and Bill Lytwynchuk, MBA, CFA, Portfolio Manager,

1832 Asset Management L.P.

Addressing the Challenge: A Simple Alternative to Yield

Considering the credit curve’s front end during a rate-hike cycle

The Current Market Environment

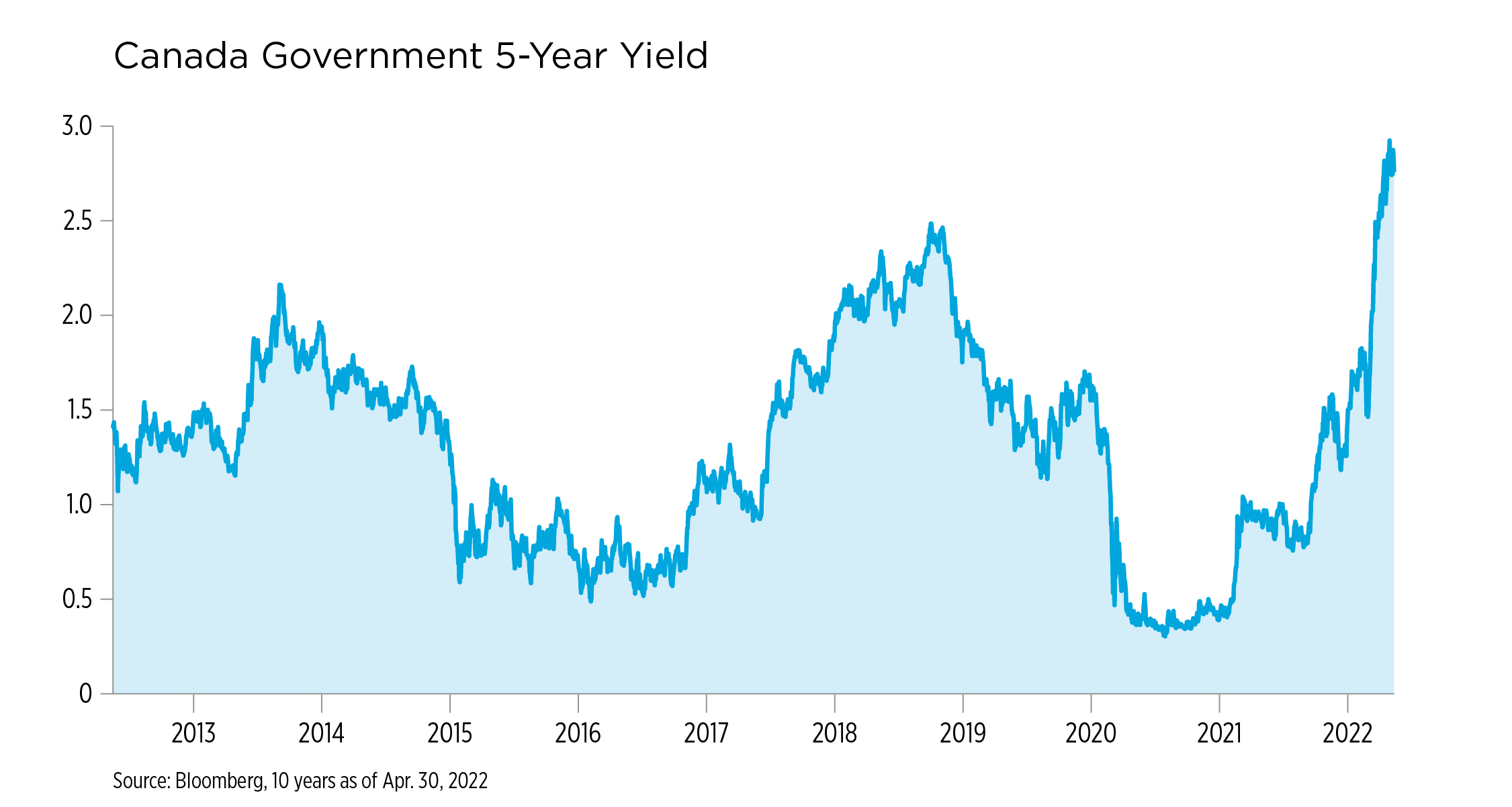

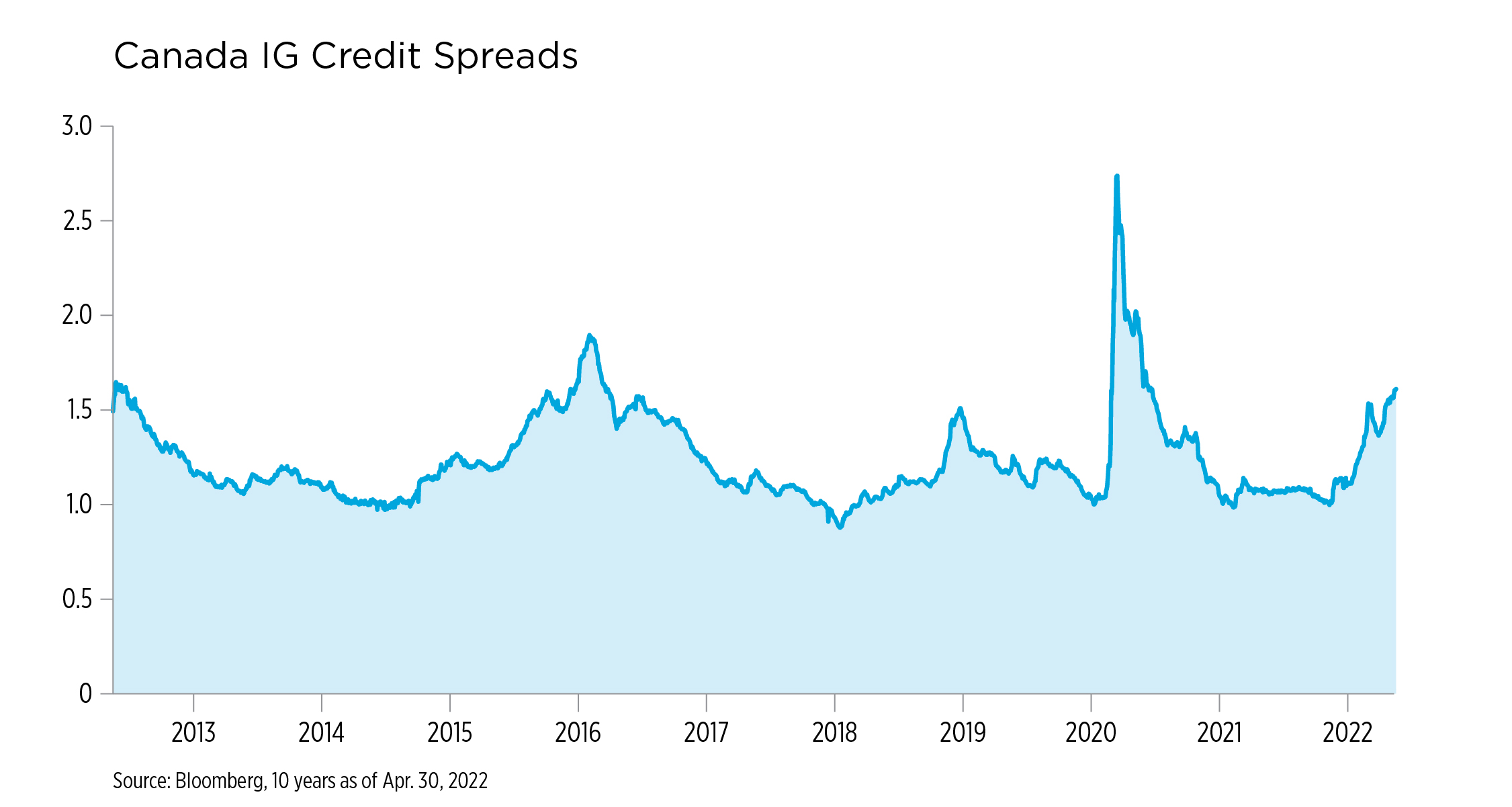

After years of stimulative and accommodative policies, we now find ourselves in a position where central banks are tightening monetary conditions. Over the course of the year, fixed-income markets have reflected this as yields have increased and financial conditions tightened.

As of the end of May, the Canadian five-year yield reached 10-year highs. The market was pricing in the equivalent of an additional seven 25 basis point hikes by the Bank of Canada (and the Federal Reserve) before the end of the year – on top of the three that have already occurred. At the same time, risk premiums have risen, approaching their 10-year highs, excluding the pandemic period of H1 2020, as concerns over an economic slowdown mount.

The combined impact of yield and risk premium increases have been material, resulting in the worst start to the year in fixed income in decades.

An Opportunity in Short-Dated High-Quality Investment-Grade Credit

We believe that investment-grade corporates are better able to withstand the current market volatility. In aggregate, balance sheets remain healthy with lower leverage and high cash balances. Also, companies have spent the past two years extending maturities and expanding their lending facilities, leaving them with strong liquidity profiles.

Given the current environment, the all-in yields for high-quality, short-duration investments are materially more attractive than they previously have been with all-in yields rivalling decade highs.

Introducing Dynamic Short Term Credit PLUS Fund

Dynamic Short Term Credit PLUS Fund features a simple strategy to augment income while preserving capital and managing credit risk through an in-depth active process. Focused on opportunities at the front end of the credit curve, the Fund targets primarily short-term, investment-grade corporate securities issued in Canada and the U.S., while also having the capability to employ conservative amounts of leverage. As of today, over three-quarters of the fund is invested in bonds whose duration is three years or less.Key Benefits

