Section

Corporate Debt

139 posts

The Intended and Unforeseen Opportunities of ESG

Listen on The Move ESG has gathered a lot of steam as an essential and strategic investment component…

July 21, 2022

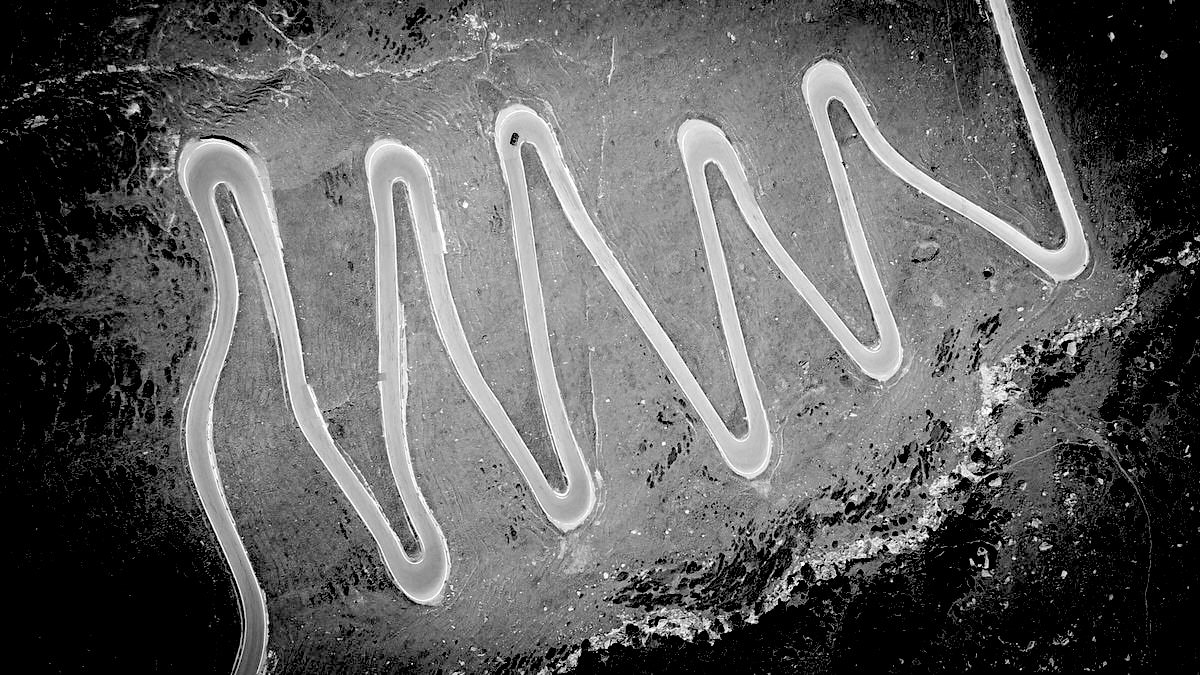

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The Lessons of Value Investing for Credit Investors

by Andy Kochar, Vice-President, Portfolio Manager and Head of Global Credit, AGF Investments LLC It may be too…

July 12, 2022

Multi-sector income: Investing for income as rates rise

by Damien J. McCann, Kirstie Spence, and Xavier Goss, Capital Group Markets are on edge over soaring consumer…

July 6, 2022

After the Revaluation, the Slowdown

by Erik L. Knutzen, CFA, CAIA, Chief Investment Officer—Multi-Asset Class, Neuberger Berman Our Asset Allocation Committee believes that,…

June 28, 2022

Will Corporate Credits Crack as Growth Slows?

by Susan Hutman, Director—Investment Grade Corporate Credit Research,Will Smith, CFA, Director—US High Yield, Robert Hopper, Director—Corporate Credit and…

June 7, 2022

Addressing the Challenge: A Simple Alternative to Yield

After years of stimulative and accommodative policies, we now find ourselves in a position where central banks are tightening monetary conditions. Over the course of the year, fixed-income markets have reflected this as yields have increased and financial conditions tightened.

June 7, 2022

Want to De-Risk? Look to High Yield

by Will Smith, CFA, Director—US High Yield & Gershon M. Distenfeld, CFA, Co-Head—Fixed Income; Director—Credit, AllianceBernstein Looking for…

May 19, 2022

The Best & The Rest: Measuring the Efficacy of Alternative Strategies

Listen on The Move Financial advisors have rapidly adopted liquid alternatives in portfolios to the tune of…

May 16, 2022

4 Reasons to Be Cautious With High-Yield Bonds

by Collin Martin, Schwab Center for Financial Research We are growing more cautious with high-yield bonds. While the…

May 8, 2022

The One Metric All High-Yield Investors Should Know

by AllianceBernstein Research High-yield bonds have a reputation for volatility. But history shows that the US high-yield sector’s…

April 25, 2022

Income investing outlook: See a little light

by Adam Kramer, Portfolio Manager, Fidelity Investments A flexible multi-asset strategy finds opportunity in a time of bad…

April 18, 2022

10 Investment Themes for 2022

by Jody Jonsson, and Martin Romo, Capital Group Investors are facing a market in transition. For years it’s…

February 27, 2022

Tremors in Credit and Currency Markets

by Ashok Bhatia, CFA, Deputy Chief Investment Officer—Fixed Income, Neuberger Berman November’s modest uptick in volatility, driven by…

November 28, 2021

Bond Yields Under a More Hawkish Fed

by Brad Tank, Chief Investment Officer—Fixed Income, Neuberger Berman A more hawkish Fed may not lift Treasury or…

June 21, 2021

Technically Speaking: Howard Marks On Speculative Manias

by Lance Roberts, RIA One of my favorite investing legends is Oaktree Management’s Howard Marks. His investing wisdom…

February 18, 2021