal savings endow it with more than sufficient resources to fund its urbanization-led employment growth. While it’s true their recent investment-heavy growth path has been funded with enormous stimulus through the domestic banking system, in the context of an annual urbanization rate of 20 million people, we’re not concerned that industrial and infrastructure capacity will remain idle for long. Anyway, China has the $2 trillion balance sheet and policy discipline to reconsolidate its banking system NPLs any time it wants to. This is not to suggest that there aren’t risks to China’s growth path—there are plenty—but China’s fiscal situation puts it in a much better position than ours to deal with excesses.

Japan's Dismal Fiscal Outlook

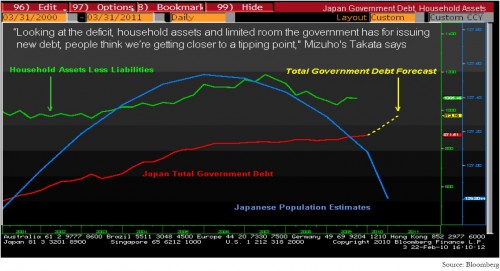

Here’s one last idea, a short leverage / long resources macro trade we’d use for portfolio accent: Short the Yen against the Canadian Dollar. Japan is shrinking while its debt is growing, exactly the opposite of the urbanizing emerging markets. Its total government debt is approaching 200% of GDP and forecast to exceed the entire net asset base of the country’s households. Its debt service burden is growing faster than total GDP. And the government is facing hopelessly conflicting policy options. It needs to keep its bonds attractive to a dwindling demographic base of local buyers, which implies a stronger yen and higher rates. But is also has to offset the damage inflicted on its economy by falling exports, and that suggests a weaker yen and lower rates.