Conservative use of leverage can enhance the distributions received, providing a monthly income stream.

Focused on opportunities at the front end of the credit curve, historically a less volatile part of the credit market.

Unlike passive fixed-income funds that simply match an index, the Fund is actively managed to hold only companies with stable-to-improving credit profiles and will actively hedge interest rate risk.

Focused on established names with a stable-to-improving credit profile in the investment-grade universe.

A diverse range of attractive issues in both Canada and the United States.

About Domenic Bellissimo and Bill Lytwynchuk

Vice President & Portfolio Manager

Domenic joined Dynamic Funds in 2005. As a key member of the Toronto-based core fixed-income team, Domenic has over 24 years of industry experience.

Portfolio Manager

Bill joined Dynamic Funds in 2017 as Portfolio Manager, Fixed Income. He has over 15 years of investment experience managing U.S. and Canadian fixed-income assets.

At Dynamic, Domenic and Bill are responsible for managing over $8 billion in assets primarily focused on North American corporate investments. They have been able to leverage their experience to establish a disciplined management process across various mandates, Canadian- and U.S.-focused credit mandates, short-term fixed-income mandates, and fixed-income components of balanced funds.

Disclaimer:

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Views expressed regarding a particular company, security, industry or market sector are the views of the writer and should not be considered an indication of trading intent of any investment funds managed by 1832 Asset Management L.P. These views should not be considered investment advice nor should they be considered a recommendation to buy or sell. These views are subject to change at any time based upon markets and other conditions, and we disclaim any responsibility to update such views.

© Copyright 2022 1832 Asset Management L.P. All rights reserved.

Dynamic Funds® is a registered trademark of its owner, used under license, and a division of 1832 Asset Management L.P.