Sum-of-Parts Creates Cheap Option

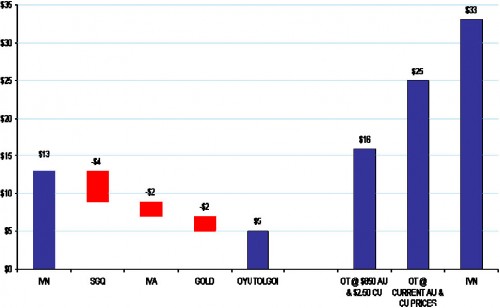

Backing out the coal business and other peripheral assets, the stock at its current price around $13 creates the copper mine at less than $2.5 billion, which is less than half of what it's worth on an NPV basis, and a tiny fraction of in-ground metal value, assuming $2.50 long-term copper and $1,000 gold. At recent commodity prices, we think the stock could be worth up to $30 to Rio. That’s 130% up from here.

Midstream Opportunities

Another play on the theme is to look for good downstream businesses trading at attractive discounts to comps and growing aggressively in EM. We like Solutia (NYSE: SOA, $14.37/share, $1.74 billion MCAP) and Celanese (NYSE: CE, $27.43/share, $4.29 billion MCAP). These are solid twenties margin chemical companies with dominant market shares in their core products, both trading at 30% multiple discounts to their domestic peers. Both are enjoying aggressive Asian growth which is way under-reflected in valuation.