Section

Strategy

2466 posts

Rick Ferri: What's the Optimal Allocation to Foreign Equities?

What's the Optimal Allocation to Foreign Equities? by Rick Ferri Nearly every financial adviser will tell you that…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The Wisdom of Looking Like an Idiot Today

Now is the time to act with the courage of our convictions by Adam Taggart, Peak Prosperity IF…

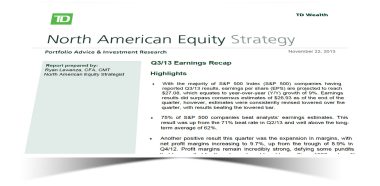

Ryan Lewenza: North American Equity Strategy - Q3/13 Earnings Recap

North American Equity Strategy - Q3/13 Earnings Recap by Ryan Lewenza, North American Equity Strategist, TD Wealth Highlights…

"The More Comfortable You are in Valuing a Company, the Less Point There is to Doing that Valuation"

One of the responses to my last post on valuing young companies was that even if you can…

Portfolio Rebalancing is Not One-Size Fits All (Capital Spectator)

Rebalancing "Mistakes" by Capital Spectator Paul Merriman concludes that “rebalancing could be a huge mistake.” Perhaps, although it…

Passive Management ≠ Passive Investing

Passive Management ≠ Passive Investing by Ashwin Alankar, Michael DePalma and Guoan Du, AllianceBernstein Passive investments are often…

Jim Rogers: "Own Gold" Because "One Day, Markets Will Stop Playing This Game"

Jim Rogers hope-driven wish is that the politicians were smart enough at some point to say (to the…

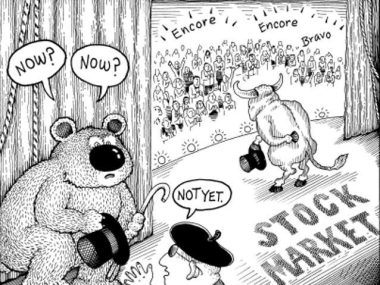

Jeremy Grantham: U.S. Market "Will Head 20-30% Higher in the Next Year or, More Likely Two Years"

by Jeremy Grantham of GMO Timing Bear Markets My personal view is that the Greenspan-Bernanke regime of excessive…

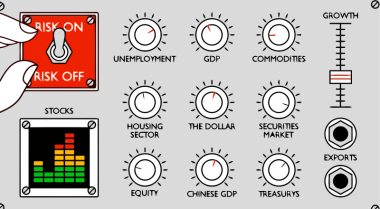

For Now Market Indicators Point to More Risk-on Behavior

by Cam Hui, Humble Student of the Markets About three weeks ago, I wrote that stock prices appeared…

Paranormal Markets: What’s Bad for the Economy Is Good for Stocks?

Negative economic news has been causing increases in stock prices. Jeff explains how uncertainty over Fed policy is…