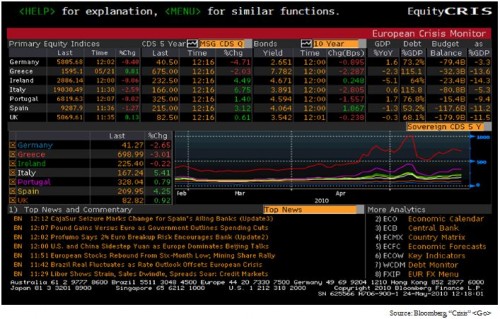

CRISIS <GO>!

Welcome to the End Game of the Debt Supercycle—Type “Crisis Go” on your Bloomberg for a live update. Rising risk premia and declining currencies are just the beginning. Investors fleeing the Euro for the Yen or Dollar may find little sanctuary, because the debt problems of the front G-7 countries are, by key metrics, the worst of all. As confidence in fiat paper erodes, expect to see a real acceleration in demand for the world’s original medium of exchange: gold.

Gold On The Run

We like Gold and Other Precious Metals. In case you didn’t notice, while much of the commodity complex has been hammered this month, Gold is still up. Notwithstanding this ridiculous gold ATM idea from--of course -- Dubai, there’s obviously something going on here, and I doubt it’s a top. It’s not that we’re interested in gold as a hedge against traditional metrics of inflation: all this excess labor in the West, and capacity in the East, points to a deflationary framework. Gold isn’t necessarily going up; it’s the value of the paper we use to buy it that’s headed down. Prepare for a new strain of stag-asset inflation as we experience monetary debasement and economic deflation at the same time.

We like Gold and Other Precious Metals. In case you didn’t notice, while much of the commodity complex has been hammered this month, Gold is still up. Notwithstanding this ridiculous gold ATM idea from--of course -- Dubai, there’s obviously something going on here, and I doubt it’s a top. It’s not that we’re interested in gold as a hedge against traditional metrics of inflation: all this excess labor in the West, and capacity in the East, points to a deflationary framework. Gold isn’t necessarily going up; it’s the value of the paper we use to buy it that’s headed down. Prepare for a new strain of stag-asset inflation as we experience monetary debasement and economic deflation at the same time.