We still have a few weeks left this year, but Howard Silverblatt at S&P tells me that dividends for the S&P 500 are on pace to grow by another 3% this quarter.

That may sound low but keep in mind that it’s on top of the huge tax-related payouts from last year’s Q4. The truth is that dividend growth has been and continues to be quite strong. Since 2010, dividends are up 53%.

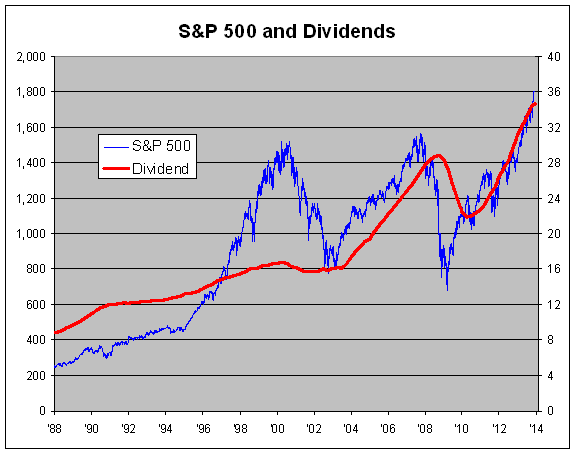

The S&P 500 looks to pay out $34.72 in dividends this year. That’s up 11% from last year. It also works out to a yield of 2.43% based on the S&P 500′s level at the start of the year.

Here’s a look at the S&P 500 (blue line, left scale) and its dividends (red line, right scale). I’ve scaled the lines at a ratio of 50-to-1, so whenever the lines cross, the dividend yield is exactly 2%.

So while it’s true that the stock market has rallied, it’s largely kept pace with dividends. In fact, the dividend yield has been close to 2% for more than a decade (except for during the worst period of the bear market).

But the chart shows the dramatic difference between today’s market and the stock bubble from 14 years ago. Back then, stocks were far, far ahead of dividends.

Posted by Eddy Elfenbein on December 3rd, 2013 at 10:43 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.