IVN's Mine Extends the Length of Manhattan

One of our favorites continues to be Ivanhoe Mines, which we've owned for five years (NYSE: IVN, about $13/share, $6 billion market cap). IVN owns the world's largest undeveloped copper and gold mine, on the border of China's industrial heartland. It also owns met coal assets, recently IPO-ed with a lead order from China Investment Corporation, which should deliver $600 million of annual EBITDA by 2013. The met coal and other non-core assets alone are worth over half the current market cap.

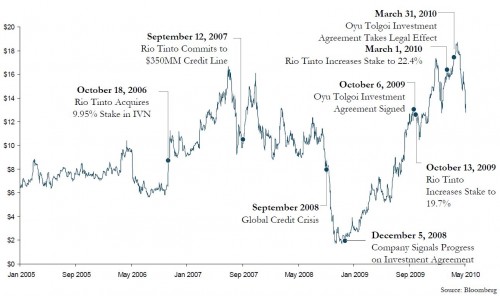

Milestone Driven Performance

Rio Tinto invested as a strategic partner in 2006, and will have bought over 46% of the Company, first paying $10 a share, and most recently up to $16 (which by the way is 23% up from where the stock closed yesterday). Rio’s financing and operating role substantially de-risks this story. And once they finish building the mine, I have no doubt Rio will want to consolidate their ownership, so there's an endgame here too. Excluding the drop in late ’08 (which presented an epic buying opportunity), the chart is a junior mining stock’s dream: gapping up to new levels closer to cash flow potential as the company achieves each successive financing and project development catalyst.