CAD VS. JPY

Canada, by contrast, has arguably the soundest economy in the G-7. No coincidence, they really don’t like leverage up there. And the country is rich in Shake Hands With China resources. Australia and Brazil enjoy many of the same riches, but Canada’s got the added edge on oil, and its trade ties with the U.S. give it more insulation from a potential EM slowdown.

Just watch those correlated risk off days in the market though, because for some inexplicable reason, investors still flock back to the Yen as a safe-haven currency during risk reversions. The trade has downside to the low $80s, but it’s ultimately headed to parity.

Investing As The Foundation Shifts

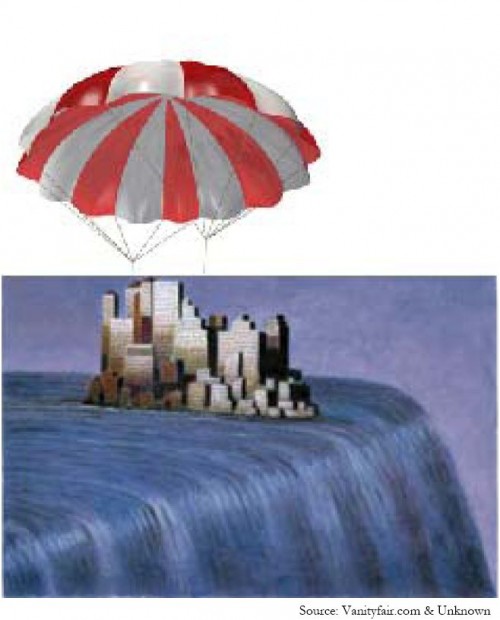

Let’s end with some context around recent market turmoil. In 2008, we learned that banks weren’t safe. Now we’re seeing that even nations are a risk. The ultimate credit firewall has been breached. This heralds the end of the line for the buy-now-pay-later era, and markets want to know what comes next.

Let’s end with some context around recent market turmoil. In 2008, we learned that banks weren’t safe. Now we’re seeing that even nations are a risk. The ultimate credit firewall has been breached. This heralds the end of the line for the buy-now-pay-later era, and markets want to know what comes next.

The new framework is right there in front of us. American innovation and EM modernization will power the global economy for the rest of our careers. The pending demise of the debt super-cycle should finally force a long-over due discourse on structural improvements that will lead to a sustainable global growth trajectory. The rebalancing process will be messy, but it will also be restorative. And, as long as we lock on to fixed points on the horizon through the fog of volatility, it should be loaded with investment opportunity for all of us.

DANIEL J. ARBESS. Mr. Arbess is a partner of Perella Weinberg Partners and portfolio manager of the PWP Xerion Funds. Prior to its joining with PWP in October 2007, he was the founder and Chief Investment Officer of Xerion Partners from its establishment in 2003. Xerion pursues event-driven and special situation corporate investments across the capital structure, using macro themes for directional accent and hedging. He has participated in numerous creditor committees in connection with distressed credit investments over the years, including among others, Polaroid, Solutia and Chrysler. Mr. Arbess was born in Canada and received an LL.B. degree from Osgoode Hall Law School (Toronto) and an LL.M. from the Harvard Law School.

Download PDF Here

Copyright (c) Daniel Arbess, Perella Weinberg Partners

![]()

Don’t Forget to Sell What Emerging Markets Make Better. About 70% of all products now sold by Walmart are made in China. China has crushed U.S. manufacturing margins, by bidding up raw materials and selling finished products at everyday low China prices. We’re conceptually short labor-intensive, downstream Western producers, especially of the leveraged variety. We’ll eventually be long the debt capital structures of the few that can survive, giving us the next generation equity after inevitable balance sheet restructuring. Many of the best junk franchises were overleveraged to begin with. Now the triple whammy of falling margins, declining revenues and credit-constrained multiples has dropped valuations by half or more. There will be some great distressed debt opportunities, as the next $1 trillion of junk credit matures over the next five years.

Don’t Forget to Sell What Emerging Markets Make Better. About 70% of all products now sold by Walmart are made in China. China has crushed U.S. manufacturing margins, by bidding up raw materials and selling finished products at everyday low China prices. We’re conceptually short labor-intensive, downstream Western producers, especially of the leveraged variety. We’ll eventually be long the debt capital structures of the few that can survive, giving us the next generation equity after inevitable balance sheet restructuring. Many of the best junk franchises were overleveraged to begin with. Now the triple whammy of falling margins, declining revenues and credit-constrained multiples has dropped valuations by half or more. There will be some great distressed debt opportunities, as the next $1 trillion of junk credit matures over the next five years.