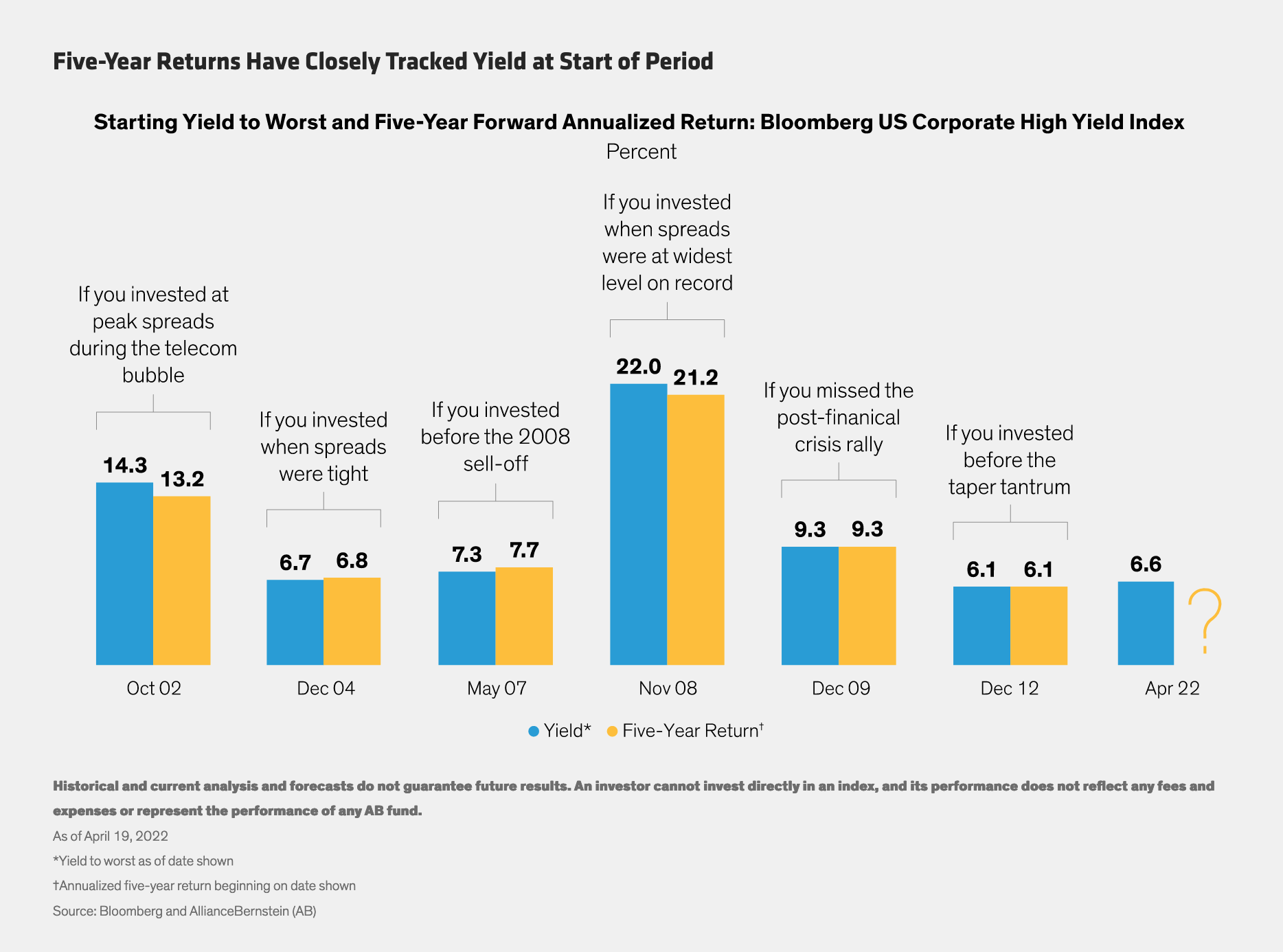

High-yield bonds have a reputation for volatility. But history shows that the US high-yield sector’s yield to worst has been a reliable indicator of its return over the following five years.

In fact, US high-yield bonds have performed predictably, even through rough markets. The relationship between yield to worst and future five-year returns held steady during the global financial crisis, one of the most stressful periods of economic and market turmoil on record.

Why? High-yield bonds supply a consistent income stream that few other assets can match. And when high-yield issuers call their bonds before they mature, they pay bondholders a premium for the privilege. This helps compensate investors for losses suffered when some bonds default.

What does all this mean for today’s investors? High-yield bonds may experience some near-term volatility, but investors with a long-term lens can ride out short-term drawdowns.

Copyright © AllianceBernstein Research