Section

Bond Market

1725 posts

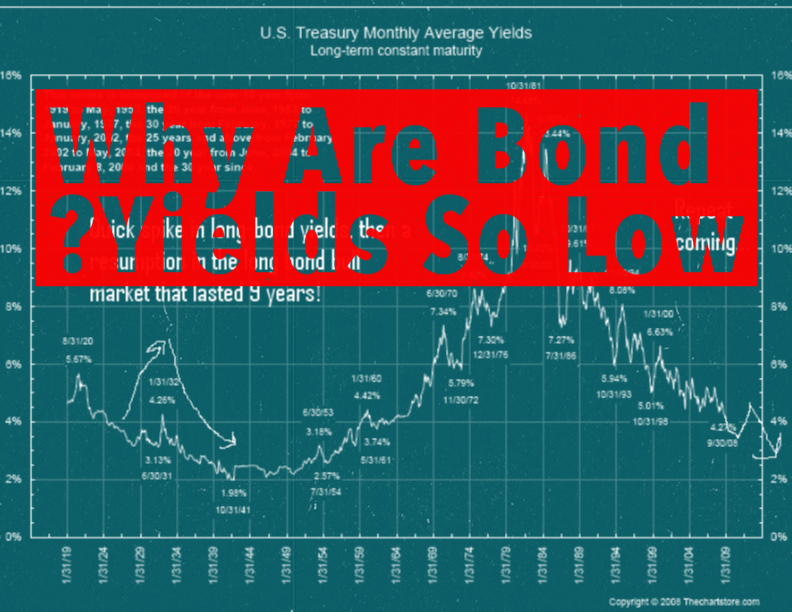

Louis Vincent Gave: Why Are Bonds Yields So Low?

by Louis Vincent Gave, Gavekal Research Why Are Bond Yields So Low? As long as men continue to…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

An Improving Economy, But Lower Rates. Why the Disconnect?

Despite economic data showing an improving economy, interest rates remain stuck in a low and narrow range. Russ…

The Economy and Bond Market Radar (May 5, 2014)

The Economy and Bond Market Radar (May 5, 2014) Treasury bond yields declined again this week, pushing the…

Economic Policy Uncertainty Doesn’t Tell us Much About Stock Returns

by Rick Ferri What happens in Washington has broad-reaching effects on the economy and our personal wealth. Uncertainty…

How Major Asset Classes are Performing April 2014, YTD

by James Picerno, Capital Spectator April was kind to the major asset classes, at least in relative terms.…

Want to See The Markets Get Confused? Even Lower Interest Rates

by Market Anthropology The most fatal illusion is the settled point of view. Since life is growth and…

A Tale of Two Regimes

Fed Model, Buybacks, and M&A (excerpt) by Dr. Ed Yardeni Previously, I’ve argued that as long as the…

Jeffrey Saut: "Throw Deep?!"

“Throw Deep?!” by Jeffrey Saut, Chief Investment Strategist, Raymond James April 28, 2014 Back in the late 1980s…

The Economy and Bond Market Radar (April 29, 2014)

The Economy and Bond Market Radar (April 29, 2014) Treasury bond yields declined this week, pushing the benchmark…

Emerging Markets Radar (April 29, 2014)

Emerging Markets Radar (April 29, 2014) Strengths A report by Erste Group shows European Union (EU) membership has…

David Merkel: Why it is Hard to Win in Investing

by David Merkel, Aleph Blog Before I start this evening, I want to say something about many investment…

Why the Bull Market (and Economy) Still Have a Couple of Years to Run

The Transition From a Risk Premium Reduction Market to a Growth Market by Conor Sen Matt Busigin (@mbusigin)…

Deborah Frame: Why Do We Accept Volatility as a Measure of Risk?

Not Your Grandfather’s Risk Measurement by Deborah Frame, Vice President, Investments, Cougar Global Investments Why Do We Accept…

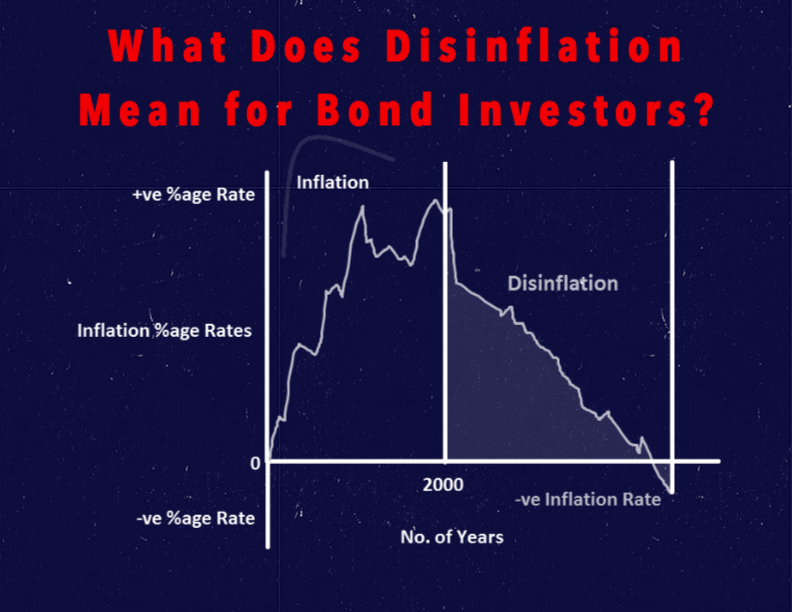

What Does Disinflation Mean for Bond Investors?

by Kathy Jones, Vice President, Fixed Income Strategist, Schwab Center for Financial Research Key Points With slow global…

What’s the Worst 10 Year Return From a 50/50 Stock/Bond Portfolio?

by A Wealth of Common Sense “The stock market is designed to transfer money from the active to…