Passive Management ≠ Passive Investing

by Ashwin Alankar, Michael DePalma and Guoan Du, AllianceBernstein

Passive investments are often misunderstood. Instead of providing static positioning as implied by the label, they can be very capricious because of market and sector turbulence. To tame a passive asset, we think investors need to exert more active control over the dynamics of volatility.

Sound confusing? Not really. Think of it this way: volatility determines much of the risk profile of any asset. So when market volatility fluctuates, the risk of a passive investment in the market’s index changes.

For example, if you invested $100 in the MSCI World Index earlier this year when volatility was hovering at about 11%, you risked losing $11. Yet little more than a year earlier, when volatility was nearly 25%, the same $100 in the same index put $25 at risk. With this in mind, isn’t it a misnomer to describe a fund with such variable risk as a passive investment?

Don’t Ignore Sector Volatility

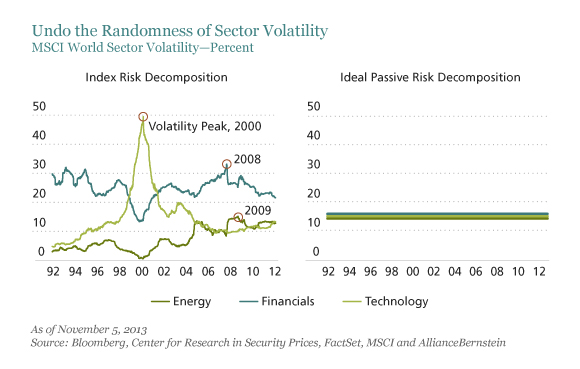

Our colleagues have written extensively on the concentration risks of investing in a benchmark. For example, in 2000, the technology sector ballooned to nearly 30% of the S&P 500 Index, leaving investors exposed to the crash. However, less attention is typically paid to the volatility risks of erratic sector behavior, as illustrated in the left-hand chart below.

At around the same time that indices were getting bloated with technology stocks, the risk of being in that sector shot up fourfold—accounting for 50% of the total index risk, as illustrated in the above index risk decomposition chart. When oil prices flare up amid Middle East tensions, the volatility of the energy sector will typically rise as well. And of course, during the global financial crisis, the financial sector accounted for more than 30% of the MSCI World’s total volatility.

In other words, you may have ditched your active manager to invest in a market capitalization–weighted global equity index, but instead you are letting the world actively manage your money. Conventional wisdom that passively managed buy-and-hold portfolios, such as many market-cap benchmarks, yield passive investments is not entirely true. Passive management of an investment portfolio in a dynamic world results in active and variable risk-taking.

Flattening the Waves

Is there a way to create a portfolio that delivers truly passive risk? We think so. The trick is to take a dynamic approach that aims to undo the randomness of volatility. An ideal passive benchmark would convert the waves to a fixed straight line, as shown in the right-hand chart above. The flat lines reflect equal passive non-varying risk-taking in each sector. So if there are seven sectors in the benchmark, a flat line at about 15% yields equal risk for each sector.

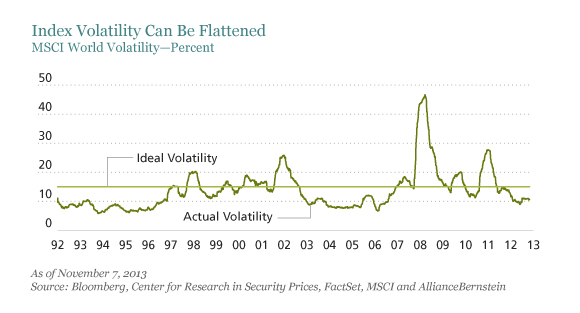

That may sound easier said than done. But when the passive proposition is clearly redefined, it can be achieved. At the index level, the idea is to de-risk exposure to equities to when overall index volatility rises. For example, when Federal Reserve Chairman Ben Bernanke started talking about tapering the asset purchase program in May 2013, the average volatility of the S&P 500 jumped from 12% to 20%.

In other words, stocks became nearly twice as risky as they were before, so a $100 investment in the S&P 500 is now risking $20 instead of $12. To maintain the initial risk profile, the prudent response would be to get rid of the additional risk by moving $40—nearly half of the total—out of the index into cash. That way, even though index volatility has nearly doubled, an investor hasn’t taken on any more risk. By doing this, the varying risk of an index can be flattened to a desired constant in expectations, as illustrated below.

The same exercise can be done at the sector level. When a sector’s volatility spikes, shift some of the total away into other sectors and/or cash. This will maintain a static risk profile even when one sector or another suddenly becomes more precarious.

This approach may sound complex, but the good news is that it can be achieved at a reasonable incremental cost that would be slightly more expensive than a purely passive approach, yet much cheaper than an actively managed portfolio. We think that’s a small price to pay to keep volatility from spoiling your passive portfolio.

This blog was originally published on InstitutionalInvestor.com.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Ashwin Alankar and Michael DePalma are Co-Chief Investment Officers of Tail Risk Parity Services at AllianceBernstein. Guoan Du is Quantitative Analyst at AllianceBernstein.